Issue #2: Live Streaming Top 5 Stock Ideas

July/August 2025 issue

*Legal Disclaimer: This post and all its contents are for informational or educational purposes only. Continuous Compounding assumes no responsibility or liability for any errors, inaccuracies, or omissions in this post, links, attachments, or any actions taken based on its contents. The information sources used are believed to be reliable, but accuracy cannot be guaranteed. Recipients of this research are advised to conduct their own independent analysis and seek professional financial advice before making any investment decisions. The opinions expressed by the publisher in this post are subject to change without notice. From time to time, I may have positions in the securities discussed in this post.

This post and all its contents herein are the exclusive property of Continuous Compounding. This post is intended solely for informational purposes and is not to be distributed, reproduced, or transmitted, in whole or in part, for commercial purposes or sale without prior written consent from Continuous Compounding. Any unauthorized use, dissemination, or sale of this research is strictly prohibited and may be subject to legal action.

Disclaimer: I am long shares of Buffalo (6676) and Hammock (173A) at the time of publishing this post.

Dear Continuous Compounders,

In this post I recap the top 5 stock ideas I uncovered in my live streams up until the release of this post.

In addition, I was experimenting with ChatGPT 5 so it did help with research and writing in this post. Apologies ahead of time if some parts sound AI like.

For those who missed my last 2 emails, I have 2 major announcements:

A full deep-dive on my newest high-conviction stock, the last post was a quick pitch, now you have the full comprehensive analysis

Readers of the quick pitch who invested are already up +5-7% depending on cost basis!!!

New pricing post August 15th, 2025 (Extended until Aug 30th!!!):

Monthly plan: $30/month or $360 over 12 months

Annual plan: $180/annual or $15 per month

To incentivize long-term subscribers and disincentivize short-term subscribers, the new pricing post Aug 15th will be $30/month ($360 paid over 12 months). For those who see long-term value in my stock pitches, the new annual plan is only $180, a mere 20% increase from the former annual plan and a 50% discount compared to the month-to-month plan over 12 months.

Former plan:

Monthly plan: $15/month or $180 over 12 months

Annual plan: $150/annual or $12.50 per month

If you would like to lock in the previous $15/month plan or $150/year annual plan (save 2 months with the annual plan). Here is the link to take advantage of that offer:

https://continuouscompounding.substack.com/50PERCENTOFF

Act now, or the offer will end on August 15th, 2025!

THIS PROMO WILL BE EXTENDED UNTIL AUG, 30TH, 2025!!!

*The reason the non-discounted annual plan states 300 USD and not 180 USD is because the special offer setting from Substack does not allow me to apply different discounts for monthly and annual. So after August 15th, I’ll manually adjust it back down to $180.

**Current paid subscribers, you will be unaffected by this price change for the time being. If you are, please do let me know and slide into my DMs on here or Twitter/X. I’ve adjusted prices in 2024, and I’ve had 0 issues before.

***My thought process has always been to provide immense value to readers far greater than what I charge. There will be a time when the value I bring to the table is so large relative to what some of my early paid subs are paying that I will have no choice but to raise the prices. I may also change my mind on this and keep you guys grandfathered. I could also send each of you a special link that is still a major discount to the current market rate being charged. I’ll be fair.

Newest Stock Pitch (Paid Sub Exclusive)

I hate it when a stock I’m in the process of writing about rallies, and my paid subs can’t take advantage of a lower cost basis.

To mitigate this problem, before I wrap up my very in-depth stock pitch, I will be releasing this shorter quick pitch on the current high-conviction deep dive I’m writing about.

Update: Paid Subs who read my quick stock pitch and invested are already up 5-7% on the stock this deep dive is based on.

This kind of happened to Glory, where I was able to give you guys a short overview of why you should invest in Glory (2280 yen per share), but by the time the deep dive came out, it had rallied 20-25%. It has rallied another 40% since I released the stock pitch (2770 yen per share), but I want you guys, my paid subs, to make as much money as possible.

If you are a free sub, I mainly release immediately actionable ideas. I put my money where my mouth is, so if you’ve noticed, in almost every stock pitch I’ve ever released, I disclose I am currently long the position.

Here at Continuous Compounding, I focus on quality over quantity.

(Can skip if you don’t care to learn more about me) My first passion in life was actually drawing. When I was a kid, I took sketching lessons. The teacher would put up his personal cartoon sketches and have us copy them. The teacher would walk around and give us pointers as he saw the need to. Sometimes he’d be lazy if no parents were around. My goal was to get as close of a sketch to my teacher’s sketch as possible. I noticed that some kids saw the lessons as a race. At a comfortable pace I could do 4-5 drawings a session. At the end of a session, I remember a kid boasting that he completed 9 drawings. I challenged myself once, and while maintaining my standard of quality, I could only do 6. I remember it like it was yesterday; a kid was having trouble with her sketch. She wasn’t able to draw a certain part of a boat correctly. It was a challenging part of the sketch; I had erased and redrawn many times before finally being satisfied with my output. Other students glossed over the intricate details of that part of the boat in favour of speed. My teacher came over to my booth, went through my past drawings that day to find the sketch in question, and must have noticed I had drawn it properly. He grabbed my sketch and showcased it in front of the other kid, who just couldn’t get it. I felt bad for her because the teacher was purposely trying to compare her to me. A very Chinese thing to do. Besides the potential trauma the teacher bestowed upon another student, this validation gave me confidence that what I was doing was correct; there was no point in racing other kids to output more, because at the end of the day we were drawing to acquire new techniques and skills, not to race. I have been programmed this way ever since. I don’t release stock pitches to meet some arbitrary quota. I deliver less but offer more. I want to impress upon you guys the level of work that allows me to get this level of conviction, which doesn’t happen over a few days or sometimes weeks of research.

Be honest, for the $150 annual fee I’m charging, how many stock pitches do you need to truly work out? If we are being honest, anyone with a decent-sized portfolio, 1 would be all it takes.

High-conviction ideas are rare to come by, so I release less than some larger creators who have a frequent quota, but my hit rate has been phenomenal since I started. My pricing has been tuned to reflect the market price $/stock pitch you’d pay for a newsletter that outputs more. In a sense, with my Substack, you are only paying for actionable undervalued stock pitches not for fair-valued ones.

Are you really telling me it is that easy to find a high-conviction stock pitch? You can find 1 every 2-4 weeks? I can spend anywhere between 100 to 200 hours on an idea if I believe it warrants it. Haier Smart Home 690D was an idea that took me 1.5 months to finish extensive research on. Sometimes I enjoy the process of learning about a new company and developing a full picture of its business economics that time just flies. I also have a bad habit of letting ideas marinate for too long. Developing theories, trying to find evidence that disproves and supports it. It is a time consuming process, but I believe it’s worth it and you as readers get quality work that inspires conviction.

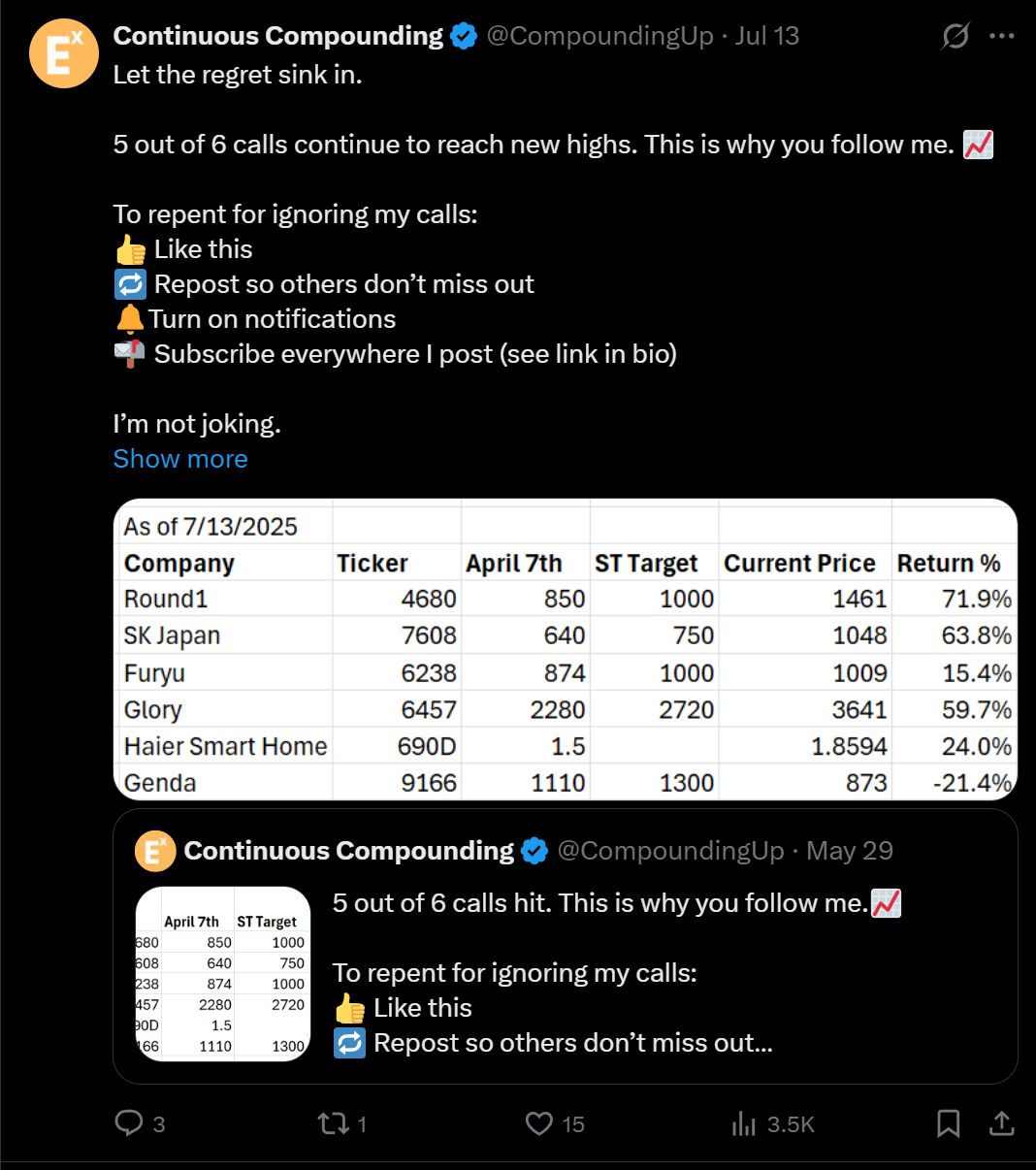

Here is how my recent picks did:

*The only loss I made was on Genda, which isn’t a stock pitch I wrote up. Notice how for every stock pitch I wrote myself, they have gone up. I am biased here given those are my stock pitches, but I know the stocks I’ve pitched in and out. I’m confident that I also know them far better than 98% of the investors that are in them, so whenever the stock gets cheap, I can recommend and invest in them with conviction.

Paid subs were notified of Glory (6457) 1 month before free subs. Those who followed my Glory trade in April would have made a +70% return (3876 yen per share as of July 25th, 2025)

My paid sub below has made a +72% gain, as his average price is 2255 yen/share (3876 yen per share as of July 25th, 2025)

Nice problem to have when you regret not buying more:

Don’t miss out on my current high conviction stock:

*Not investment advice. Do your own due diligence. For entertainment purposes only. Past performance does not indicate future performance.

Now back to the reason you are here, here are the Top 5 stocks:

6676 - Buffalo

*Click company name for IR link

*Price as of Aug 19th, 2025

Former Rating: A when I did the live stream; at current prices, probably B

Quick Company Overview:

Buffalo, formerly Melco Holdings Inc. until April 2025, is a Japan-based developer, manufacturer, and distributor of digital home appliances and computer peripherals. Founded in 1975 and headquartered in Tokyo, the company operates through 14 subsidiaries and one affiliated company across Japan, the U.S., Europe, and Asia. Its core products include Wi-Fi routers, wired LAN equipment, NAS storage systems, SSDs, Blu-ray/DVD drives, memory products, USB devices, and PC accessories, along with AV equipment, smartphone/tablet accessories, and network infrastructure solutions. Beyond hardware, Buffalo provides data recovery, storage software, erasing solutions, and direct marketing services, while also managing construction, installation, and maintenance of IT infrastructure.

Following its April 2025 reorganization, Buffalo shifted to a streamlined focus on IT-related businesses, shedding its food segment (Shimadaya Co., Ltd.) via spin-off in late 2024. Despite shrinking consumer demand in Japan, Buffalo is leveraging its brand in PC peripherals and network devices while expanding solutions through its corporate-focused “Value Chain Engineering” strategy. Buffalo is positioning itself as a specialized IT engineering company.

What I like:

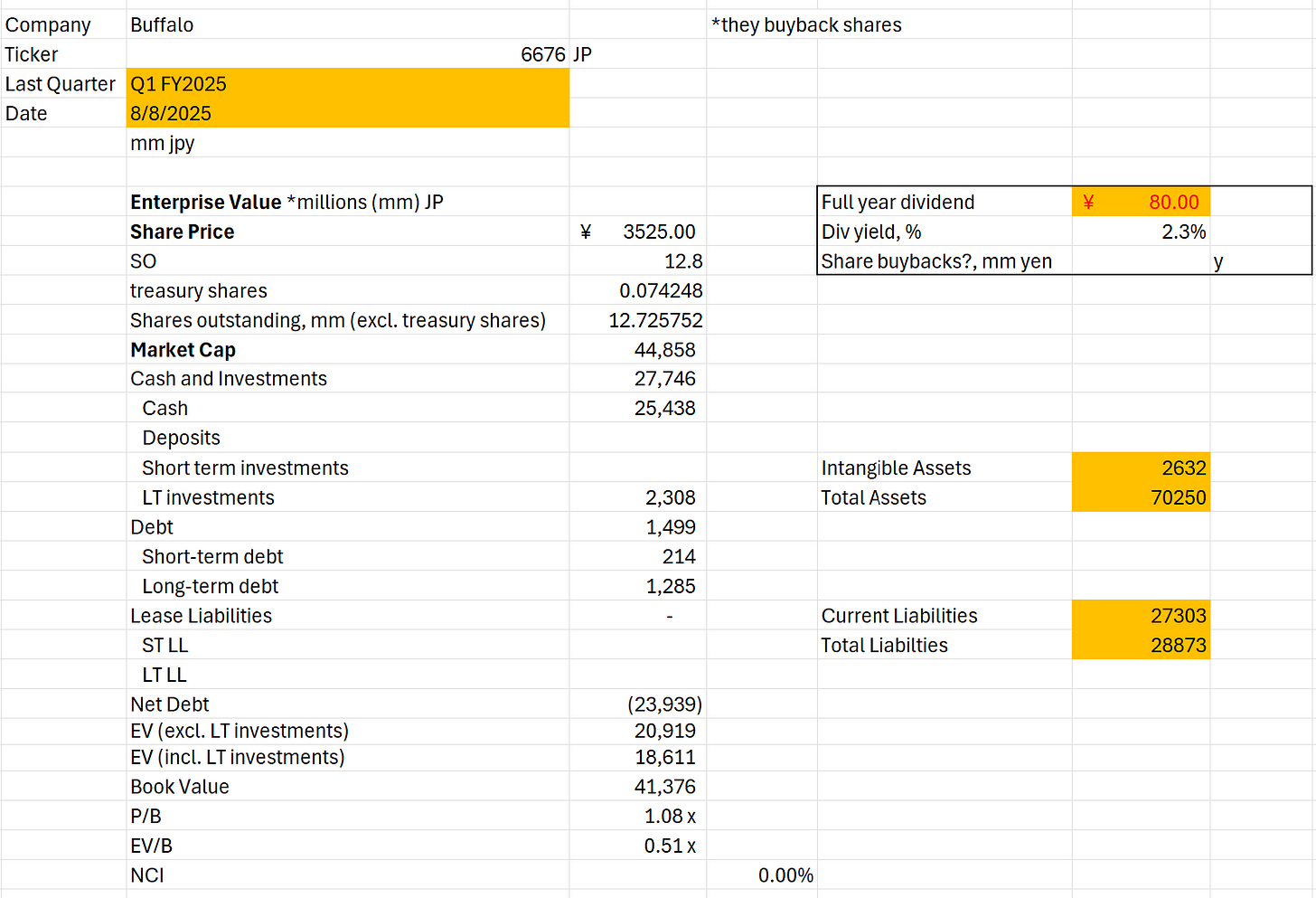

Management is aggressively buying back shares, having bought 5.2 bn yen worth acquired from May 1st to May 13th, 2025 (avg share price approx. 2081 yen/share).

The company bought back 1.498 mm shares (avg. cost 3498 yen/share) for 5.2 bn yen in the fiscal year ended March 2025.

Dividend yield is okay at 80 yen per share, or 2.3%. Formerly the dividend was 120 yen per share. The dividend could have been reduced to opportunistically prioritize buybacks.

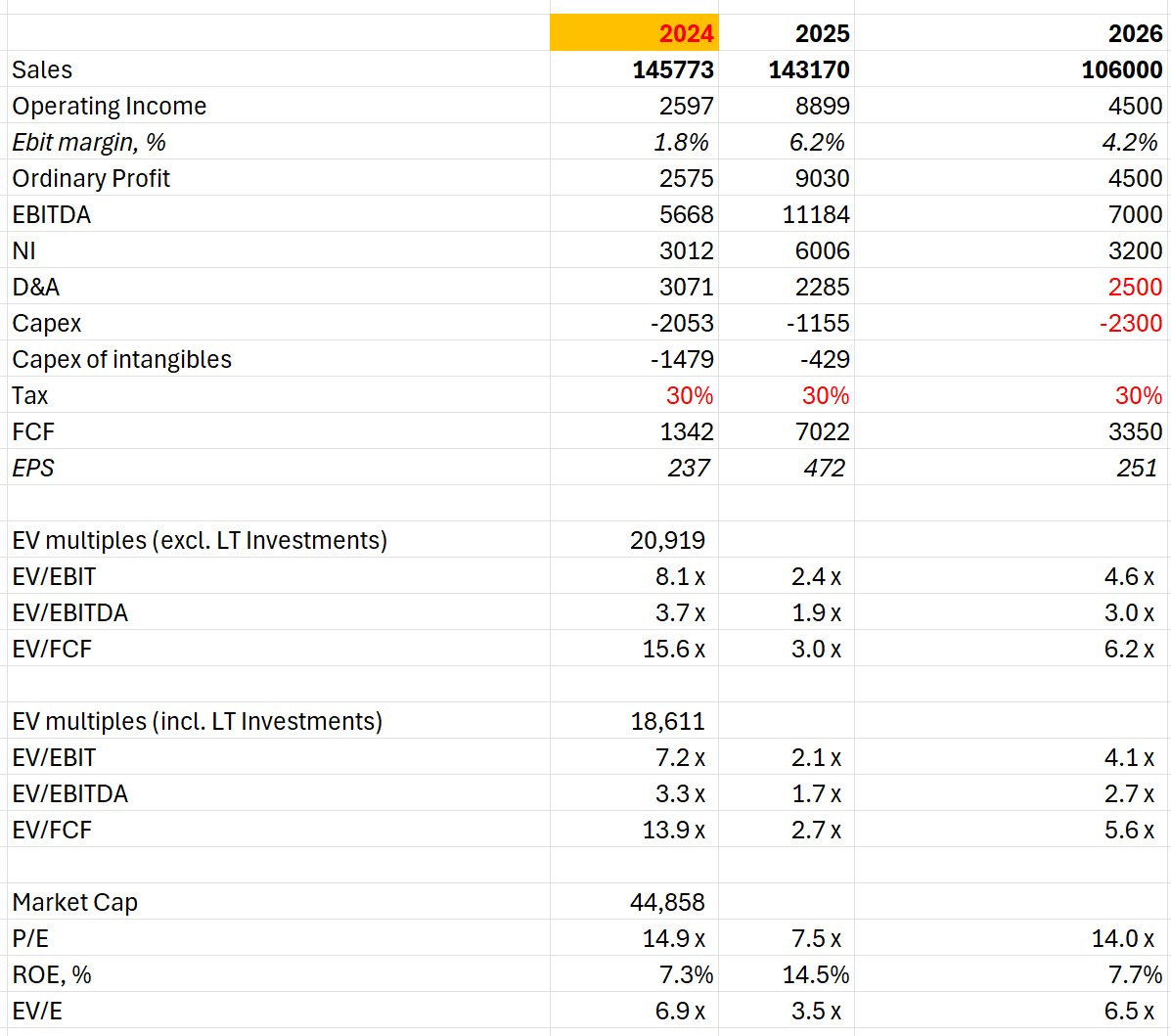

Trades cheaply based on EV valuation multiples

I reviewed the stock on stream in July at 2248 yen per share, and the stock was trading at 0.76x P/B. Currently the stock trades at 1.08x P/B, so it's less of a bargain now.

The former play on Buffalo was that it was cheap and it was trading below 1x P/B, so let’s ride the share buyback narrative. Now that Buffalo is trading at over 1x P/B, the current investment thesis may rest on where we believe a reasonable P/B ratio is.

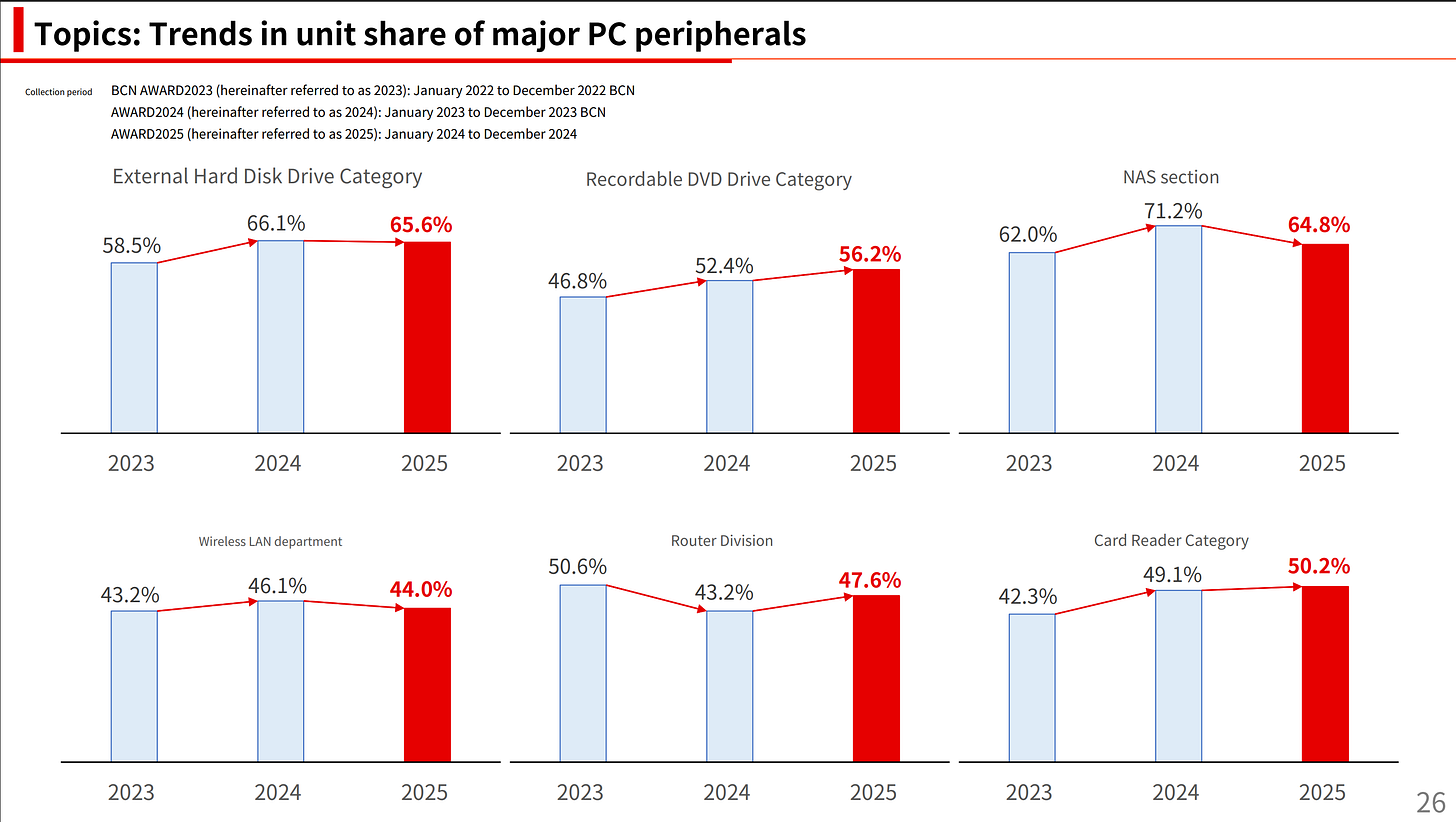

Buffalo has really high unit market share in quite a few product lines; I’m not sure how they were able to secure such high market share

What I don’t like:

Despite Buffalo being a brand, they are selling relatively undifferentiated goods with lots of competition. I am not convinced their products are higher quality or technologically superior. The margins on their PC peripherals have been very thin in the low single digits.

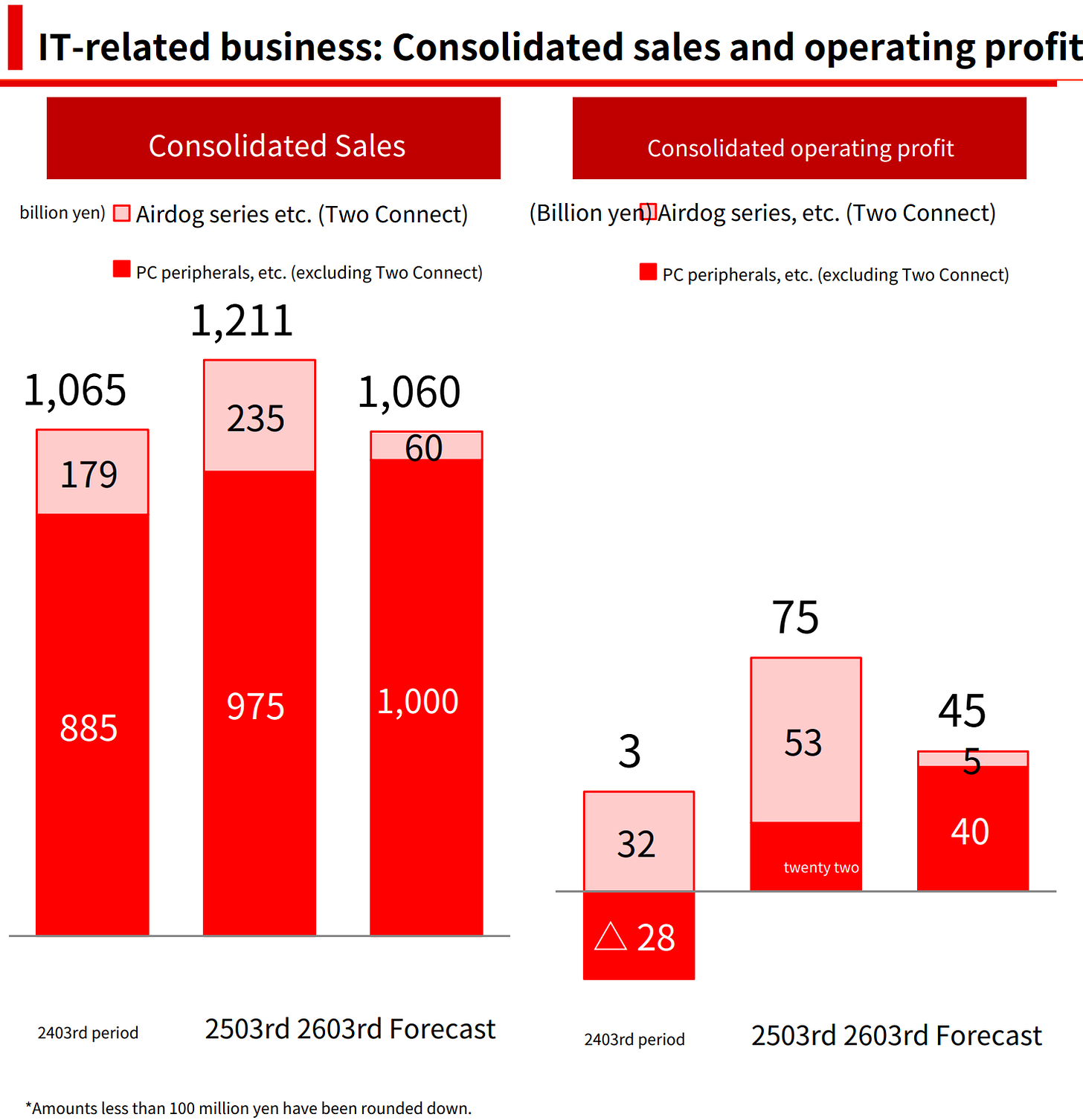

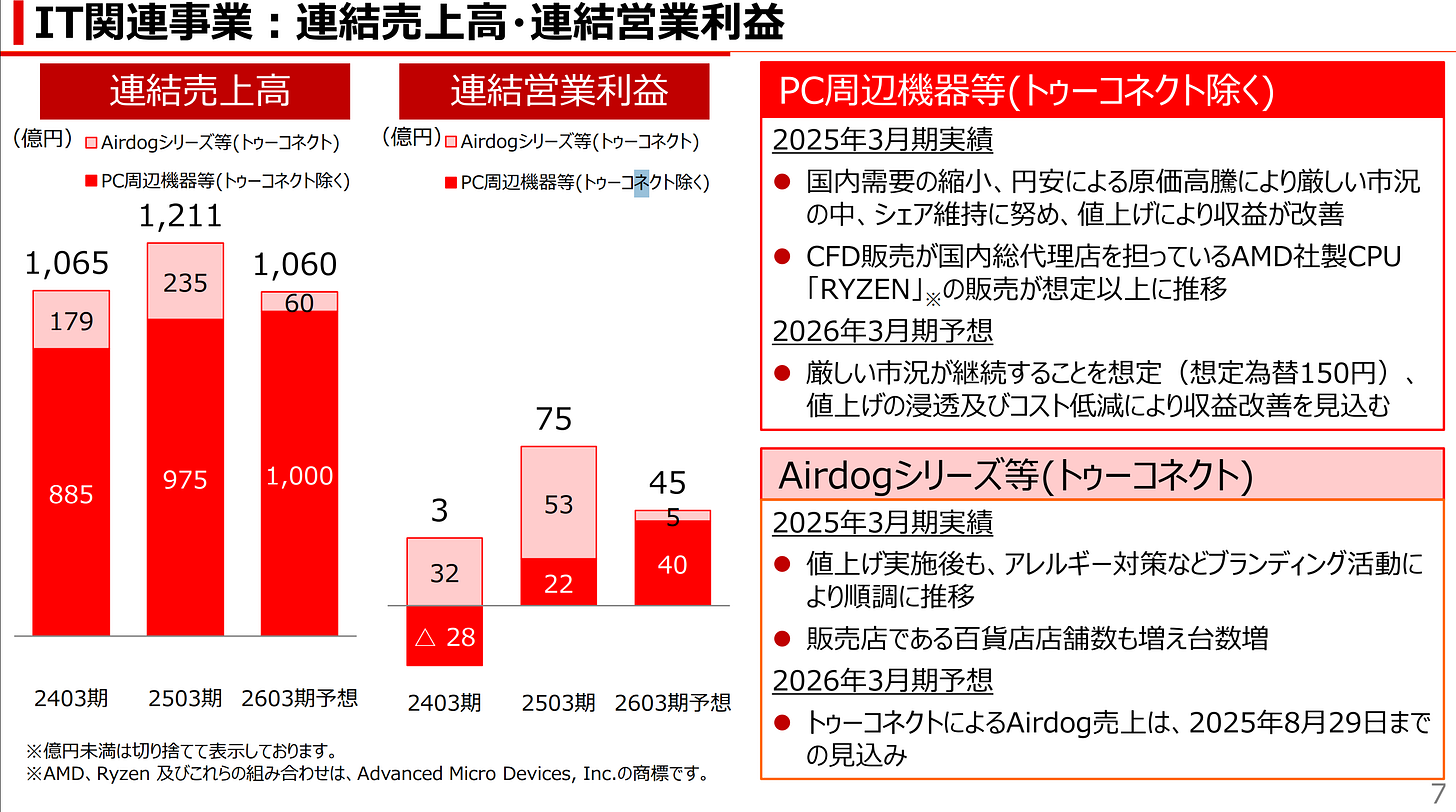

Airdog (air purifier and fan products) exclusive sales contract ends on Aug 29, 2025. Airdog positively contributed to segment profit in FY2024; hence, now that Buffalo is a secondary distributor, their operating margins from this product will decline drastically. Buffalo must rely on its PC peripherals for segment profit.

Additional questions we want answered:

How can Buffalo maintain positive margins and raise margins?

How can Buffalo raise revenues?

What do we think the equilibrium P/B ratio is where buybacks make less sense?

How can Buffalo ensure they don’t get their lunch eaten by Chinese or other competitors?

What are the advantages working in Buffalo’s favor to allow it to stay competitive?

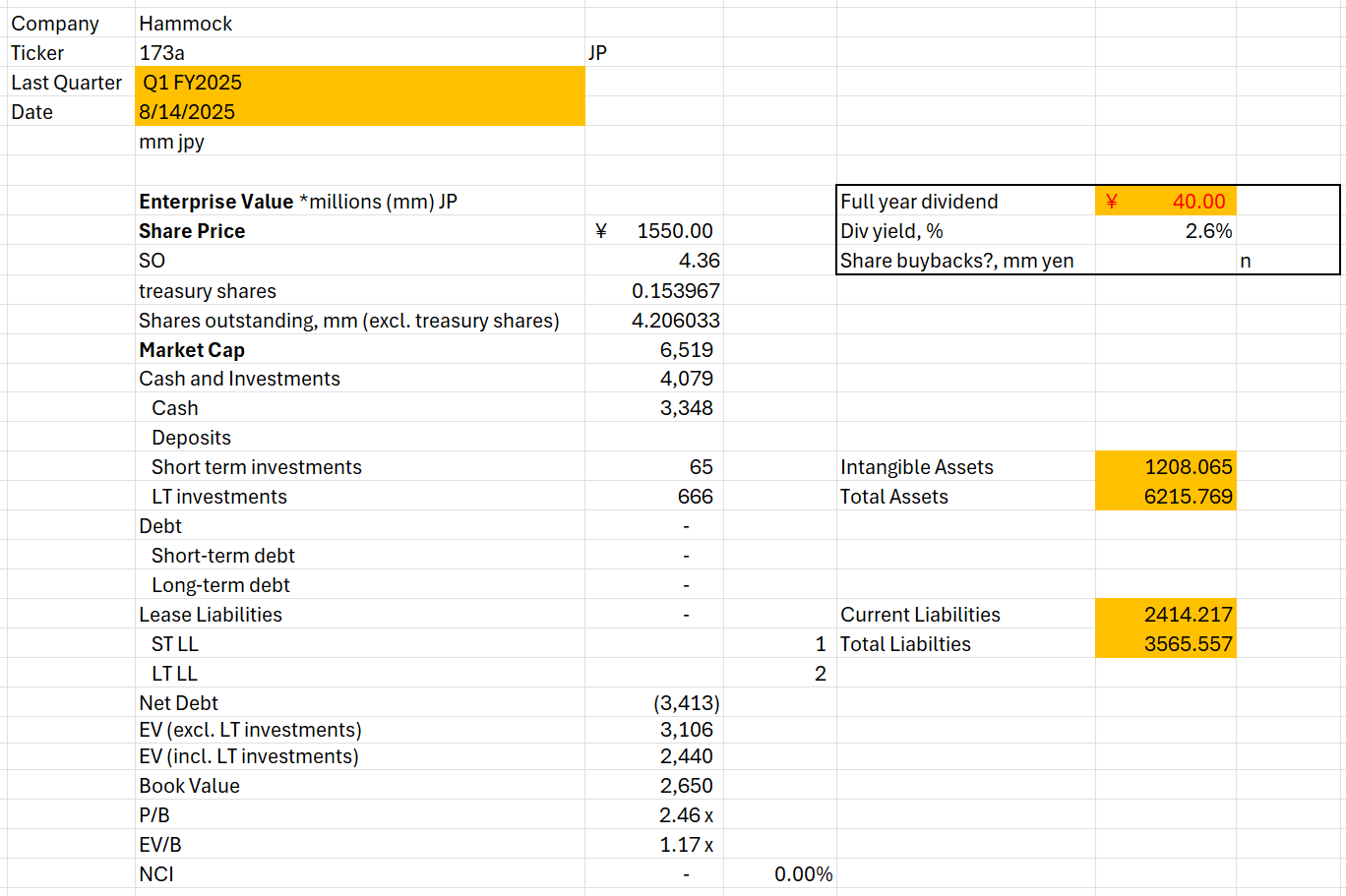

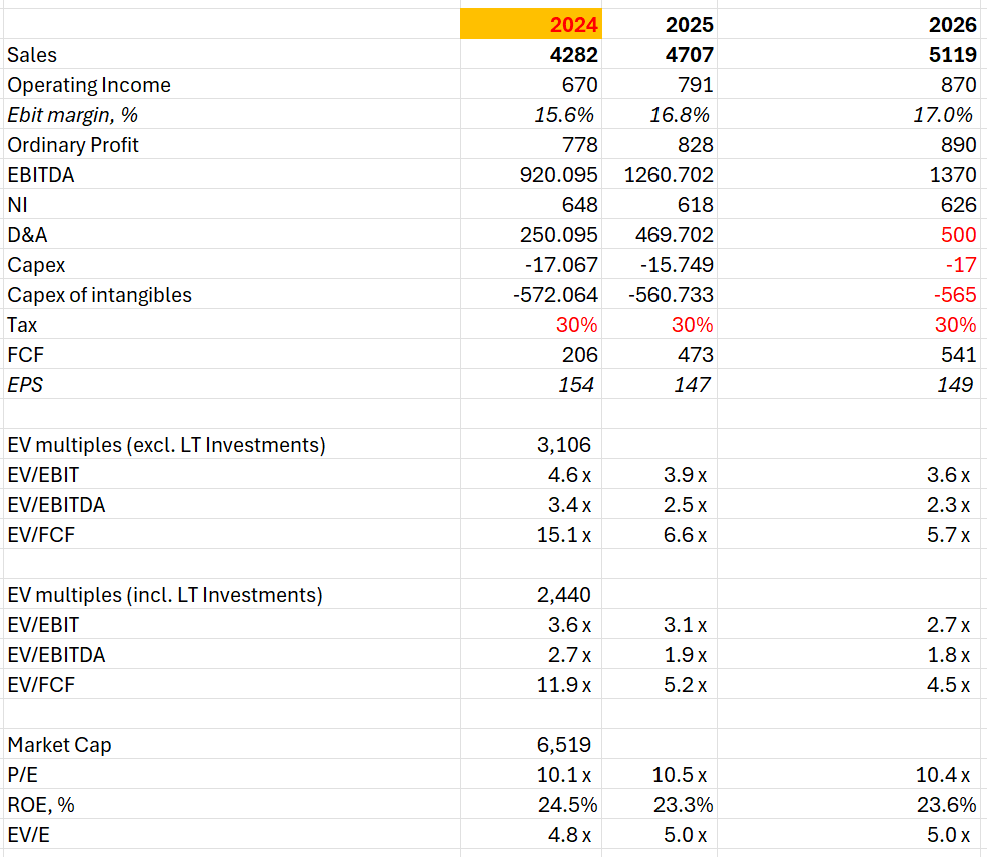

173A - Hammock

*Price/share: 1550¥/share (Aug 19th, 2025)

Quick Company Overview:

Hammock Inc. (TSE Growth: 173A) is a Japan-based IT solutions company specializing in enterprise software development and sales. Its operations are divided into three solution lines:

Network Solutions, led by the “AssetView” series, which provides IT asset management, security, and data leakage prevention

Sales DX Solutions, which integrate business card management, SFA/CRM, and MA tools into comprehensive sales support platforms

AI Data Entry Solutions, offering AI-powered OCR (Optical Character Recognition) services such as “WOZE” and “DX OCR” that streamline data entry.

*Each solution is delivered in both on-premises and cloud formats, with cloud adoption accelerating in recent years.

…to continue reading this post, consider becoming a paid subscriber!