*Legal disclaimer: This stock write-up/financial model is not investment advice. Please do your own due diligence. Please seek guidance from a professional financial advisor near you. Investing in stocks carries risk. No returns are guaranteed. No hardcodes, formulas, data points, or references are guaranteed to be correct. The creator of this post will not be held responsible for any inaccuracies.

A full equity research report and full financial model for Haier has been released to paid subscribers. This is simply a quick pitch.

Haier Smart Home is a Tri-listed stock. It’s stock trades on the Shanghai (A shares), Hong Kong (H shares), and Frankfurt stock exchanges (D shares). The D shares trade at a 60% discount to the mainline. In this stock pitch, I will go over my investment thesis on investing in the D shares trading on the German line.

Table: Tri-listed breakdown

Table: A Shares Valuation at a Glance

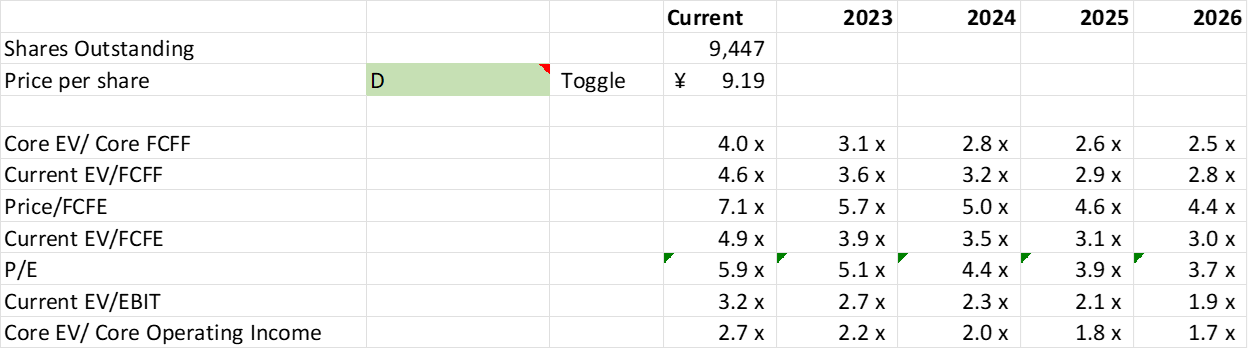

Table: D Shares Valuation at a Glance

Key Highlights:

-Great (A) management and good (B-) business economics at an extremely attractive price (A+)

-The D shares trade at a 60% discount to the A shares and a 59% discount to the H shares.

-This stock provides a 2.5% dividend yield to A and H shareholders. D shares have equal voting rights, equal rights to dividends, and are equivalent to their A and H counterparts in equity ownership of the company. Given the heavy discount, the dividend yield of D shares is 6.2% in 2023, 7.2% 2024 (annual dividend already past ex-dividend date in 2023).

-Protection on the downside due to the dividend yield. The lower the D shares go, the higher the dividend yield increases. If A or H shares drop, it becomes increasingly difficult to maintain the same discount rate or even expand the discount rate. If A or H shares drop, the likely outcome is that the discount rate will narrow. This is only a logical deduction; historically, this has not been the case.

-High Margin of Safety: Market Value of ¥23-24 RMB, margin of safety to market value of 58-59%. Without even taking intrinsic value into consideration, there is already a large margin of safety in reference to other stock exchanges the shares trade on.

-Large cash pile, resulting in a net cash/share balance of ¥2.88 RMB per share. In other words, at €1.15 per D share, you are paying a RMB equivalent of ¥9.19 RMB per share. Due to cash exceeding debt, each share has an equitable interest of ¥2.88 RMB per share in net cash. The true value you are paying for the company is ONLY ¥6.30 per share. This means that the already attractive 5.9x P/E is the incorrect metric to look at when cash exceeds debt on the balance sheet because enterprise value is lower than the market cap of the company. The PRIMARY multiples to look at are enterprise value multiples. The D shares trade at 2.7x 2023 EV/EBIT and 3.6x EV/FCFF multiples.

-A large-cap stock that’s growing market share, revenue, and earnings and trading at low single-digit multiples of FCFF, EBIT, or operating income is astronomically cheap.

Important Message:

New Subscribers:

New Free Subscribers until the end of August, 2023 will receive my full equity research package on Haier Smart Home 690D directly in their inbox.

Current Subscribers:

If you want a copy of my full equity research report on Haier, all you have to do is refer me to someone in your network. An email should have been sent to you describing the referral program. You will be awarded 1-6 months of paid subscription, depending on how many referrals you generate.

This is a win-win, as you don’t have to pay $10 for a monthly subscription, and I get a subscriber in return.

Business Overview:

Haier makes white goods, or major home appliances. Think refrigerators, dishwashers, laundry machines, A/C units, and water heaters & purifiers. Not only does Haier have the largest market share domestically, but Haier is the global leader of the major home appliance industry. According to data from Euromonitor, the Company ranked first in terms of sales volume in the global major appliance market for 13 consecutive years (2022 Annual Report (AR)).

The Company has a global portfolio of brands, including Haier, Casarte, Leader, GE Appliances (acquired in 2016), Candy (acquired in 2019), Fisher & Paykel (acq. 2012) and AQUA (acq. 2018). From 2008 to 2022, Haier brand refrigerators and washing machines ranked first among global major home appliance brands in sales volume for 15 and 14 consecutive years, respectively.

Main Thesis:

“Only buy something that you'd be happy to hold if the market shut down for 10 years.” -Warren Buffett

Table: Tri-listed breakdown

Let’s say you were interviewing for a finance job. The interviewer gives you the fundamentals of the company and asks you to value the business. Afterwards, he tells you that the stock is traded on 3 different stock exchanges. 1 of the exchanges it trades on will close for 10 years. What discount would you ascribe to the shares in the market that are closed? (Keep this question in the back of your mind.)

Table: Market Cap Breakdown

In 2021, the special situation on this stock was to long the D shares and short the H shares. The special situation was brought to my attention by Jeremy Raper who was being interviewed on “Yet Another Value Channel” on YouTube. You make a theoretical risk-free return based on the discount narrowing. The thesis was that, given that the HK line opened in 2021, this provided a path to fungibility that did not exist before. Fungibility means you can move the D shares over to the Hong Kong Stock Exchange and convert your D shares to H shares. If this were allowed, then D shares would trade on par with H shares. Furthermore, given the HK line is 30% of the market cap of the entire company and D shares only make up 1%, we simply needed 1/30th of the shareholders to hold D shares to get the discount to narrow. There is also a cost to shorting H shares in the form of the interest rates set by your stock broker. Given the positive dividend yield in the 4-5% range and the cost to borrow in the 1-2% range, the trade was not only risk-free but also had a “positive carry,” or positive yield, from the difference between the dividend yield and cost to borrow.

Fast forward to 2022, interest rates rose, and the positive carry has turned negative. The management has not repurchased a single D share, and the discount has expanded as high as 69% at its peak or narrowed to as much as 33% at its lowest. Given the opportunity cost of capital, management’s lack of intention to repurchase shares, the lack of motivation from public investors to narrow the gap, and the expanding discount, special situation investors have left the scene, and the stock continues to trade at a steep discount.

Table: Discount Analysis (D shares to H shares)

What is worthy to note is that if we are to compartmentalize the discount rates by year, the largest range of discounts came in the first year since the inception of H shares. This period corresponds with when the special situation was first identified and when investors believed in the possibility of the discount narrowing. In 2022, with interest rates rising, the positive carry became negative, and the long/short trade became riskier than before. This period corresponded with the discount expanding to its historically highest point. In 2023, we are currently sitting at the average of the range of discounts.

Table: Historical Discount Rate %

Table: Share Price and Discount % Trendline

This is the most interesting chart in my analysis of the relationship between the price of D shares and the discount rate relative to H shares. As the price of the stock has dropped, the larger the discount has gotten. The higher the price, the lower the discount. This completely goes against my own initial thesis that if the stock price drops, the dividend yield should act as a counterbalance to prevent the discount from getting too large. So far, I have been wrong. But this provides us prudent investors with a rare opportunity: to invest in the stock at the widest possible discount with the highest possible dividend yield. This provides us with downside protection on multiple fronts.

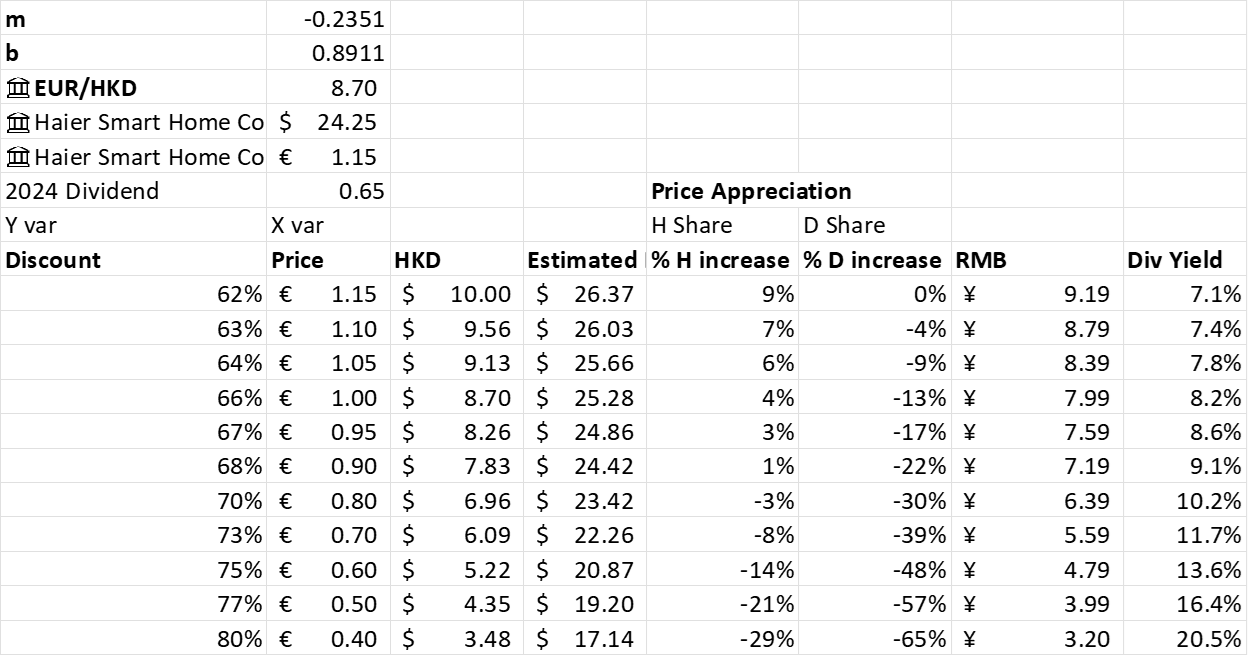

Correlation: -0.926

Y=-0.2351x +0.8911 (y = mx+b, m= -0.2351 is the slope of the trendline)

R2=0.8577 (How much the variation of a dependent variable is explained by an independent variable)

Here the discount rate (variable Y) is the dependent variable and the D share price (variable X) is the independent variable. The R2 of 85.77% means 85.77% of the variation of the discount rate is explained by the variation of D share’s stock price.

The discount and share price are negatively correlated, as demonstrated by the downward-sloping trendline. Correlation measures the degree to which 2 variables move in relation to each other. The discount rate is, to a high degree, negatively correlated to D share’s stock price.

What conclusions can we draw from these statistics if they hold true?

This is good news for investors in D shares because, as the prices of the A and H shares increase over time, the D shares will increase along with the A and H shares. In addition to this, if the correlation holds, not only will D shares increase in price, but the discount rate should narrow as well, providing additional price appreciation potential. With such a high correlation of -0.926, we can assess the price appreciation potential of D shares at different price points.

Table: Change in Discount at Different D Share Prices

Let’s assume we believe it is possible for the H shares to increase by 17–21%; based on our linear regression, the discount should drop from the current 60% to around 47–54%, and the price of the D shares should increase by 31–57%.

How long do we believe it will take H shares to go up roughly 20%?

In any given year, this is likely to happen, but to be conservative, let’s say 2 years. In 2 years, we should expect the price of D shares to go up by 31–57% and to collect 2 dividend yields in the amounts of 7% (2024) and 8% (2025). For sake of simplicity, that is roughly a 46-72% return in 2 years.

How long do we believe it will take H shares to go up 30%?

Now, I personally don’t believe the relationship will hold all the way down to the 35% discount mark, mainly because, fundamentally, the discount was at its lowest point in 2020/2021 when H shares were first publicly issued. This coincided with when the special situation of longing D shares and shorting H shares was first introduced. There is no such short-term catalyst today.

But let’s think about the best-case scenario. I believe H shares can definitely increase by 30% in 1-3 years. If the linear regression holds true, how does a potential 1-bagger plus dividends sound in 1-3 years?

Although I am skeptical, as correlation does not mean causation, the fact that we are entering at near the bottom of its 3-year price range and at near the top of the range of discount rates means that we have the following working for us:

1) Low downside potential

2) Less risk of discount expansion

3) High dividend yield

4) Higher asset appreciation potential through discount narrowing

Hence, my main thesis is to long D shares of Haier Smart Home. It currently provides limited downside, with high potential price appreciation and a juicy dividend yield to keep one satiated along the way.

*These are forecasts for dividends announced. Dividends paid are for the following year. The dividend paid in 2023 was ¥0.566. The ex-dividend date is July 24, 2023, so unfortunately, you have missed the dividend for this year.

D shares make up just north of 1% of the company’s market cap. I found it very interesting that essentially 99% of shareholders were willing to invest in this business at roughly 15x 2022 P/E and roughly 10x 2022 EV/EBIT. These multiples imply some level of growth; hence, for 99% of shareholders, this stock was not a value trap but a company with growth potential.

After doing a deep dive on Haier’s history and reading “Reinventing Giants,” a book that describes the company’s unique management system, the following are the company’s competitive advantages:

RenDanHeYi(人单合一) superior management system with less bureaucracy and faster decision-making and execution without the need for management intervention.

Speed Kills: Haier’s Rendanheyi management system has 4 pillars: self-organization, self-motivation, self-driven value creation, and self-evolution. Haier provides autonomy to employees to quickly react to consumers needs and wants. Through the creation of purpose-built microenterprises within the firm, the company can go from ideation, procurement, manufacturing, and distribution of the finished good to the end consumer faster than most competitors.

Distribution: Like Amazon, Haier has the most expansive distribution network that reaches the 1st, 2nd, 3rd, and 4th tier cities in China. In China, there are many layers of middlemen you must get through before getting the product into the hands of end consumers. There are national wholesalers, regional wholesalers, department stores, and retailers. Every layer of distribution cuts into profits. Like Apple, they have their own customer experience store called “Three-Winged Bird.”

Low-cost producer: Given the companies’ size and scale, they can produce white goods at lower costs than their competitors. This has allowed Haier to price its products extremely competitively in comparison to its rivals. This, coupled with the company’s ever-growing efforts to reduce components within appliances, increase shared components across products, and create components in-house, further reduces COGS.

I expand on why the above are so important in my full equity research report. In fact, only in my full equity research report will you understand why Haier trades at growth multiples. Haier has superior competitive advantages working in its favour in a highly competitive industry. The reason the company trades for growth multiples on the mainline is because, with its competitive advantages, it is likely to continue to gain market share and increase its revenue and profits overseas. We get all this growth at non-growth/value trap multiples.

Fundamentals:

The company has substantially more cash than debt. Given the lower interest rates in China and the abundance of cash to pay down debt, the debt is not a burden at all.

The company generates positive free cash flow (FCF). Given the cash-flow nature of the business, the company has the balance sheet to make acquisitions to expand its market share and international brand footprint.

If one were to access my model, you would see that the company has consistently had higher capex than depreciation. This is consistent with them increasing sales and capturing more market share. They need to spend money on additional buildings and factories to produce more products. Despite the growth capex the company spends each year, the company still attains a healthy FCF.

As shareholders, we would not like for the company to simply build a cash pile, as the return profile on cash is lower than the company’s core operations. I believe the cash accumulation will opportunistically allow the company to continue to spend on growth capex, R&D, or acquisitions in overseas markets.

Sources of Return:

There are a couple ways to get to the Promised Land:

Price Appreciation:

The share price will appreciate if the following occur:

Price discrepancy between D shares and A/H shares narrowing.

Based on our regression model, A/H shares increasing in price should allow D shares to not only increase in tandem, but at a faster rate than A/H shares given the discount narrowing

As a result of organic business growth

Utilizing cash for acquisitions

Share repurchases by management

D shares delisting and fungibility approval through the Hong Kong Stock Exchange

Most investors have given up on the notion of the company repurchasing D shares. Well invert, adopting Charlie Mungers mental model, what are the chances the company doesn’t do anything with the D shares in the next 10 years? The company has not repurchased D shares. The company won’t repurchase D shares. The difference between these 2 statements is night and day.

What I think could be going on is that the investment public has assumed that, given the company has not repurchased D shares in the short term and their trades from doing a long/short strategy haven’t paid off too well given the discount expansion, they have written off the simple case of investing in the D shares by itself entirely.

Dividend yield:

While we are waiting for the price to appreciate, we get some peace of mind and downside protection through a decent dividend yield.

If we believe the discount rate will remain, then what provides D share investors with peace of mind is the dividend yield. When the share price drops, the dividend yield increases; hence, there is a limit to how much the stock can drop before dividend investors come in to support the stock price.

Based on our linear equation we derived from the trendline of the discount and share price data, historically, my assumption above hasn’t held. To be honest, the scenario where my assumption doesn’t hold can be interpreted as good news. This means that as the A/H shares drop in price, the price of D shares will not only get lower in tandem, but the discount will expand.

If this is the case, then I would recommend a multi-tranche investment strategy to take advantage of this irrationality.

Table: Dividend yield at different discount rates

*Keep in mind that the H share prices might look a bit high because the Euro has recently strengthened in relation to the HKD.

When we look at the extreme predictions in this table, if they hold true, this provides prudent investors with a lot of potential upside. If A/H shares drop 20–30% from current prices, the discount will expand to 77–80%, which would provide me with a 16.4–20% dividend yield. If this were to happen and the market blessed me with such irrationality, believe me, I might have a 30% position in my portfolio. If we can purchase shares at €0.40, imagine the price appreciation potential given discount narrowing; we would have a multi-bagger on our hands in that scenario.

The max the dividend yield has gotten is 8.6% during the last dividend period. I do think it would be irresponsible to blindly believe in a trendline and wait for such extreme results to occur. The market is already offering us a very good investment opportunity. Just recognize that if the market does give us a sweet offer, we must have high enough conviction to size up the position in our portfolio. I provide you with a detailed explanation of the business economics and competitive advantages of Haier in my full equity research report.

What is the street or analyst missing?

D shares aren’t being acknowledged

What I find very interesting is that D shares aren’t even mentioned by most analysts in China. In their equity report they will mention the A and H shares, but provide no forecast for D shares.

On Interactive Brokers, the number of analysts that provide forecasts for D shares is 1. The number of analysts that provide forecasts for A shares is 30+.

The price appreciation potential D shares have when A and H shares rise in price and the discount narrows

The potential for D shares to be repurchased given a long enough time frame

Investors are seeing the D shares as something to trade, not a security to hold long-term

Catalyst:

Share repurchases are possible in the short-, medium- and long-term.

Effective utilization of the cash pile

The stock is expected to have 80 to 100 bn RMB of cash from 2024 to 2026.

There is likely pressure from shareholders on management to use the cash in a productive manner if the cash pile gets that large. Productive uses of cash include:

a. Repurchase of shares, especially beneficial for A/H shareholders if D shares are repurchased at pennies on the RMB.

b. Acquire a company domestically or overseas

c. Increase dividend/Special dividend

Continuous acquisition candidates

How to win in this investment:

This stock was targeted at the dividend investors out there. D shares offer a higher dividend yield and higher price appreciation potential than their A and H share counterparts, along with a free 1.5-bagger price appreciation lottery ticket. I see no problem with starting out with a small position and forgetting about it. This investment is for the patient, long-term-oriented investor.

This stock, in my opinion, has an ultra-low downside given the already heightened dividend yield and the massive discount rate from the main line. The counterforce to downside pressure is an ever-increasing dividend yield. Historically, this counterforce hasn’t been present; hence, I recommend using a multi-tranche strategy.

You can make each trade when the market offers you an egregious dividend yield or an egregious discount rate. I would personally size each tranche at different sizes. i.e., the size of the position would be greater if the dividend yield was 10% vs. 8%. Have in mind what your max position could be for this stock. Portfolio management decisions are personal and are based on one’s risk appetite.

Risks:

Discount rate expansion

FX risk. Stocks trade on the Frankfurt stock exchange in Euros. Half of Haier’s revenues are derived in RMB. The other half is derived internationally. Over a 5-10 year investment horizon, the FX risk on an annual compounded basis is very small for USD and CAD investors.

Supply chain issues or chip shortages

Disclosure: I am currently long shares of 690D D Shares.

Want to enjoy paid memberships for free? Help me grow by referring a friend!

1. Share Alan’s Substack: Continuous Compounding.

When you use the referral link below or the “Share” button on any post, you'll get credit for any new subscribers. Simply send the link in a text, email, or share it on social media with friends.

2. Earn benefits. When more friends use your referral link to subscribe (free or paid), you’ll receive special benefits.

Get a 1 month comp for 1 referrals

Get a 3 month comp for 5 referrals

Get a 6 month comp for 10 referrals

Thanks for your support!

To stay up-to-date or receive notification of when I release my latest stock pitch, please follow:

Substack:

Twitter: https://twitter.com/compoundersEX

YouTube: https://www.youtube.com/@continuouscompounding

Instagram: https://www.instagram.com/compounders.ex/

I am into the Haier D-Shares since 2 years. The main problem IS the catalyst. There is no sign of a catalyst ( except the acquisitions maybe ). De-Listing without converting the share classes could also be one risk. I am not 100% sure about the rules but that could lead to investors getting paid in cash at an average stock price of the last 6-12 months.

"I might have a 30% position in my portfolio."

If stock again drops to unreasonable prices i agree with this. Currently this is an 8% position to me, but with the div as downside protection, when discount would get further irrational i might double down easily.

This seems still one of the weirdest , insanest market situations ever. Where all information is layed out for years, yet most investors ( every day )still bying the expensive H-Shares. Even in germany...

I remember hearing about Haier Smart Home during the roona, some video on youtube. Its hilarious to me that the the D listing is still even higher discounted 2 years later. I guess patience is a virtue.