Dear Continuous Compounders,

Today, I have 2 major announcements:

A quick pitch on my newest high-conviction stock

New pricing post August 15th, 2025:

Monthly plan: $30/month or $360 over 12 months

Annual plan: $180/annual or $15 per month

To incentivize long-term subscribers and disincentivize short-term subscribers, the new pricing post Aug 15th will be $30/month ($360 paid over 12 months). For those who see long-term value in my stock pitches, the new annual plan is only $180, a mere 20% increase from the former annual plan and a 50% discount compared to the month-to-month plan over 12 months.

Former plan:

Monthly plan: $15/month or $180 over 12 months

Annual plan: $150/annual or $12.50 per month

If you would like to lock in the previous $15/month plan or $150/year annual plan (save 2 months with the annual plan). Here is the link to take advantage of that offer:

https://continuouscompounding.substack.com/50PERCENTOFF

Act now, or the offer will end on August 15th, 2025!

*The reason the non-discounted annual plan states 300 USD and not 180 USD is because the special offer setting from Substack does not allow me to apply different discounts for monthly and annual. So after August 15th, I’ll manually adjust it back down to $180.

**Current paid subscribers, you will be unaffected by this price change for the time being. If you are, please do let me know and slide into my DMs on here or Twitter/X. I’ve adjusted prices in 2024, and I’ve had 0 issues before.

***My thought process has always been to provide immense value to readers far greater than what I charge. There will be a time when the value I bring to the table is so large relative to what some of my early paid subs are paying that I will have no choice but to raise the prices. I may also change my mind on this and keep you guys grandfathered. I could also send each of you a special link that is still a major discount to the current market rate being charged. I’ll be fair.

Newest Stock Pitch (Paid Sub Exclusive)

I hate it when a stock I’m in the process of writing about rallies, and my paid subs can’t take advantage of a lower cost basis.

To mitigate this problem, before I wrap up my very in-depth stock pitch, I will be releasing this shorter quick pitch on the current high-conviction deep dive I’m writing about.

This kind of happened to Glory, where I was able to give you guys a short overview of why you should invest in Glory (2280 yen per share), but by the time the deep dive came out, it had rallied 20-25%. It has rallied another 40% since I released the stock pitch (2770 yen per share), but I want you guys, my paid subs, to make as much money as possible.

If you are a free sub, I mainly release immediately actionable ideas. I put my money where my mouth is, so if you’ve noticed, in almost every stock pitch I’ve ever released, I disclose I am currently long the position.

Here at Continuous Compounding, I focus on quality over quantity.

(Can skip if you don’t care to learn more about me) My first passion in life was actually drawing. When I was a kid, I took sketching lessons. The teacher would put up his personal cartoon sketches and have us copy them. The teacher would walk around and give us pointers as he saw the need to. Sometimes he’d be lazy if no parents were around. My goal was to get as close of a sketch to my teacher’s sketch as possible. I noticed that some kids saw the lessons as a race. At a comfortable pace I could do 4-5 drawings a session. At the end of a session, I remember a kid boasting that he completed 9 drawings. I challenged myself once, and while maintaining my standard of quality, I could only do 6. I remember it like it was yesterday; a kid was having trouble with her sketch. She wasn’t able to draw a certain part of a boat correctly. It was a challenging part of the sketch; I had erased and redrawn many times before finally being satisfied with my output. Other students glossed over the intricate details of that part of the boat in favour of speed. My teacher came over to my booth, went through my past drawings that day to find the sketch in question, and must have noticed I had drawn it properly. He grabbed my sketch and showcased it in front of the other kid, who just couldn’t get it. I felt bad for her because the teacher was purposely trying to compare her to me. A very Chinese thing to do. Besides the potential trauma the teacher bestowed upon another student, this validation gave me confidence that what I was doing was correct; there was no point in racing other kids to output more, because at the end of the day we were drawing to acquire new techniques and skills, not to race. I have been programmed this way ever since. I don’t release stock pitches to meet some arbitrary quota. I deliver less but offer more. I want to impress upon you guys the level of work that allows me to get this level of conviction, which doesn’t happen over a few days or sometimes weeks of research.

Be honest, for the $150 annual fee I’m charging, how many stock pitches do you need to truly work out? If we are being honest, anyone with a decent-sized portfolio, 1 would be all it takes.

High-conviction ideas are rare to come by, so I release less than some larger creators who have a frequent quota, but my hit rate has been phenomenal since I started. My pricing has been tuned to reflect the market price $/stock pitch you’d pay for a newsletter that outputs more. In a sense, with my Substack, you are only paying for actionable undervalued stock pitches not for fair-valued ones.

Are you really telling me it is that easy to find a high-conviction stock pitch? You can find 1 every 2-4 weeks? I can spend anywhere between 100 to 200 hours on an idea if I believe it warrants it. Haier Smart Home 690D was an idea that took me 1.5 months to finish extensive research on. Sometimes I enjoy the process of learning about a new company and developing a full picture of its business economics that time just flies. I also have a bad habit of letting ideas marinate for too long. Developing theories, trying to find evidence that disproves and supports it. It is a time consuming process, but I believe it’s worth it and you as readers get quality work that inspires conviction.

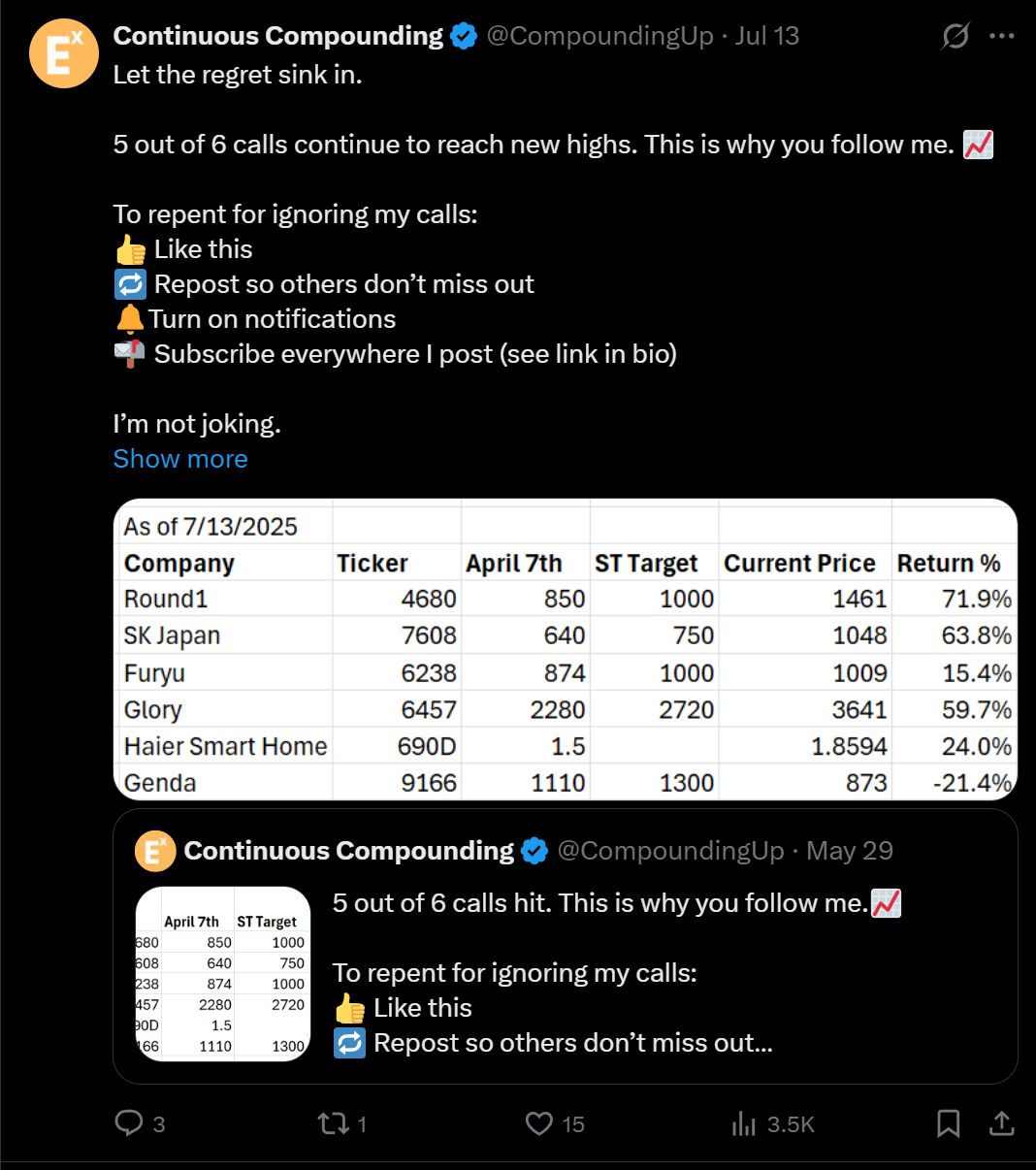

Here is how my recent picks did:

*The only loss I made was on Genda, which isn’t a stock pitch I wrote up. Notice how for every stock pitch I wrote myself, they have gone up. I am biased here given those are my stock pitches, but I know the stocks I’ve pitched in and out. I’m confident that I also know them far better than 98% of the investors that are in them, so whenever the stock gets cheap, I can recommend and invest in them with conviction.

Paid subs were notified of Glory (6457) 1 month before free subs. Those who followed my Glory trade in April would have made a +70% return.

My paid sub below has made a +72% gain, as his average price is 2255 yen/share (3876 yen per share as of July 25th, 2025)

Nice problem to have when you regret not buying more: