*Legal Disclaimer: This post and all its contents are for informational or educational purposes only. Continuous Compounding assumes no responsibility or liability for any errors, inaccuracies, or omissions in this post, links, attachments, or any actions taken based on its contents. The information sources used are believed to be reliable, but accuracy cannot be guaranteed. Recipients of this research are advised to conduct their own independent analysis and seek professional financial advice before making any investment decisions. The opinions expressed by the publisher in this post are subject to change without notice. From time to time, I may have positions in the securities discussed in this post.

This post and all its contents herein are the exclusive property of Continuous Compounding. This post is intended solely for informational purposes and is not to be distributed, reproduced, or transmitted, in whole or in part, for commercial purposes or sale without prior written consent from Continuous Compounding. Any unauthorized use, dissemination, or sale of this research is strictly prohibited and may be subject to legal action.

Disclaimer: I am long shares of AGF.B at the time of publishing this post.

I recently spoke to 2 Canadian small-cap portfolio managers and wished I could have pitched them a stock. Also, I haven’t pitched a North American stock in a while, so to all my NA investors, here you go.

I present to you AGF Management Limited (AGF.B -TSX)

Why you should care?

Trades at almost half the multiples of its direct comps (excl. long-term investments). 4.8x FY2024E EV/EBIT

Trades at $8.49 (Sept. 20th, 2024) and has $4.64/share of long-term (LT) investments (309mm)

Management has consistently raised dividends since FY2017, 5.4% div yield

Management is actively repurchasing shares and has performed substantial issuer bids once every 2/3 years

Target price of $12-$21, or 45-150% upside

*This stock pitch is based on the Q2 financial results, which was the latest quarter at the time this post was released. Here is the latest Q3 update!

It would help a lot if you could like, share, and refer an investing friend!

Consider supporting Continuous Compounding:

AGF was pitched at $8.49 and has quickly risen up 20% to $10.16. If you were a paid sub, you would have been able to invest in this opportunity.

Track record of stock pitches:

Active Positions:

Haier 690D: +50%

Furyu: +1%

SK Japan: +5%

Closed Position:

Round1: +55% (closed)

Okano Valve Manufacturing: +45% (closed)

GAN: +80% (closed)

CNTY: -50% (closed)

*As of Sept 21, 2024. Returns are rounded.

Hit rate: 6/7 (86%) *likely not sustainable

Average return: 27%

Average return excl. Furyu (published in June 2024): 31%

Average return for stocks outside of NA (excl. CNTY US): 40%

*Past performance is not indicative of future performance. I’d be happy if my hit rate is 60-80% in the long-run.

Paid sub testimonials:

Business Overview:

AGF is a $45.7 billion (bn) AUM global investment management company headquartered in Canada and offers investment solutions in the public and private markets through AGF Investments, AGF Capital Partners, and AGF Private Wealth. Aside from AUM, the company has $2 bn in fee-earning assets, investments in joint ventures, and indirect ownership in funds (unreported AUM).

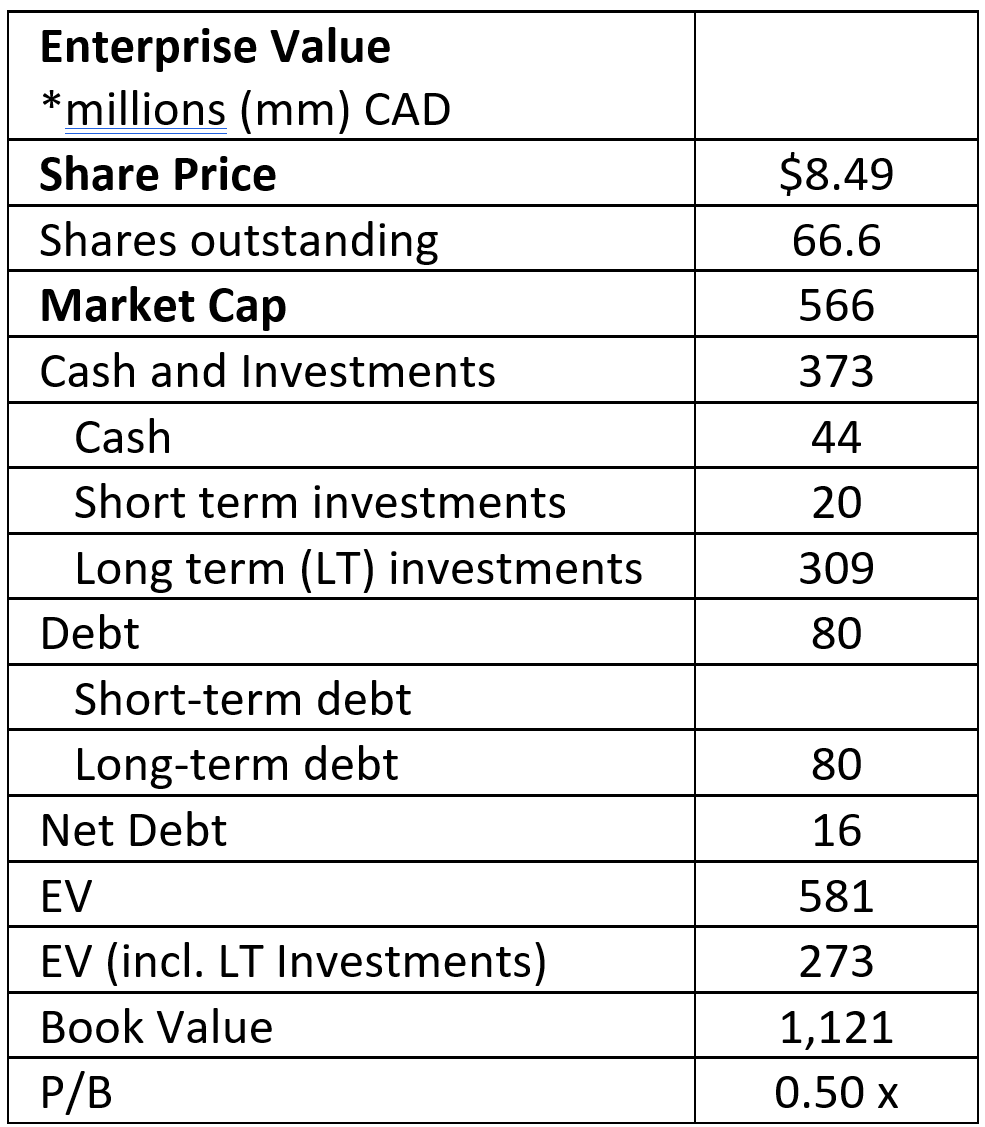

Quick Valuation:

*Price on Sept. 20th, 2024

With a share price of $8.49, the market is not fully appreciating the $4.64 per share of long-term (LT) investments (309mm) on AGF’s balance sheet. The LT investments consist of committed capital to various funds within the “AGF Capital Partners” segment. The value of the LT investment portfolio is deserving of an illiquidity discount, given likely redemption limitations, but not to the degree that the current valuation implies.

Comps:

Ignoring LT investments, AGF trades at a severe discount relative to its comps (CN Comps: FSZ, GCGA, CIX, IGM, US Comps : DHIL):

4.4x FY2024E (forecast period) EV/EBITDA vs. 8-12x of peers

4.5x FY2024E EV/EBIT vs 9-15x of peers

6.2x FY2024E P/E vs 10-13x of peers (*excludes CIX as debt is 2x that of market cap, hence trading at 5x P/E)

Sum of parts:

Value of operations + Value of Investments = EV

EV - Net Debt = Market Cap

Value of operations: 9x FY2024E EV/EBIT ≈ 1.1bn EV

+

Value of LT investments: 10% discount on LT Investments ≈ 280mm EV

≈1.4bn EV

-

Net Debt: 80mm - 44mm - 20mm ≈ 16mm

≈1.4bn MCap or ~$21/share (upper bound)

If we assume 9x FY2024E P/E (excl. Investments) ≈ $12/share (lower bound)

Excluding LT investments at the lower bound estimate of 9x P/E, the present market price of AGF provides a 30% margin of safety,

Based on a target range of $12-$21/share, the upside potential is ~45-150% return

Analysis:

So is AGF a value trap?

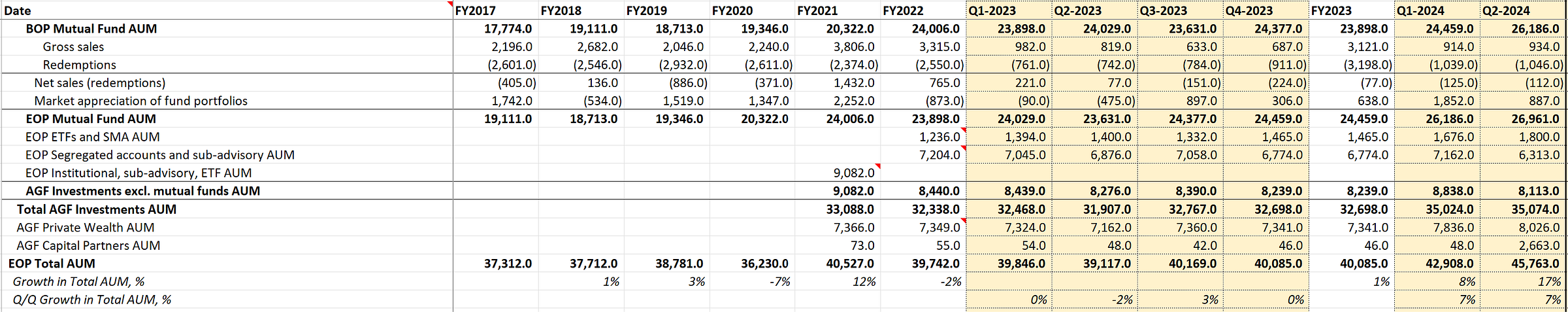

Gross sales, redemptions, and AUM growth:

The market is likely penalizing AGF for not being able to grow its business through gross sales.

Gross sales = inflow of client funds

Redemptions = outflow of client funds

Since FY2017, gross sales have only marginally covered redemptions, and net sales were negative (redemptions > gross sales) in the last 4 quarters.

If we look solely at net redemptions, then there could be a minor case for AGF being a value trap, but the AUM tells a different story.

Despite negative net sales, mutual fund AUM grew 2.5bn in the last 2 quarters due to market appreciation of funds. The positive impact that positive (good?) investment performance has on gross sales is lagging, so there could be a reversal in the current trend when financial advisors can more confidently pitch AGF. But then again, the TSX and S&P500 are up YTD, so all funds are easier to pitch when markets are going up as the business model survives on not drastically underperforming one’s benchmark at the cost of usually not outperforming one’s benchmark.

Furthermore, AUM increased by 2.6 bn through acquiring a majority stake in Kensington Capital Partners and strategic investments in New Holland Capital. Given AGF's highly cash flow generative core business and low leverage on the balance sheet, the market is underestimating AGF's potential to finance its own growth and increase AUM through joint ventures, acquisitions, and strategic investments.

Clients and Margins:

In 2022, the Canadian Securities Administrators banned the sale of funds that have deferred sales charges (DSC). Deferred sales charges are charges an investor would have to pay if they withdrew funds earlier than a predetermined investment time horizon (typically 3-7 years).

The benefit to the investor of investing in a DSC fund is that they would not have to pay any up-front fees if they plan to hold the fund long-term. The upfront fees are paid by the mutual fund to the financial advisor (FA).

1More on DSC funds and the DSC business model in the Appendix. AGF has other funds, but DSC funds were a substantial portion of AUM.

DSC elimination in 2022 by the Canadian Securities Administrators marked a potential risky event to AGF’s business model, which could have led to a lack of gross sales and redemptions. What is surprising is that net sales were positive in FY2022 and for the first 2 quarters of FY2023. Clients have proven themselves to be sticky. Financial advisors have also transitioned to selling non-DSC funds that AGF has to offer.

As a result of DSC elimination, a pleasant surprise is that margins have improved due to the removal of deferred sales commissions to financial advisors (FA). Operating income margins have improved from mid teens to now over 20%. The business economics of AGF’s business model have improved post-June 2022.

If FAs have switched from pitching DSC AGF funds to front-end load (FEL) or no-load AGF funds, churn of new clients becomes less costly.

What do I mean by this? Before, let’s assume AGF had to pay 5% of AUM as an upfront fee to incentivize FAs to pitch their fund. For a FEL fund, the upfront fee is paid by the investor, so the cost is passed onto the investor. This roughly 7-8% operating income margin boost is the new normal! The market may not fully understand that this increased profitability is here to stay. Better yet, the DSC elimination does not affect clients already in a DSC fund, so if you withdraw funds before the agreed upon holding period, clients still have to pay a deferred sales charge, making existing clients sticky.

You have a setup where:

Current clients of contingent DSC fund holders are incentivized not to switch due to deferred sales charges (no change to clients of former AGF FEL or NL funds)

Customer acquisition cost of new clients have substantially declined

Corporate Governance:

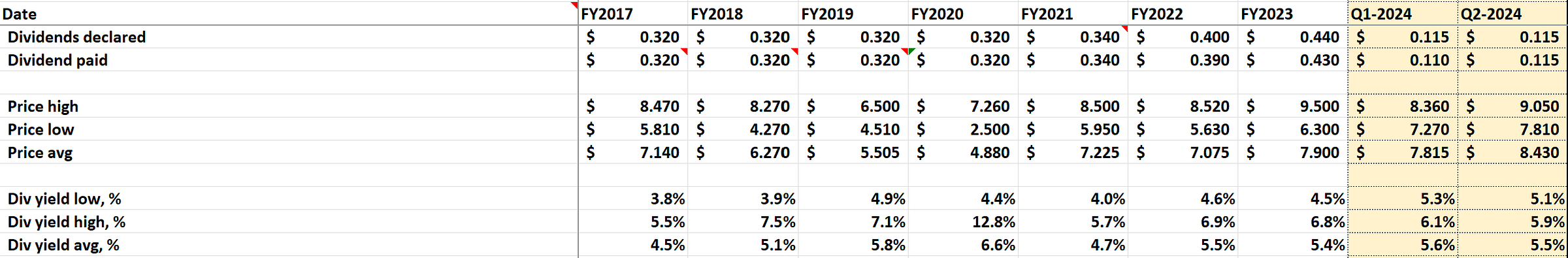

Dividends:

Dividends have been increasing since FY2017. The current quarterly dividend is $0.115 or $0.46 (5.4%) annualized

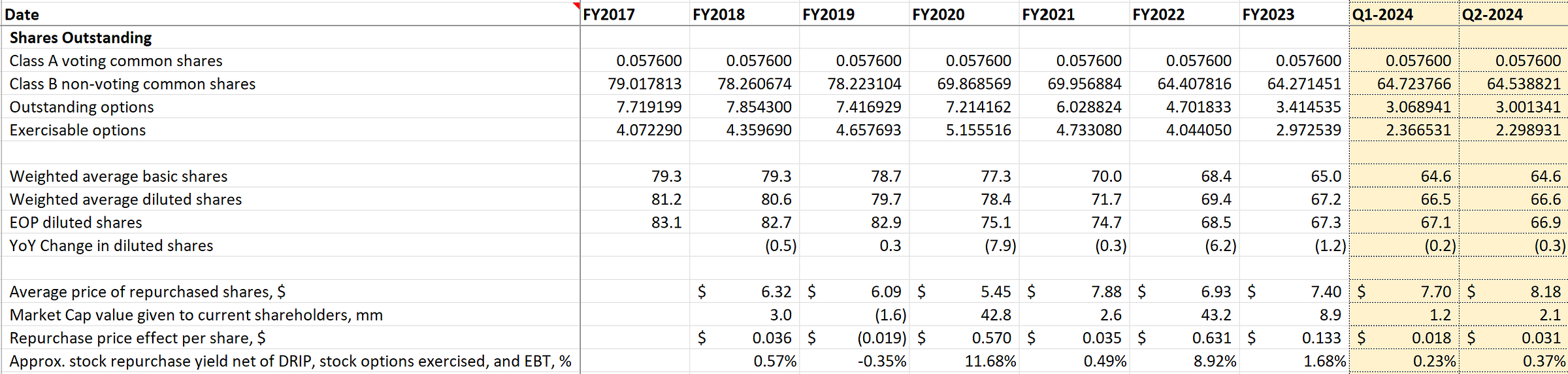

Share buybacks:

AGF has performed routine share repurchases via its “normal course issuer bid” (NCIB). See image above for estimated share price impact of repurchases.

Also, the company had 2 substantial issuer bids (SIB) in FY2020 and FY2022, showing a willingness to perform large share repurchases.

Share repurchases for the employee benefit trust to offset the dilutive effects of employee restricted stock units (RSU).

What is not considered in the above image are the dilutive effects of stock options and stocks issued for the company’s dividend reinvestment plan offered to shareholders.

Since FY2017, the company has reduced diluted shares from 83mm to 67mm in Q2 FY2024.

Catalysts:

Although unlikely, a hard catalyst would be AGF being targeted for an acquisition. Soft catalysts are from management’s continued efforts in growing intrinsic value, paying a high dividend, and repurchasing shares.

Risks:

Risks could arise from increased fee pressure from low-cost funds (Index funds/ETFs)

larger than expected redemptions

poor fund performance

recession/stock market in a downtrend

limited candidates for JVs, acquisitions, or strategic investments

poor returns on LT investments, JVs, acquisitions and strategic investments

Summary:

To conclude, AGF is not a value trap and can grow its AUM through fund appreciation and transactions. While we patiently wait for the share price to reflect intrinsic value, management has demonstrated a willingness to increase dividends (5.4% yield) and perform routine and opportunistic share buybacks.

Disclaimer: I am long shares of AGF.B at the time of publishing this post.

To stay up-to-date or receive notification of when I release my latest stock pitch, please follow:

Twitter: https://twitter.com/compoundersEX

YouTube: https://www.youtube.com/@continuouscompounding

Instagram: https://www.instagram.com/compounders.ex/

r/TSEvaluestocks: https://www.reddit.com/r/TSEvaluestocks/

Appendix:

More on DSC Funds:

DSC: Deferred Sales Charges

In 2022, the Canadian Securities Administrators banned the sale of funds that have deferred sales charges (DSC). Deferred sales charges are charges an investor would have to pay if they withdrew funds earlier than a pre-arranged investment time horizon (typically 3-7 years). The benefit to the investor of investing in a DSC fund is that they would not have to pay any up-front fees if they plan to hold the fund long-term.

Before I continue, I’d like to pay a quick homage to Charlie Munger who said, “Show me the incentives, and I’ll show you the result.”

Essentially, DSC funds were marketed as funds that were beneficial to investors that planned to invest long-term. The business model works like this:

A client meets a financial advisor (FA) to discuss their investment goals and needs. The client states they are looking to invest long-term. Either that or the financial advisor shows them a typical picture of the beauty of compounding and what investing 100 dollars a month can do to their fortune at retirement and persuades you to invest long-term.

Seeing that the client is looking or persuaded to invest long-term, the financial advisor advises the client to invest in a DSC fund or low-load fund*.

FA to client: There are front-loaded funds that charge an upfront fee, but since you are committed to investing long term anyway, why not go with a DSC fund?With a DSC fund, the client does not have to pay any upfront fees to the financial advisor or the mutual fund. The FA is incentivized to pitch the DSC fund because once the client commits funds, the mutual fund pays the FA around 5% of the committed capital as an up-front commission.

Mutual funds typically charge 2% a year on AUM, so the mutual fund recoups the commission paid to the FA if the investor stays an investor for long enough.

*A low-load fund is essentially a DSC fund, but with a shorter investment horizon, i.e. 3 years, after which the investor will not be charged a DSC if they withdraw their money. The financial advisor receives a lower upfront commission from the mutual fund as a result, typically 2-3%.

The client is happy they didn’t get to pay an upfront fee, and the financial advisor is happy they earned a hefty commission.

After the initial sale, the FA continues to receive trailing commissions, typically around 0.25% to 1% per year, paid by the mutual fund based on the assets under management (AUM).

What could go wrong?

What if the DSC fund underperforms its benchmark and the client wants to withdraw funds?

Typically, if a client withdraws early, the client must pay, as the name implies, a deferred sales charge. The deferred sales charge % declines the longer you hold the investment. The fee is highest in the first year (typically 5-6%) and gradually decreases over the holding period until it reaches 0%.

The DSC allows the mutual fund to recoup the 5% upfront commission paid to the FA. If the mutual fund charges 2% management fees on AUM, factoring in trailing commissions paid to the FA, it will take a few years to break-even ignoring fund performance. If the client invests for 7 years, the mutual fund eats, the financial advisor eats, and the client pays no upfront fee. A win-win-win!

But let’s think about this deeper. The only party that has something to lose is the investor in the arrangement. The FA already received an upfront commission. The mutual fund charges a management fee and gets their up front commission back in the form of a DSC if the investor withdraws. The DSC fund option does not provide flexibility in the following scenarios:

Switching to a better fund with a better investment track record

Change in risk tolerance and wanting to switch to a lower risk fund or a fund that is invested in more fixed income

a family emergency or an urgent need for liquidity

a client that does not have a complete grasp of their risk tolerance. i.e. they were in a risk-seeking/gambling mood, but they are really risk-averse.

The investor may stay an investor for longer than they are comfortable due to the high switching costs of the DSC.

Back to Charlie, based on the compensation structure to the FA, the FA is incentivized to sell you a DSC fund as it puts the most amount of money in their pocket. I have personally worked in sales as my first job in college. Setting up the sale is as important, or more important than the actual product pitch itself. The setup here is getting you to think long-term via the beauties of long-term compounding and then coincidentally pitching you the fattest fee fund they have. Coincidence, probably not.

Thus, in June 2022, further sale of DSC funds are banned. It’s worth noting that DSC funds that have already been sold, are labelled as contingent DSC funds and AGF still receives deferred sales charges if the client withdraws early. The Canadian Securities Administrators announced this ban well in advance of June 2022, to provide ample time for mutual funds and financial advisors to adapt. A lot of the former DSC funds are converted to front-load funds or no-load funds. Mutual funds also gave incentives to assist current clients in their transition and to prevent redemptions. i.e. migrating to a front-loaded fund for a reduced cost. Under this new regime, there is more transparency, goals are more aligned, and FAs stand to make less money.

What is worthy to note is that AGF still receives “deferred sales charges” from contingent DSC funds. The amount of this charge hasn’t really declined in 2023. Potentially some investors really set it and forget it.

thanks for the write up. How did your deep dive into video production turn out ?