Uncovering Pachinko: Part 2 Pachinko Peripheral Companies

A comprehensive guide to Pachinko Peripheral Companies

*Legal Disclaimer: This post and all its contents are for informational or educational purposes only. Continuous Compounding assumes no responsibility or liability for any errors, inaccuracies, or omissions in this post, links, attachments, or any actions taken based on its contents. The information sources used are believed to be reliable, but accuracy cannot be guaranteed. Recipients of this research are advised to conduct their own independent analysis and seek professional financial advice before making any investment decisions. The opinions expressed by the publisher in this post are subject to change without notice. From time to time, I may have positions in the securities discussed in this post.

This post and all its contents herein are the exclusive property of Continuous Compounding. This post is intended solely for informational purposes and is not to be distributed, reproduced, or transmitted, in whole or in part, for commercial purposes or sale without prior written consent from Continuous Compounding. Any unauthorized use, dissemination, or sale of this research is strictly prohibited and may be subject to legal action.

Disclaimer: I am long shares of Glory (6457) at the time of publishing this post.

Table of Contents:

Overview of opportunity in the pachinko industry

Commentary on impact of 2029/2030 integrated resort on pachinko industry

Business Economics

Gamecard - 6249

Glory - 6457 (Paid sub access)

Mars Holdings - 6419 (Paid sub access)

Daikoku Denki - 6430 (Paid sub access)

Ending Remarks (Paid sub access)

Before I start this section, I want to reiterate that I believe that the “current opportunity” in pachinko lies not in hoping for the industry to stabilize or resurge.

I believe it is highly likely for the pachinko industry to continue its decline unless notable innovation that can capture young adults is possible. But given the technology used in pachinko games is inferior to other modes of gaming, I see this as an unlikely event.

So where does the opportunity truly lie?

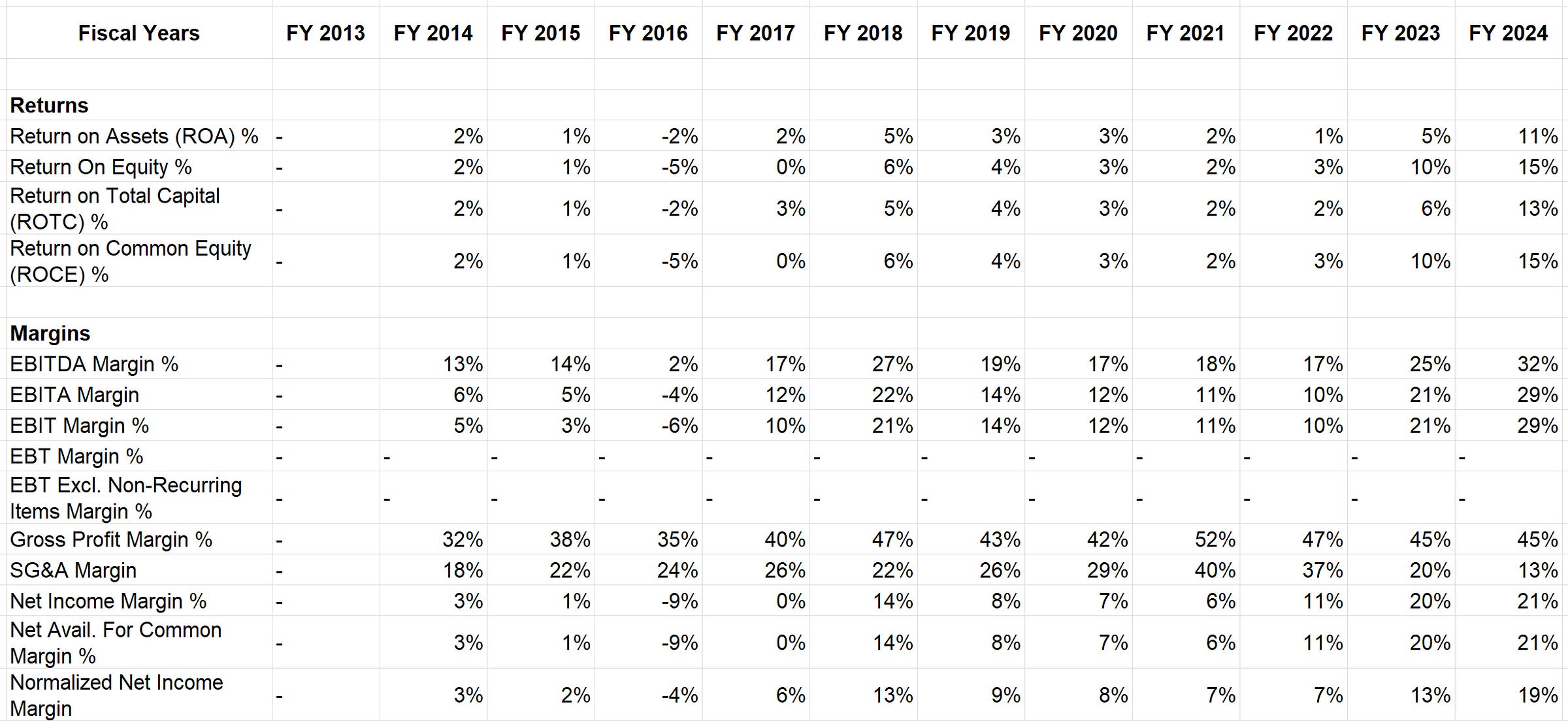

Despite pachinko being in a state of decline, the margins are healthy. Operating margins are above 10% in normal years and over 20% in great years. A catalyst in the recent margin expansion was due to the issuance of new Japanese banknotes which prompted hardware and software sales to support these new banknotes. It should be noted that once the upgrades are complete, the margins will drop back down to the historical margins of around 10%. I believe as pachinko related businesses dial back operations, they will remain cash flow positive for many years to come as they can adjust output and costs to match demand.

So if we can learn anything from Buffett, who took cash flows from Berkshire Hathaway and invested cash flows into acquiring other businesses, pachinko is also an industry with nice cash flows that can be directed into other endeavours. Pachinko is still the only legal mode of gambling in Japan (due to change in 2030 with Osaka’s integrated casino resort opens), hence is not in as dire straits as textiles were for Berkshire Hathaway.

The ideal setup is one where we have a pachinko related name, where the margins are healthy and will stay healthy, where cash flows, although gradually declining, stay positive and can be reinvested in other investment projects that are a good/great/optimal use of shareholder capital.

One example that comes to mind is Heiwa (TYO-6412). Heiwa produces pachinko machines, but it is not solely dependant on the earnings of pachinko to stay afloat. Heiwa has taken the cashflow from its pachinko business and invested it in golf courses. Heiwa has been a serial acquirer of golf courses in Japan and has the most golf courses in the world owned by a single company. Heiwa is no longer dependent on the outlook of the pachinko industry. What the pachinko business arm provides is a very nice segment that assists in the paydown of debt raised to acquire the golf courses and to pay for interest expense. Due to the speed of cash flow generation exceeds the debt and interest burden that leveraging the balance sheet provides, Heiwa is a case study in how to transition out of pachinko dependency through captial allocation.

Heiwa is still too leveraged for my taste, and the investment prospects at current prices are good but not great.

I use Heiwa as an example of what can be accomplished if companies are semi-prudent in capital allocation.

Impact of Osaka Integrated Casino Resort on Gambling in Japan and Pachinko:

Japan is set to launch its very first integrated casino and resort in Osaka in 2029/2030. Citizens of Japan must pay 6000 yen to enter the premises to gamble. Foreign tourists can enter free of charge. There are no limits on how much one can gamble once inside the resort. This model is similar to the one adopted by one of the highest-margin casinos on earth, Marina Bay Sands (owned by Las Vegas Sands—LVS), in Singapore.

Despite gambling being illegal in Japan, gamblers will always find ways to gamble, either through illegal underground games or by travelling to neighbouring countries with casinos, i.e South Korea, Macau, Manila, and Singapore.

If a public figure is caught gambling in illegal underground casinos, they risk damaging their reputation. Badminton stars Kento Momota and Kenichi Tago got banned from competing after their illegal gambling scandal.

In the US, each state’s laws determine if gambling is allowed. As many states have realized, gamblers will always find ways to gamble. Instead of making gambling illegal and feeding the pockets of criminal organizations, why not make it legal, safe, create jobs, and, most importantly, generate tax dollars. I believe Japan’s experiment with an integrated resort could go down 2 paths.

Path 1: Japan’s experiment with the integrated casino resort is a success. Data shows gambling addiction to be at acceptable levels - whatever that means. For the most part, citizens view casino gambling as a form of entertainment. Japan becomes a country open to the idea of gambling as long as it doesn’t become a problem with citizens. The stigma around gambling will become less negative, and the integrated casino resort will remain open to Japanese citizens.

If Japan can truly enter path 1, my view is that this is very positive for pachinko, and this could be a precursor to relaxing rules against pachinko. If gambling is not problematic at a casino with no betting limits, then there is a weak argument that betting limits in pachinko are problematic. A relaxation on betting limits and a relaxation on max payouts would instantly revitalize the industry.

For pachinko, a player needs to be seated for hours on end just to win a few hundred bucks. This is super drawn out and doesn’t attract the gambler with a high-risk appetite. I understand Japan is doing this to prevent pachinko from being an addiction and to prevent large financial losses at the individual level.

Path 1B: An alternate version of this is that Japanese citizens have betting limits. Max 10,000 yen. This is very difficult to implement because if foreign tourists have no betting limit, how are you going to ensure which players are local and foreign? This would be an operational nightmare. What if you bring a foreign friend to accompany you and place bets for you?

Path 2: Japan's experiment with the integrated casino resort is a failure. Data shows gambling addiction to be a major problem; hence, the integrated resort in Osaka becomes open to foreign tourists only. This is a similar model adopted in South Korea, where citizens are not allowed to gamble at local casinos.

Japan is a country where gambling is seen in a negative light. At one point there could have been 3 casino resorts in Japan, but only 1 city, Osaka, approved the construction of one. For gambling to flourish in Japan, political alignment is also important. When political parties seek to get votes, suggesting they are supportive of casinos being built can hinder the parties ability to attract voters.

This commentary is viewing what is beneficial to pachinko from a purely business standpoint.

Business Economics of IC Card System Companies:

New pachinko parlour openings mean capex on pachinko peripherals, so the more openings, the greater the sales for entire IC card systems. Currently closures outpace openings.

Once a store has an IC card system installed, they pay data system management fees. This is high-margin and recurring. Switching costs of IC card systems are high; hence, once you pick a system, you’re unlikely to change.

Like any machinery, it requires consistent upkeep and maintenance. Peripheral companies make money on maintenance, repairs, and replacement parts. Some companies outsource repairs; some have in-house teams, so margins may vary.

Outlier events: In July 2024, Japan released new banknotes, so additional revenues were made on hardware replacement and software updates to make reading and verifying these banknotes possible.

Trade idea: If Japan were to ever announce new banknotes in the future, long all pachinko IC card system companies.

Different machine types (conventional pachinko, conventional pachislot, smart pachinko, and smart pachislot) require different IC card peripheral attachments. A store that is switching it’s machine mix from conventional to smart machines will need to upgrade the peripheral attachments for those new machines.

Currently the trend is towards more smart machines as they are less labour intensive; hence, this is a positive for IC card system companies as they can sell peripherals compatible with these new “smart” machines.

Gamecard Joyco Holdings - 6249 (38% market share):

Valuation:

*price dated 4/3/2025

Gamecard has no debt. Cash and investments exceed market cap; hence, EV is negative and trades at 0.55x P/B.

Gamecard trades at 4x P/E and EV multiples aren’t computable given the negative EV. 2024 and 2025 were great years for Gamecard, given the introduction of new Japanese banknotes, which led to mandatory hardware and software upgrades.

On a normalized basis, I suspect EBIT margins to be 10-15% and net income margins to be 8-12%. On a normalized basis, P/E multiples would be double what they are now, so the current 4x PE is likely around 8-10x normalized.

Margins were poor from FY2014 to FY2016 due to regulatory risk and uncertainty in regard to regulations on gameplay of new machines, banning of certain high-limit machines, betting limits, etc. Regulation risk means parlours will wait for clouds to clear before investing in machines and new stores. This would result in a delay in capex and negatively affect Gamecards peripheral business.

Description:

Gamecard is the only company that operates third-party prepaid cards. Gamecard also offers “self-issued” prepaid cards, just like the other 3 competitors. The difference between third-party prepaid cards and self-issued cards is that for the third-party prepaid card, a third party handles the payment transactions between sellers and buyers. This means that if for any reason the pachinko parlour goes bankrupt, the player with the third-party prepaid card will 100% get their money back.

The risk of the self-issued card is that there is a small risk that the parlour could withhold funds in the scenario that they were to go bankrupt. This risk is technically very low, given most players cash out on the day of. Very rarely do players keep funds on a card overnight, even though this is possible. Even if a player were to keep funds on a card, the risk of loss is around 12k yen (80 USD), given that is the average a player spends per session at the pachinko parlour.

Gamecard operates the following 4 segments:

Equipment: card systems, card units, ticket vending machines, and settlement machines

Card: IC cards and coins. Data management fee from affiliated stores based on the amount spent by players

System Usage Fees: System usage fee is charged to operate the prepaid card system

Maintenance and installation services

*The company does not break down the margins for each of the above segments, but I suspect the best margins come from system usage fees.

How dependent are they on the pachinko industry?

Very dependent. All operating segments are related to pachinko.

What is their competitive advantage?

Being the only third-party IC card system.

High switching costs. Stores that already have an existing IC card system installed are very likely to continue using the same system. I would further speculate that pachinko chain operators would prefer to go with 1 system rather than having different systems at different stores.

Is this a value trap?

Despite having the highest market share in the IC card system market, Gamecard is completely dependent on the future outlook of the pachinko industry, which is looking grim. Having a large piece of a shrinking pie isn’t very appealing. Even if market share were to grow, the shrinkage of the market size more than offsets any additional market capture.

Gamecard also faces competition from the likes of Daikoku Denki (DD) who has the highest market share in hall management systems. DD provides hall management systems to pachinko operators with high machine counts, like Dynam (HKSE: 6889). As I mentioned in part 1 of my post, stores with 500+ machines have stayed resilient in this state of store decline, so since DD has the majority of the hall management market share of stores with 500+ machines, by inference DD’s IC card system has more opportunity to increase market share going forward. If the above scenario were to play out, the top 3 IC card system companies would be competing with each other for a shrinking 0-100 and 100-500 store market.

Daikoku Denki’s rise in pachinko hall management systems has allowed it to gain market share from the top 3 players, so Gamecard’s current market is likely to stay flat or shrink due to competition.

* I was originally a bit confused by the hall management system and IC card system. Daikoku Denki certainly does not have the leading market share in IC card systems; that belongs to Gamecard, so by inference they are separate systems.

The next issue with Gamecard is its cross shareholdings:

From the above, we can see that 55% of the register is owned by primarily pachinko/pachinko-related companies. If I were to guess, the reason every company has a stake in Gamecard is likely to prevent any one company from gaining control. If all 4 IC card system companies were to consolidate into 1 company, then prices would rise and pachinko parlour margins would further depress, limiting their ability to perform capex on new machines, which would negatively affect pachinko producers.

Gamecard is unlikely to be acquired by a horizontal or vertical company.

I believe if Gamecard could be acquired by Heiwa (TYO 6412), for example, they can take their cashflows and excess cash on the balance sheet and direct them to other investments like golf courses.

Verdict:

How to invest in Gamecard?

Gamecard doesn’t use many tangible assets to generate its return. Based on my calculation, Gamecard’s return on operational assets (essential capital/assets needed to run the business) was around 60% in FY2024 and FY2025. On a normalized basis, if EBIT margins were cut in half (post-banknote), we can expect the return to be 30%. This is the reason I am confident that cashflows will remain positive; it’s simply the rate at which these positive cashflows decline that is of most concern. Even then, I believe Gamecard will adapt by further optimizing its cost structure and tuning down operations to remain profitable, like it did from FY2014 to FY2016.

Given the enterprise value of Gamecard is negative, the way to play Gamecard would be to add it to an existing basket of super cheap net nets. I would not invest in Gamecard as a concentrated position or as a standalone investment without having a basket net-net strategy in place.

If Gamecard’s current pachinko shareholders start unwinding their positions, this could be a hidden catalyst for Gamecard.

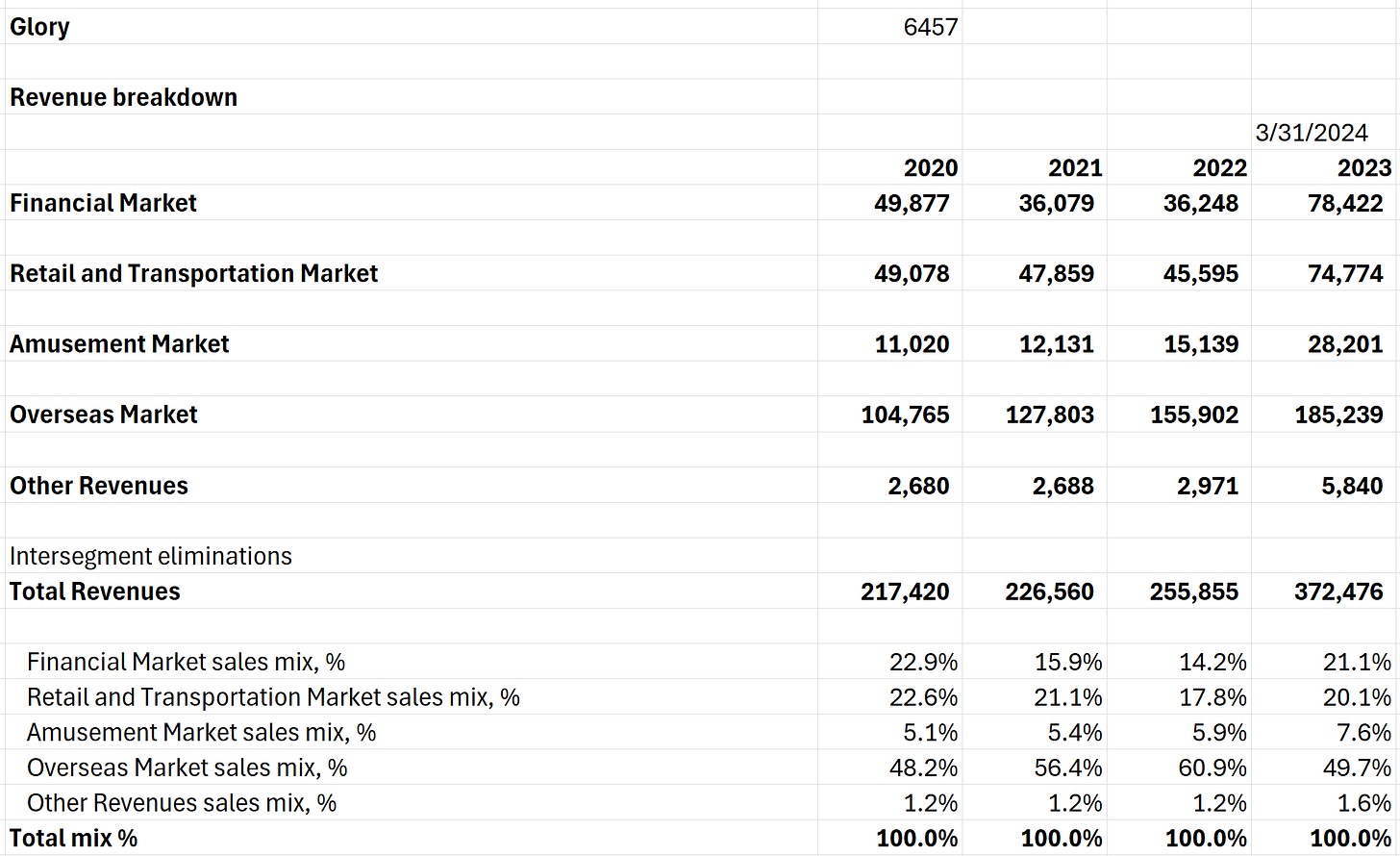

Glory - 6457 (23% market share):

In my opinion, Glory has the highest quality business out of the four pachinko peripheral companies and offers the best investment opportunity.

The rest of this post will be available to free subs in about 1 month. Consider supporting my Substack to receive the newest and most up-to-date content.

Valuation:

*Price as of 4/3/2025

Glory, despite having a lot of cash on its balance sheet, also has a lot of debt.

Why does Glory need debt? Different from its competitors, Glory isn’t completely dependent on the pachinko industry. Glory offers cash-handling solutions to the financial, retail and transportation, food and beverage, and amusement markets. The company has used a combination of debt and cashflows to finance strategic investments to strengthen its core business and expand into new business domains.

From the above, we can see amusement revenue (pachinko-related) is only 5-7% of total revenue. For Glory, even if the pachinko industry were to cease to exist, Glory would be fine.

As of the latest FY2024, Glory trades for 5x P/E, but if we normalize earnings into 2025 and 2026, consensus estimates point to a P/E of 10x.

Historically, EBIT margins are around 8-9%, with FY2024 being a great year with 14% EBIT margins.

FY2023 outperformance was attributed to

Sales increase due to hardware and software sales in relation to the new Japanese banknotes

COGS savings through improved product mix and price pass-through of costs

Lower COGS due to an easing in the pricing of high-priced parts (semiconductors).

FY2022 poor margins were due to the following:

Sales were negatively impacted by production delays and supply chain disruptions.

The company had trouble procuring parts and alternative parts for its products, as there was a global parts shortage (i.e semiconductors).

COGS were increased due to increased price for parts

FX impact to weakening of yen

Description:

Different from the other pachinko peripheral companies, Glory is unique in that it has a diverse portfolio of products it sells to the financial market, retail and transportation market, and amusement market. In addition, it generates sales overseas. See below for a description:

What is the opportunity for Glory?

Glory has 2 main avenues for growth

Organic Growth

Growth through acquisition, strategic investments, and R&D

Organic Growth:

Glory is known worldwide for its cash-handling solutions. Whether it is for retail, financial, or amusement applications, in one form or another these machines accept and dispense cash.

“According to the newly published Global Retail Cash Automation 2025 study from RBR Data Services, a division of research and consulting firm Datos Insights, GLORY (TYO:6457) continues to lead the Global market for retail cash recycling solutions excluding Japan with 44% market share. Including Japan, Glory’s market share rises to 68%. The report examined retail cash recycling at both the point of sale and in the back office and found that Glory leads both deployment categories with 40% and 54% market share respectively, excluding Japan.”1 (Jan 5, 2025)

Organic growth comes from Glory executing on its core products and competencies.

The following are videos showcasing products Glory offers.

Retail Application:

Financial Application:

The second pathway for growth is through strategic investments, acquisitions and R&D.

Glory has diversified away from simply cash-handling solutions and invested in electronic payment solutions. In 2020, Glory acquired Acrelec, a self-service kiosk ordering company that focuses on the food and beverage industry. If you live in the US or Canada and you’ve stepped into a McDonald’s recently or driven through a McDonald’s drive-thru, it is highly likely you have used a Glory self-service kiosk or engaged with a Glory drive-thru system.

Food and Beverage Application:

Besides horizontals, Glory has invested in verticals as well. Glory has invested in management software that allows customers to track data and perform data analytics on Glory’s core product offerings. Besides maintenance, software is another form of recurring revenue Glory can tap into.

Where does the investment opportunity lie?

I will be releasing a full stock pitch on Glory, but the TLDR is essentially Glory is the market leader in many of its products. Glory is still in the market penetration phase of its growth. Despite having a market-leading position, they do have competitors. If I were to theorize, Glory is accepting lower margins on equipment to establish itself as the market leader and to capture as much of the market as possible. Glory is the “globally approved digital cash solution for McDonald’s.” Having one the most popular QSR (quick service restaurant) use your product is great marketing for other QSRs to follow along.

Glory operates a printer-like business model. The money made on an inkjet printer is not in the printer itself, but in the cost of ink that becomes a recurring revenue stream. The margins on the ink are drastically higher than the printer. For Glory, recurring revenues come in the form of routine maintenance and repairs and upselling their management software. The maintenance and management software will be the high-margin revenue streams that contribute to operating leverage over time.

While Glory grows its market share and its recurring revenue streams increase over time, I expect Glory to continue to make strategic investments to further solidify its market position and build a strong competitive moat.

All the above opportunities are trading for 5x LTM P/E and 10x NTM P/E.

The company targets 340 bn yen of sales and 38 bn yen of EBIT by FY2026.

The company currently has a market cap of 130 bn yen and EV of 180 bn yen (excl. LT investments). This implies FY2026 EV/EBIT of 4.7x.

Glory is not a value trap in that it has many avenues to further grow and many geographic markets where its products have not fully penetrated.

The sales growth potential, operating leverage potential, opportunity to reinvest cashflows, and ability to utilize cheap debt for 5x EV/EBIT are simply too cheap.

For Mars Holdings and Daikoku Denki, similar to Gamecard, I believe they are too dependent on the pachinko industry. None have done a great job attempting to diversify earnings and utilize cashflows to invest in other business segments. Hence, I will keep my following analysis brief.

Mars Holdings - 6419 (24% Market Share):

What I like:

-Attempted to diversify from Pachinko with “automatic identification system related business” and “Hotel and Restaurant related business”

-Appears cheap

What I don’t like:

-Mars has not been successful in gaining traction in its other segments.

The automatic ID business has not grown revenues in over 5 years.

A similar story is seen in the company’s hotels and restaurants business, but what makes matters worse is that they are currently unprofitable, leading to shareholder value destruction.

-Based on the above results, Mars is still highly dependent on pachinko industry

TLDR verdict:

-Like Gamecard, Mars is cheap. The redeeming quality of Mars is that it pays a generous 195 yen dividend per share, or a 6.6% dividend yield (at 2961 yen per share). Given Mars benefited from the one-time earnings boost from new banknote-related sales, I expect EBIT and EPS to decline by approximately 50% or more. Given the company targets a dividend payout ratio of 30%, I expect the dividend to drop to 70-100 yen per share.

-Despite Mars being cheap, I don’t see how sales can expand from Pachinko and its other segments. Management execution on the other 2 segments has been poor. If my interpretation of the Japanese documents from Mars is correct, Mars started its hotel business in 1996 and RFID tech-related business in 2000. For this to be the outcome from over 25+ years of investments in other categories means management doesn’t really care to reduce its pachinko dependency.

-I believe Mars can be a part of a basket of cheap stocks, but with no catalyst for earnings growth, Mars could simply be a value trap.

Daikoku Denki - 6430 (14% Market Share):

What I like:

-Capturing more market share in pachinko industry

-Leading market share position in high machine count pachinko parlours for hall management systems. This has likely enabled the company to cross-sell its other pachinko peripheral products, such as IC card systems (14% market share), allowing DD to gain market share.

*Daikoku Denki states it has the market-leading market share in hall management systems. My assumption is that IC card systems and hall management systems are separate systems.

What I don’t like:

-Despite being able to capture more market share in the pachinko industry, it’s an increasing market share of a shrinking pie

-Very dependent on the outlook of the pachinko industry which I am bearish on

TLDR verdict:

-On the surface, DD looks cheap, but could turn out to be a value trap given the decline of the pachinko industry.

-DD highlights its expansion project is to create its own pachinko machine. I don’t know about competing with the likes of Sega Sammy, Heiwa, Sankyo and many other pachinko producers.

Summary:

Although all the pachinko peripheral companies appear cheap, it is important to understand that, outside of Glory, these companies don’t have new business domains to reinvest cashflows in a manner that creates shareholder value.

For some of you deep value investors out there, Gamecard, Mars, and DD could be additions to your cheap basket of stocks, especially Gamecard.

If Gamecard could be acquired, this would be highly beneficial to an acquirer that can efficiently utilize the excess cash in a productive manner.

Given Glory appears undervalued and does not appear to be a value trap, I will be writing a deep dive on Glory (6457), so stay tuned for that.

Alan - Continuous Compounding

If you’ve made it this far, you might as well become a subscriber.

Want to read more from Continuous Compounding?

Continuous Compounding Directory/Menu ←click link

Continuous Compounding’s most relevant content all in one place.

Subscribe for free to receive new posts and support my work.

Give Me A Follow On My Other Social Media Accounts:

Twitter ←More active on X than any other platform

YouTube ←Video Content. More content to come on this platform.

Reader Exclusive Promo:

Koyfin is my go-to tool for quickly rejecting or diving deeper into potential opportunities. With its intuitive platform, I can:

Instantly access business descriptions.

Analyze valuation multiples and historical profitability.

Review analyst estimates to gauge future prospects.

It’s a huge time-saver for forming a clear, initial opinion on any company. Ready to streamline your research process? Sign up to Koyfin here to save an additional 20% and take your due diligence to the next level!

https://www.glory-global.com/en-gb/news/2025/en-gb/rbr-confirms-glory-as-leader-in-retail-cash-recycling-solutions/