*Legal Disclaimer: This post and all its contents are for informational or educational purposes only. Continuous Compounding assumes no responsibility or liability for any errors, inaccuracies, or omissions in this post, links, attachments, or any actions taken based on its contents. The information sources used are believed to be reliable, but accuracy cannot be guaranteed. Recipients of this research are advised to conduct their own independent analysis and seek professional financial advice before making any investment decisions. The opinions expressed by the publisher in this post are subject to change without notice. From time to time, I may have positions in the securities discussed in this post.

This post and all its contents herein are the exclusive property of Continuous Compounding. This post is intended solely for informational purposes and is not to be distributed, reproduced, or transmitted, in whole or in part, for commercial purposes or sale without prior written consent from Continuous Compounding. Any unauthorized use, dissemination, or sale of this research is strictly prohibited and may be subject to legal action.

Disclaimer: I am long shares of Glory Co., Ltd. (6457) at the time of publishing this post.

Dear Continuous Compounders,

I started my first live stream on June 5th. It has been quite the fun and entertaining experience.

In this post I recap the top 5 stock ideas I uncovered in my live streams up until the release of this post.

YouTube Livestream Recapping the Top 5 Stock Ideas:

Google drive folder containing translated and raw documents: link

*If company has english filings, then they may or may not be included in the above folder

3991 - Wantedly

*Click company name for IR link

Price/share: 1312 ¥ (June 12th, 2025)

MCap: 12.5 bn ¥

Net Cash: 5.7 bn ¥

EV: 6.7 bn ¥

P/B: 2.8x

Div yield: 1.5%

FY2025 EV/EBIT: 4.2x

FY2025 P/E: 12.0x

Quick Company Overview:

Linkedin of Japan, with far lower market share

A different approach to job posting. Employers showcase their employer profile, department you are applying to, what team members you will be working with, and images showcasing the company to attract candidates who “vibe” with the company

Example of employer profile/job posting:

Working in Thailand! Looking for a back office staff member who loves VTubers and esports!: https://www.wantedly.com/projects/1810149

Global Strategy & Biz Ops: https://www.wantedly.com/projects/2055219

Backend engineer: https://www.wantedly.com/projects/1986970?featured=0

What I like:

High margins. 34% EBIT margins, 22% NI margins, due to capturing economies of scale and reaching a user base that allows for the positive effects of operating leverage to kick in

Asset-light business model, without much need for capex. Annual D&A and capex are very low. High free cash flow generating business.

Growth opportunities:

Increase members

Increase number of employer companies

Expansion beyond Japan, i.e. Singapore

Adding additional add-ons and features to their existing subscription offering

A different type of hiring platform that is way more personable than traditional job postings. Appeals to younger generations.

What I don’t like:

The increase in user base has been slowing, indicating marginal returns from marketing spend

The increase in companies (employers) has been slowing down as well

Hoarding cash. How does the company effectively use cash?

The company should have been aggressive in their marketing spend, but have actually dialled it back down. In an ideal state, Wantedly becomes the LinkedIn of Japan, but if their primary objective is not to capture as much market share as possible, then they may have lost that opportunity.

Additional questions we want answered:

How is the company investing in its own growth? R&D? Capex?

Are they effectively using marketing spend, and how are they using it?

What is the total number of members they could penetrate? What is Japan’s labour pool

What does the hiring platform market look like? Are there a lot of generalist hiring platforms or a lot of specialized ones?

3723 - Nihon Falcom Corporation

Price/share: 1123¥/share (June 12th, 2025)

MCap: 11.5 bn ¥

Net Cash: 9.8 bn ¥

EV: 1.7 bn ¥

P/B: 1.15x

Div yield: 0.9%

FY2025 EV/EBIT: 1.4x

FY2025 P/E: 14.4x

Quick Company Overview:

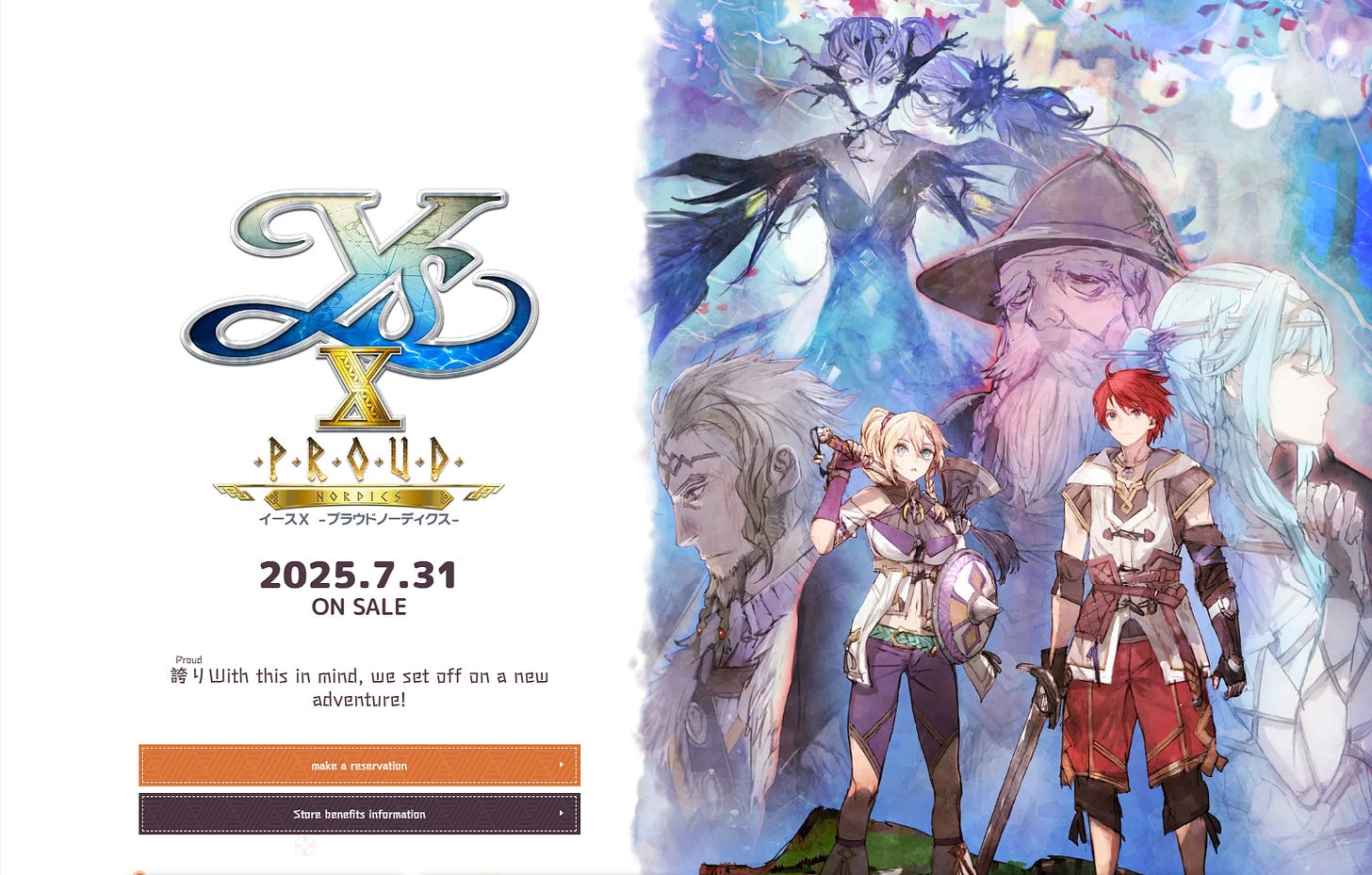

JRPG company with 2 major gaming IP: YS series, Legend of Heroes

Loyal fans who comeback to each new IP release

Games are available on Playstation (PS4/PS5), handheld consoles (Switch), PC, and Mobile

The company also sells music and merchandise related to its IP

….To read the latest high conviction stock pitch from Continuous Compounding, consider becoming a paid subscriber!

Consider supporting my Substack! Paid subs get first dibs on my actionable and timely stock pitches. Not investment advice. DYODD.

Paid subs were notified of Glory (6457) 1 month before free subs. Those who followed my Glory trade in April would have made a +70% return (3876 yen per share as of July 25th, 2025)

My paid sub below has made a +72% gain, as his average price is 2255 yen/share (3876 yen per share as of July 25th, 2025)

Nice problem to have when you regret not buying more:

Don’t miss out on my current high conviction stock!

Update: Paid Subs who read my quick stock pitch and invested are already up +5-7% on the stock this deep dive is based on.

*Not investment advice. Do your own due diligence. For entertainment purposes only. Past performance does not indicate future performance.

Now onto the rest of the Top 5 Stocks!

Nihon Falcom Corp (3723) continued…

What I like:

Highly profitable: EBIT margins 50%, NI margin 34%,

Stable and stagnant revenues at 2.5 bn yen. Loyal fan base that enjoys the IP and returns for new releases.

Have established 2 strong IPs in YS series and The Legend of Heroes.

Growth opportunities:

New IP being established: Tokyo Xanadu (Persona competitor targeting a younger audience)

Releasing their title to more game consoles (PS5, Switch) and across platforms (PC, Mobile)

What I don’t like:

Potentially overreliant on their 2 major IPs in YS series and The legend of Heroes. What if the fan base gets old and doesn’t want to play anymore?

Potentially, management just wants to keep milking their existing IPs

Small team of 66 employees. Don’t have excess labour capacity to create another popular IP. Should be more aggressive in hiring and building out capacity to expand or develop new IP.

Hoarding cash on BS, 9.8 bn yen cash

Additional questions we want answered:

How can they further grow revenues?

How can they create more IP?

Could they get bought out, and by whom?

Family-owned 60% pre-founder Masayuki Kato passing away in Dec 2024. The company is in the process of dealing with the inheritance situation, so even with a 55% inheritance tax, the family’s post-passing ownership would be exceeding 50%. On the surface, if the heirs want to continue controlling the company, it will be difficult for 3723 to be acquired.

If the heirs Kei and Sho Kato don’t want to run the business anymore, they could sell the company.

Has management ever discussed corporate governance? Dividends, buybacks, and creating other segments.

4380 - M-Mart

Price/share: 1400 ¥/share (June 15, 2025)

MCap: 6.9 bn ¥

Net Cash: 2.2 bn ¥

EV: 4.6 bn ¥

P/B: 3.8x

Div yield: 1.8%

FY2026 EV/EBIT: 7.5x

FY2025 P/E: 17x

Quick Company Overview:

M-Mart: E-commerce marketplace connecting buyers and sellers of commercial ingredients and food.

B-net: ecom marketplace for commercial tableware, kitchen equipment, supplies, etc

Other:

Sellers pay a fixed fee to open up a virtual store. For online transactions, sellers pay a commission rate on sales in certain product categories. Buyers pay nothing to use site.

What I like:

Highly profitable: EBIT margins 40%, NI margin 27%, operating leverage experienced through decline in SG&A margin

The company has carved out its own niche and has a first-mover advantage and has created a platform that is the go-to for 230k buyers and 2.1k sellers (sellers pay to create virtual storefronts and pay a commission on completed transactions).

Growth in sellers was slow up until FY2024, before increasing 28% in FY2025. Did M-Mart reach a critical mass of buyers where now sellers are willing to market themselves on the site?

What I don’t like:

Growth in buyers has been growing at a decreasing rate.

Over 50% of the company is owned directly and indirectly by Sumio Murahashi (Founder and CEO). The company will be managed for Sumio or their family’s benefit potentially.

2.2 bn yen of cash sitting on BS

Additional questions we want answered:

The company had 1636 sellers in FY2024 and increased to 2098 by FY2025. How did the number of sellers increase by 462 in 1 year?

How can the company grow from this stage? Can it grow horizontally?

How can the company effectively allocate cash?

Who are the competitors that have created a competing product, and what is preventing them from taking market share from M Mart?

Would the Murahashi family be willing to sell the company?

5570 - Jenoba

Price/share: ¥716/share (June 16th, 2025)

MCap: 9.2 bn ¥

Net Cash: 2.9 bn ¥

EV: 6.3 bn ¥

P/B: 3.0x

Div yield: 0.8%

FY2025 EV/EBIT: 8.8x

FY2025 P/E: 18.5x

Quick Company Overview:

Offers high precision location services: GNSS positioning

By analyzing signals from positioning satellites and correction information data, your position can be determined with high accuracy. Reducing meter level errors to centimeter level errors

Has many applications:

land and marine surveying

remote control of unmanned construction machinery

automating agricultural machinery

labor saving in infrastructure inspection

automation and autonomy of industrial equipment

Consumer/entertainment applications

What I like:

Highly profitable: EBIT margins 55%, NI margin 38%

Existing contract sales are increasing, and new contracts continue to accumulate. 9162 contracts as of Q2 FY2025

“The data purchase fees for CORSs, the usage fees for the analysis system, and the maintenance fees are all fixed.” (Q2 IP) Since so much of the cost structure is fixed, Jenoba experiences positive operating leverage when sales increase

Many use cases and applications for Jenoba’s location technology.

i-construction (remote construction), smart agriculture, drone, and autonomous driving.

Business partnership with KDDI to expand application to drone surveying, drone delivery and MAAS.

The company has a large TAM and can go in many directions; hence the growth multiples.

What I don’t like:

Seems beyond my current circle of competence

Beyond land survey, there doesn’t seem to be much progress made in the “other” use cases.

Additional questions we want answered:

How much do they spend on R&D?

Who are their competitors

Do they have a moat? IP moat? (They do have a patent)

Jenoba has been in business for 20 years. What kind of applications did they try to expand into? What has been their speed of execution?

Can Jenoba live up to its potential?

Can they be bought out?

How exactly does the tech work, and how unique is it?

1450- Tanaken Inc.

Price/share: 1375 ¥/share (June 16th, 2025)

MCap: 12.0 bn ¥

Net Cash: 4.1 bn ¥

EV: 7.8 bn ¥

P/B: 1.45x

Div yield: 4.0%

FY2026 EV/EBIT: 4.6x

FY2026 P/E: 9.8x

Quick Company Overview:

Engages in the construction and management of building demolition projects and related works in Japan.

The company also conducts demolition operations, soil and underground contamination remediation, civil engineering projects, and recycling activities.

What I like:

Decently profitable: EBIT margins 15%, NI margin 10%

Tailwind of increasing demand for demolitions in Japan. Demolition market expected to double by 2034.

Large market share upside: Tanaken only makes up 1% of the total demolition market. The total demolition market in 2023 was ¥991.5 billion, while company sales were 11 bn yen in 2023 (12 bn yen now).

The prime contractor demolition work market is approximately ¥276.9 billion and is expected to continue growing.

What I don’t like:

Large cash pile

Lack of immediate growth opportunities within the firm.

Highly competitive market with 60 thousand firms in the demolition space.

Most demolition companies handle small projects and generate less than 10 billion yen of sales a year. From a scale perspective, Tanaken is one of the few larger-scale demolition companies.

Additional questions we want answered:

What efforts can Tanaken make to capture more market share?

How can the company take on more large-scale projects?

How can Tanaken effectively allocate cash?

Are there any verticals or horizontals that Tanaken can invest in?

Could Tanaken take on a demolition company roll-up strategy of acquiring other demolition companies with excess cash on BS or taking on debt?

In summary, the top 5 stock ideas are displayed in no particular order, but I believe 3991 - Wantedly shows the most promise out of all the stocks covered in this post.

Thanks for reading! If you enjoyed this stock pitch, please leave a like, comment, and subscribe!

Alan - Continuous Compounding

Want to read more from Continuous Compounding?

Continuous Compounding Directory/Menu ←click link

Continuous Compounding’s most relevant content all in one place.

Subscribe for free to receive new posts and support my work.

Give Me A Follow On My Other Social Media Accounts:

Twitter ←More active on X than any other platform

YouTube ←Video Content. More content to come on this platform.

Reader Exclusive Promo:

Koyfin is my go-to tool for quickly rejecting or diving deeper into potential opportunities. With its intuitive platform, I can:

Instantly access business descriptions.

Analyze valuation multiples and historical profitability.

Review analyst estimates to gauge future prospects.

It’s a huge time-saver for forming a clear, initial opinion on any company. Ready to streamline your research process? Sign up to Koyfin here to save an additional 20% and take your due diligence to the next level!

I was eyeing Falcon but it’s true that they only have those IP, and the games aren’t exactly good quality, they are bought because of their fans, it’s been a decade and no signs of expanding their plans