Monster Beverage (MNST) odd lot tender offer (Time Sensitive Quick Read!)

*Legal Disclaimer: This post and all its contents are for informational or educational purposes only. Continuous Compounding assumes no responsibility or liability for any errors, inaccuracies, or omissions in this post, links, attachments, or any actions taken based on its contents. The information sources used are believed to be reliable, but accuracy cannot be guaranteed. Recipients of this research are advised to conduct their own independent analysis and seek professional financial advice before making any investment decisions. The opinions expressed by the publisher in this post are subject to change without notice. From time to time, I may have positions in the securities discussed in this post. The post and all its contents herein are the exclusive property of Continuous Compounding. This post is intended solely for informational purposes and is not to be distributed, reproduced, or transmitted, in whole or in part, for commercial purposes or sale without prior written consent from Continuous Compounding. Any unauthorized use, dissemination, or sale of this research is strictly prohibited and may be subject to legal action.

Disclaimer: I am long shares of Monster Beverage Corp (MNST) at the time of publishing this post. I plan to tender all my shares.

Press release here: https://www.bamsec.com/filing/110465924058430/1?cik=865752

MNST odd lot tender offer looks like free money.

Currently trading at around $52 per share.

Purchase price at $53-$60.

99 shares odd lot.

Conditional on MNST getting financing.

Expiry date: The Offer will expire at 11:59 p.m., New York City time, on June 5, 2024

Napkin math: $1 per share profit on 99 shares is around $99 of profit before trading fees on 99 share*$52 per share = $5148 USD. Roughly 1.9% return for 1-2 week holding period.

Before we get to Tax Implications (below this section), my sponsor, which is myself, would like to show you this terrific offer:

Subscribe to Paid to Continue Reading:

Track record of stock pitches:

Haier 690D: +45%

Round1: +15%

SK Japan: +15%

Okano Valve Manufacturing: +45% (closed)

GAN: +80% (closed)

CNTY: -50% (closed)

*As of May,1, 2024

Pricing Update

Hey everyone, after much deliberation, I will be raising prices for paid subs on July 1st, 2024.

Current Pricing:

Monthly: $10 CAD per month (~7.50 USD)

Annual: $100 CAD per year (~75 USD)

New Pricing:

Monthly: $20 CAD per month (~15 USD)

Annual: $200 CAD per year (~150 USD)

Current paid subs will be able to enjoy the current pricing for monthly and annual subscriptions until May 1st, 2025.

If you are a free sub and have seen value in my stock pitches, consider locking in this offer before I raise prices. Prices are likely to only go up from here.

*I reserve the right to change my mind on this price increase at any time. I may extend or shorten the deadline(s); and/or change the pricing. The terms and conditions of this offer may change at any time.

Tax implications:

This is not tax advice. I'm not a tax professional. Consult with a tax professional.

See page 48 of the PR for where the company discusses tax implications:

https://www.bamsec.com/filing/110465924058430/2?cik=865752

If you didn’t have a position in MNST before this trade, you should be fine.

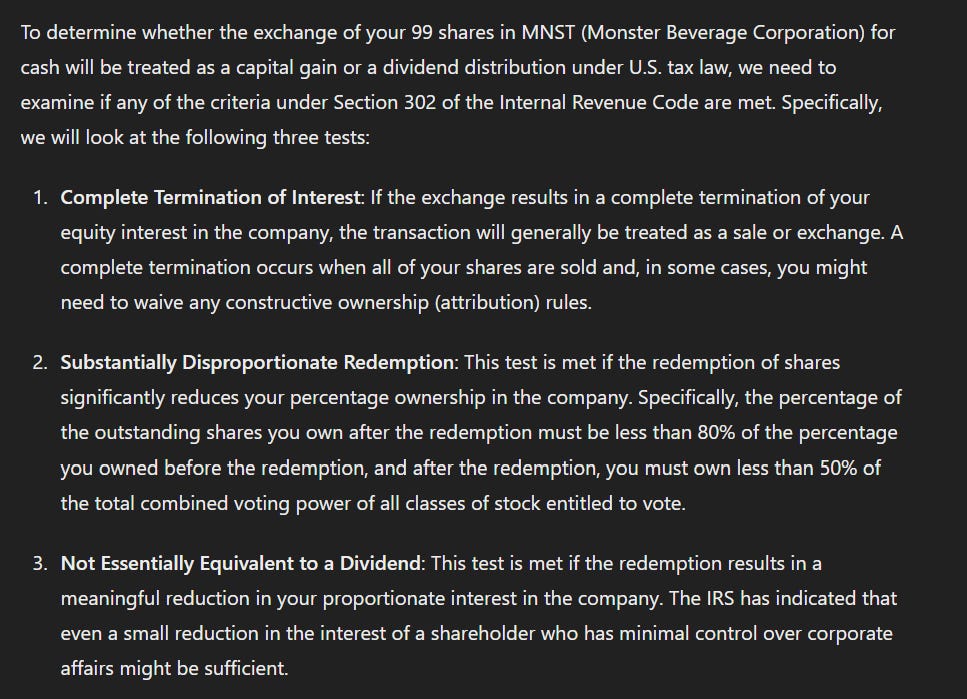

If you buy 99 shares with the intention of tendering all 99 shares, then you should meet conditions 1, 2, and 3. This way, you will be taxed as a capital gain.

Now I have no knowledge of US tax-free accounts, so I will just provide commentary to my Canadian folks below (if you are a US citizen, please comment below with your findings):

For Canadians:

This is not tax advice. I'm not a tax professional. Consult with a tax professional.

As far as I read, if you buy 99 shares and tender all shares, it will mean you have a "complete termination of interest," which means its a capital gain under Section 302 of the Internal Revenue Code of the US.

Dividends get taxed in TFSA. Capital gains do not get taxes in TFSA.

Dividends and capital gains do not get taxed in the RRSP.

Given that this should qualify as a capital gain if you simply purchase 99 shares and tender them with no prior position in MNST, that means you can hold this in TFSA or RRSP.

BUT, if you hold in TFSA, your broker may think its a dividend and take 15% withholding tax based on the US-Canada Tax Treaty, so when you do taxes, you'll have to ask the US government for the money back. This would be a real hassle for $15 bucks.

So the hassel-less way is to invest in this in your RRSP is my guess, given that dividends aren't taxed in the treaty for the RRSP.

This is not tax advice; I'm not a tax professional. Consult with a tax professional.

Not investment advice, DYODD. Could be unique tax implications that apply to you.

New to Continuous Compounding? Subscribe to stay up to date!

To stay up-to-date or receive notification of when I release my latest stock pitch, please follow:

Twitter: https://twitter.com/compoundersEX

YouTube: https://www.youtube.com/@continuouscompounding

Instagram: https://www.instagram.com/compounders.ex/

r/TSEvaluestocks: https://www.reddit.com/r/TSEvaluestocks/