*Legal Disclaimer: This post and all its contents are for informational or educational purposes only. Continuous Compounding assumes no responsibility or liability for any errors, inaccuracies, or omissions in this post, links, attachments, or any actions taken based on its contents. The information sources used are believed to be reliable, but accuracy cannot be guaranteed. Recipients of this research are advised to conduct their own independent analysis and seek professional financial advice before making any investment decisions. The opinions expressed by the publisher in this post are subject to change without notice. From time to time, I may have positions in the securities discussed in this post.

Additional Disclaimer at bottom of post.

Disclaimer: I and Dungeon Investing am long shares of Furyu (6238) at the time of publishing this post.

Furyu Corporation (TSE 6238):

This post was made in collaboration with Jesús from Dungeon Investing. Dungeon Investing specializes in all things gaming. As I only play poker, I have directed gaming-related questions to Dungeon Investing. He is very insightful and has firsthand experience with a lot of the games that are produced by publicly traded stocks on the TSE.

Table of Contents:

Business Overview

Quick Valuation Overview

Key Highlights

SOTP Analysis

Corporate governance

Trading Setup

Segment Analysis (3 segments)

Conclusion

Business Overview:

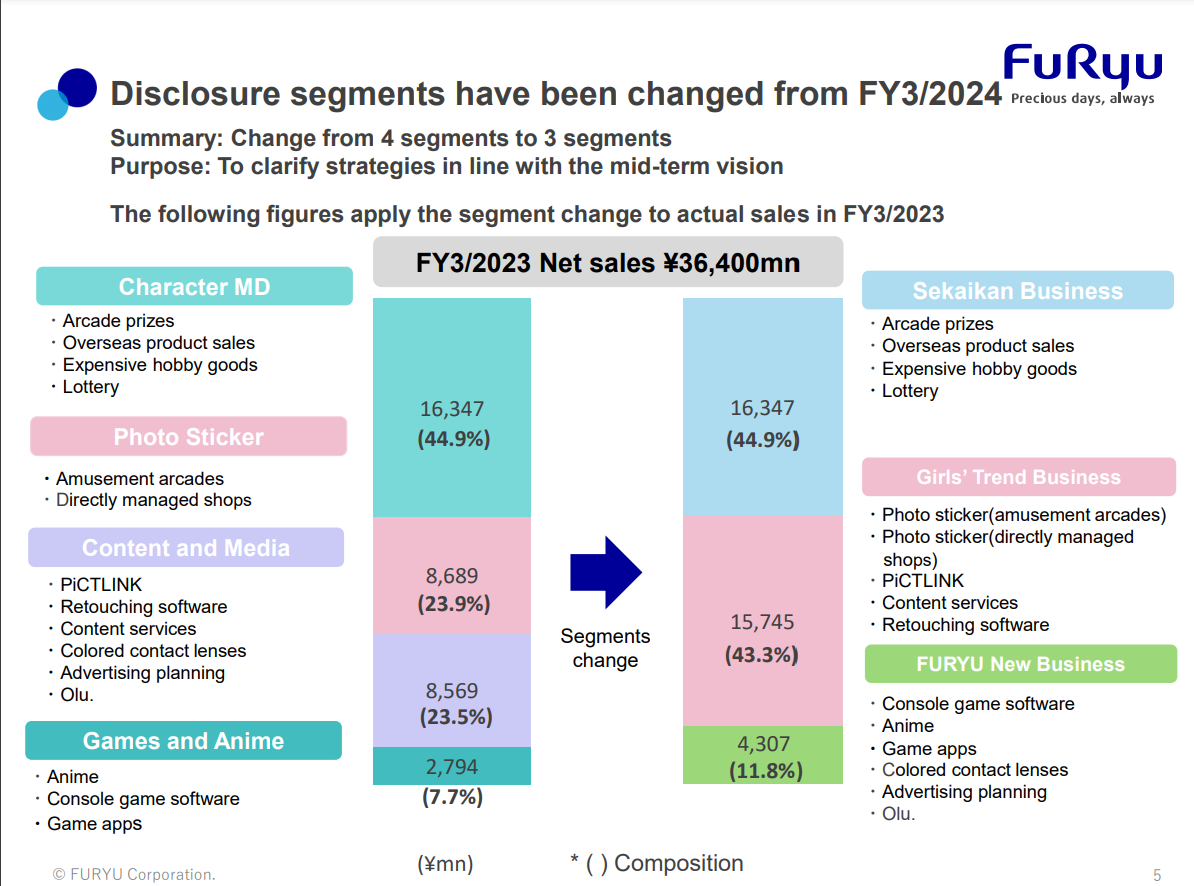

Furyu Corporation has 3 segments:

Sekaikan (Worldwide Character Merchandise) Business:

This segment acquires the IP rights of characters (manga, anime, Sanrio, games) and produces products.

Furyu creates crane game prizes for amusement facilities.

Furyu also produces anime figurines.

Girls Trend Business:

The company rents, sells, and operates photo sticker booths (purikura).

A supplementary service to their photo sticker booths is their PiCTLink app which allows users to download digital copies of photos taken at their photo sticker booths.

Furyu New Business:

Furyu is trying to create a third profitable business segment. Within this segment there are 2 main projects that could bear fruit:

Anime: Furyu is on anime committees to invest in anime production. This gives the company exclusive IP rights. If this segment is profitable, it can be synergistic with their IP merchandise business, which produces prizes for crane games and high-end figurines.

TV/Handheld/PC console video games: Furyu develops video games for PS4, PS5, Nintendo Switch, PC and mobile phones.

Other low-expectation segments (imo): Coloured contacts lenses, programmatic advertising business

Quick Valuation Overview:

MCap: 28 bn yen (180 mm USD)

No Debt

Net Cash= 11.5bn yen

EV=16 bn yen (100 mm USD)

NTM 2025 P/E: 14x

NTM 2025 EV/EBIT: 5.4x

NTM 2025 EV/FCF=8.8x

The company has no debt and a lot of cash.

Valuation Multiples:

Current Post-FY2024 Earnings Valuation:

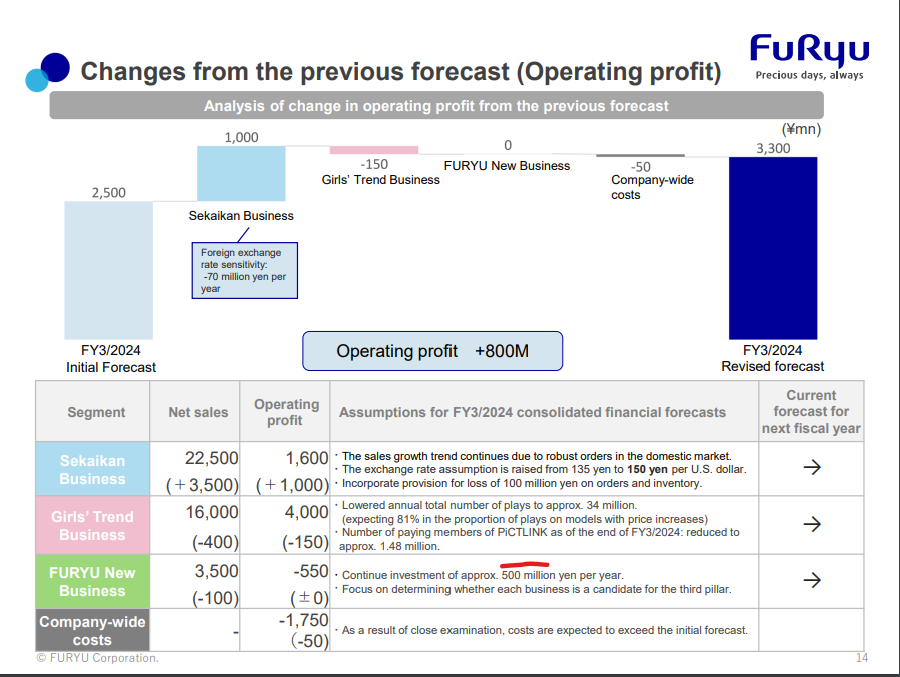

The price recently dropped -14% due to the company forecasting lower earnings for 2025 (NTM in the above table):

Pre-FY2024 Earnings Valuation:

As we can see, the drop in share price corresponds to roughly 5.5x EV/EBIT, 8-9x EV/FCF its FY2025 forecast, which is consistent with its pre-earnings multiples that were based on FY2024 forecasted values.

I believe management is being conservative, given they know the road ahead is unpredictable.

Consider subscribing to paid:

Track record of stock pitches:

Haier 690D: +45%

Round1: +25%

SK Japan: +20%

Okano Valve Manufacturing: +45% (closed)

GAN: +80% (closed)

CNTY: -50% (closed)

*As of June 11, 2024. Returns are rounded.

Let’s continue looking at this month’s stock pitch:

Key Highlights:

-Furyu is an undervalued investment with no obvious short-term growth catalyst.

-The areas in which Furyu can grow are:

Growing its domestic market share in the anime figurine space [prize figures (low-end), mid-tier (pop-up parade/tennitol), scale figures (high-end)]

Growing its overseas market share in the character merchandise segment

Lottery tickets:

Investing/Producing a hit anime => Anime IP => margin expansion in prizes

Developing a hit game => Game IP => margin expansion in prizes

Finding clever ways to expand sales to middle school and high school girls in its photo-sticker (Purikura) business.

Find clever ways to increase LTV of PiCTLINK customers

-The Japanese stock market is quite volatile when it comes to gaming companies. When a company has a few hit titles, they believe the success will indefinitely roll forward to future releases. This leads to high multiples and a tendency to overpay for “growth.”

When future title releases aren’t as promising, shareholders get scared and dump their shares. This is the case in Akatsuki (3932) which has ridden the success of Dragon Ball Dokkan battle for too long. Shareholders are fearful of what happens when the profits from Dokkan battle inevitably end.

-The Japanese market has a tendency to give up on names that are in a transitional period or show signs of an inability to effectively utilize excess cash. This creates an opportunity where enterprise value is substantially lower than market cap as cash is accumulated. Furyu falls into this camp.

-What differentiates Furyu from other low multiple companies is that it’s profitability is anchored by a high-quality, 39% segment income margin (excl. company wide expenses) photo sticker downloading app called PiCTLINK. PiCTLINK makes up 58% of the company’s segment income before accounting for company-wide expenses.

-The photo sticker business, in combination with PiCTLINK, has a strong competitive moat that cannot be penetrated by competitors. Larger competitors have tried, but all have failed.

-Furyu dominates the purikura market, with no competitor being able to take away market share from Furyu.

-The way to invest in Furyu is to wait for the market to value the stock at simply the value of its character merchandise business and photosticker business. I believe that time is now!

-At current market prices of 1050 yen per share, I believe Furyu is priced below its Photo Sticker/PiCTLINK and Character Merchandise businesses. The EV upside is 60% on these 2 segments alone.

-At the current market price of 1050 yen per share, the market is not sufficiently factoring in the growth potential of Furyu’s character merchandise segment.

-At the current market price, Furyu has:

low downside

majority of growth upside in the character merchandise segment is given to us for free

Multiple free lottery tickets in the form of the company’s anime and gaming segment

-Furyu’s no-growth valuation is 24 bn yen. 13% downside. Breakeven if factor in dividends.

-Furyu’s growth valuation, if only their character MD segment grows, is 40 to 55 bn yen. 60-110% upside (incl. dividends).

Reader Exclusive Promo:

Koyfin is my go-to tool for quickly rejecting or diving deeper into potential opportunities. With its intuitive platform, I can:

Instantly access business descriptions.

Analyze valuation multiples and historical profitability.

Review analyst estimates to gauge future prospects.

It’s a huge time-saver for forming a clear, initial opinion on any company. Ready to streamline your research process? Sign up to Koyfin here to save an additional 20% and take your due diligence to the next level!

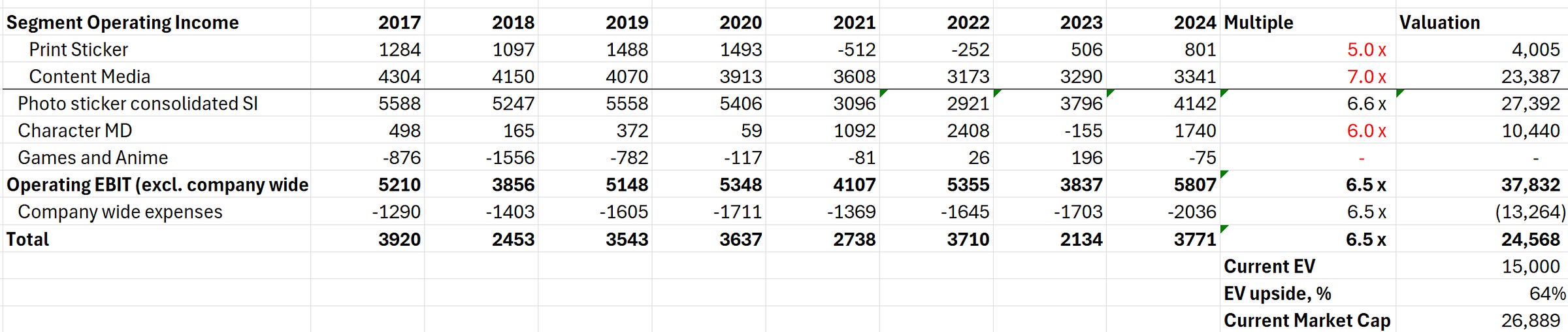

Napkin SOTP:

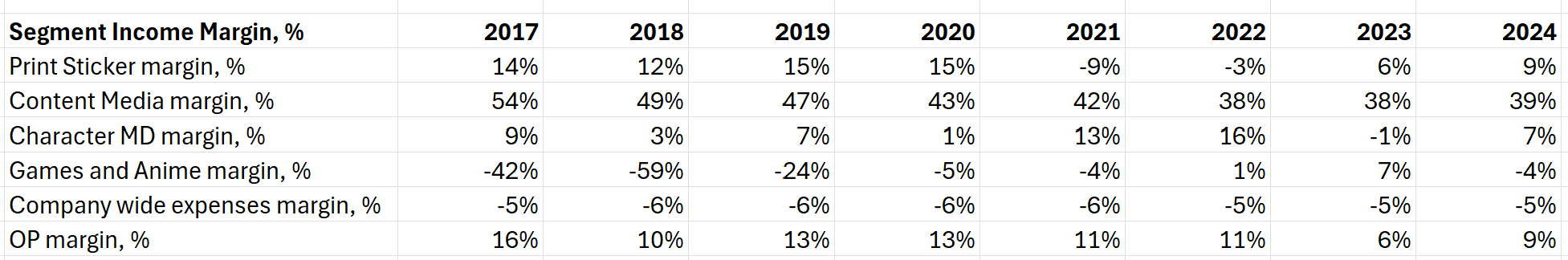

Print Sticker: In a good year, the raw print sticker business is a high single-digit to low teen operating income (OI) margin business. In a bad year, negative operating leverage can make OI margins drop to low single digits or even negative. I believe a 5x EV/EBIT multiple is appropriate given the number of Japanese elementary, middle school, and high school student populations that decline roughly 10% every decade.

Content Media: PiCTLINK is inside this segment. This is a high-margin business. I assign a 7x EV/EBIT multiple.

Character MD: This segment has actually grown sales 4x since 2019. Given the company has no popular in-house IP and relies on acquiring IP from licensors, OI margins are likely going to be 5-15% in an “okay” to “favorable” year. I assign a very conservative 6x EV/EBIT multiple.

Dungeon Investing is bullish on this segment; hence, in a bull-case scenario, we can assign a 7-8x multiple. Once Furyu proves they are capable of stealing substantial market share from the big players, this could quickly rerate to 10x+.

Games and Anime: I assign 0 value

Company wide expenses: The weighted EV/EBIT multiple, excl. company-wide expenses, is 6.5x. Nothing scientific about this. I simply applied the weighted multiple on company wide expenses.

Simple No-Growth SOTP Valuation: 24 bn yen enterprise value valuation if Furyu burns through all their cash. In this scenario, market cap would equate enterprise value. So the downside is roughly 13%.

The current enterprise value is roughly 16 bn yen accounting for the 11.5 bn yen cash pile on the balance sheet and no debt.

The company’s market cap is ~28 bn yen at ~1050 yen per share.

Scenario Analysis:

Scenario 1: No growth

Give up on finding a new segment: If the company were to burn through the entire cash pile and give up on discovering a new segment to rebuild it’s cash position, you’d be left with a company that likely earns 4-4.5 bn yen a year in operating income (due to reducing all expenses related to the new segment). Let’s say we assign a 5-6x EV/EBIT multiple, that would mean the company is still worth 20-27 bn yen.

Scenario 2: Growth demonstrated in Character MD only

Give up on finding a new segment, and character MD continues to grow:

Dungeon Investing believes the biggest opportunity for Furyu is their character merchandise line-up. After looking at it deeper myself, I agree with his conclusion.

Dungeon Investing believes there are 3 main opportunities in the character MD space: (Following points are DI’s commentary)

Continued gain of share in the prize segment (which includes all forms of sales of low-price figures, not only cranes). I think it is likely to continue, but not at this pace. Range expansion was a big part of it, and it has a limit!

Expanded line-up in the mid- and high-priced segment: Already in progress, by copying other lines. Right now, they are at a fraction (10-15%) of the sales the big companies in the space (GSC, Kotobukiya) attain, but they are growing very fast and they are also paying special attention to another opportunity…

North American market: In FuRyu, they seem to understand that sales outside of Japan are a good opportunity at this moment and they looked to sell their games overseas from the beginning. The same happens with figures. Only 5 years after they started making them, they are establishing a US subsidiary to sell there directly.

“With these three areas combined, this is the business where I think we can see, if things go well, 5-6B yen in operating profit in a few years, rather than the 2 we saw last year… and this is the growth opportunity I would try to pay for!” -Dungeon Investing

Dungeon Investing believes Furyu can achieve 3-4 bn yen more in operating profit.

Let’s examine how this can play out:

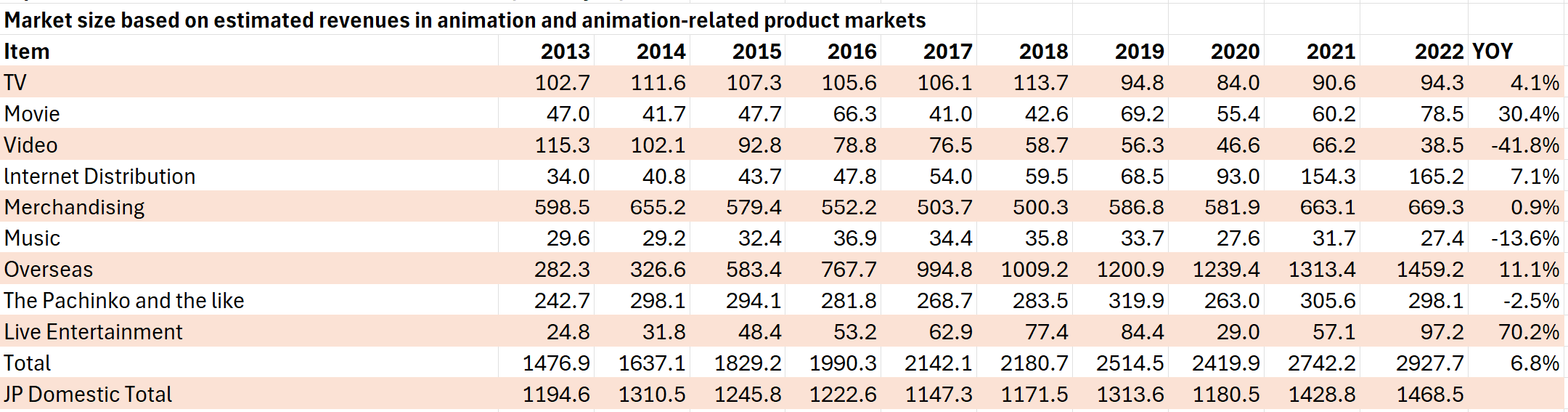

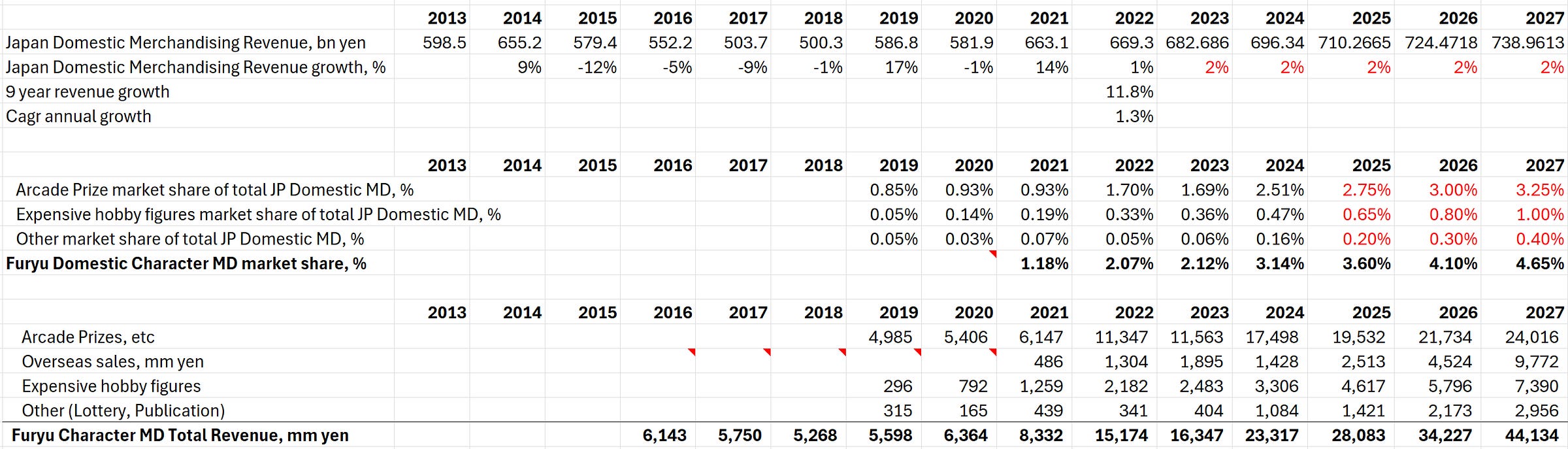

Based on “Anime Industry Report 2023” by “The Association of Japanese Animations” reports:

Merchandising revenue grew 12% from 2013 to 2022 (CAGR = ~1.3%).

*2016 is as far back as the Furyu English breakdowns go. You guys can go further back in the JP filings if you wish.

**The red corner comment: overseas sales were not broken out in 2020 and prior.

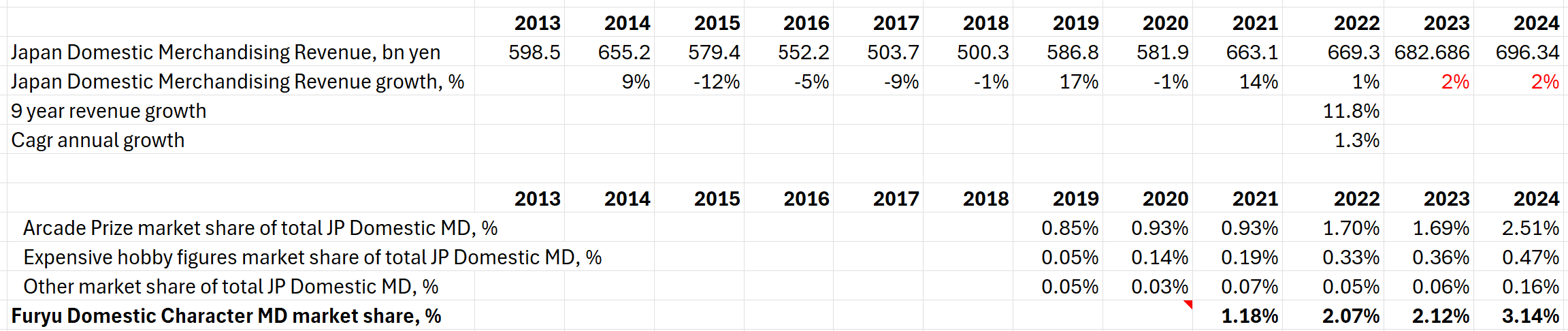

Since 2020, Furyu has grown sales roughly 4x in the character MD segment. This can be attributed to:

capturing market share in arcade prize figures

capturing market share in mid- to high-end expensive figures

"Other,” if I were to guess, is mainly attributed to their Lottery/Raffle (Minno No Kuji) Prizes segment, where fans buy raffles to win exclusive raffle prizes.

growth in overseas sales

tailwind in anime-adjacent sales (more on this later)

Subtracting overseas sales from total segment sales, we can clearly see Furyu’s revenue growth is from capturing more market share in anime sales. At least that was the initial impression until….

…we factor in anime-adjacent sales. It should be noted that the industry report is focused on purely anime-related merchandise revenue. By extension, our main target audience of anime fans are likely fans of games and certain anime adjacent character IPs (gaming/vtubers/Sanrio/bunny products/vocaloids) as well.

Even though Furyu offers mainly anime-related merchandise, Furyu offers other products that anime fans like as well.

An alternative comparison can be established with other public companies that have demonstrated success in distributing toys and collectibles in anime and anime-adjacent merchandise.

The above companies display high rates of CAGR that drastically outperform the domestic anime-related merchandise CAGR of the same period. This can be attributed to the growth of anime-adjacent merchandise in the areas of games, vtubers, Sanrio, bunny figurines, vocaloids, and more.

Most of Mandarake’s revenue growth is attributed to domestic growth, as their whole RoW revenue growth is less than half the growth presented here, and that covers all segments. Kotobukiya's domestic revenue share has grown from 68% to 72%. In the case of Bandai Namco, we could not find any detailed disclosures.

The key point here is that Furyu benefits from the anime-adjacent merchandise market expanding. The anime adjacent market tailwind, coupled with the anime tailwind, allows for growth in the domestic and overseas markets.

As it is rather cumbersome to estimate the true anime and anime adjacent merchandise market size, Furyu’s revenue growth is likely a function of capturing some level of the anime merchandise market and/or expanding sales in the anime adjacent market as well.

How did this growth in revenue translate to profits?

The revenue growth did not translate to operating leverage:

2021 and 2022 were great years, but 2023 and 2024 had lower margins. Why is this the case?

Furyu, in the figurine space, is the only company to have it’s hand in almost all figurine categories (more on this later). In the recent earnings release, the company stated they will be reducing the line-ups and focusing on categories that are the most profitable.

My interpretation of the company’s strategy during this period was to compete in as many categories as possible and just get it’s name out there. This serves the following purposes:

Free R&D expense to build experience in creating all sorts of figures if they breakeven.

Free marketing by being another option to existing competitors or the only competitor to the pioneer in a certain category. i.e. GoodSmileCompany in Mid-Tier figurines.

Have its products reach a larger audience

Establish Furyu as a brand that makes figurines. Solaris Japan states that Furyu’s reputation needs some work.

If Furyu concentrates in the categories where it has the highest margins or can attain the highest margins with scale, then we can potentially see higher margins.

My impression of Furyu as a brand is that they have established themselves as a contender but can further improve on quality. More on Furyu’s brand reputation later.

Based on DI’s commentary, I’d have to agree that Furyu has demonstrated an ability to capture market share. Exactly how much market share they can ultimately capture is anyone’s guess, but the biggest impediment is their reliance on acquiring other companies IP. It does seem that the increase in revenue market share has come at the cost of lower margins.

Now onto DI’s third point, which is international revenue. Capturing international revenue is still in its infancy for Furyu.

Based on “Anime Industry Report 2023” by “The Association of Japanese Animations”:

From 2013 to 2022, Japan’s anime-related revenue grew 23%, while overseas revenue grew 417%. In 2022, revenue generated overseas was on par with revenue generated domestically. If we simply view matters from a population perspective, there is far more potential for anime revenues to grow overseas than domestically in Japan.

Domestic merchandise sales make up 46% of 2022 domestic anime-related total sales:

The free version of the industry report does not breakdown overseas sales (if anyone has this $220 report, please share), but if we assume a similar revenue mix, then Furyu has barely penetrated its overseas sales potential.

*As 2023 and 2024 revenues are not reported, I am assuming 8% growth and 45% of total revenues are related to merchandise.

Based on the above estimates, Furyu’s overseas sales are only ~0.2%. GameStop, a major retailer of anime merchandise, allows pre-orders of Furyu’s figures on its website.

In summary, Furyu’s character MD business segment is a growth segment. Whether Furyu can capture enough market share domestically in Japan and overseas is a matter of execution. Can Furyu perform the following:

Rival its competitors in design, quality control, innovation, and value?

Maintain and build on its successes

Correct past mistakes and rekindle customer trust

Bonus: develop some in-house IP that expands margins

Here is an example of what Character MD growth can look like:

In the above example, Furyu’s domestic anime merchandise market share grows from 3.14% to 4.65% in 3 years. For the overseas merchandise market, Furyu grows market share from 0.18% to 1% in 3 years. The result is 44 bn yen of revenue. If OI margins are 10%, then that would be 4.4 bn yen of operating income.

*The same result can be achieved if Furyu is able to grow anime adjacent sales to a level that is equivalent to the ~1.5% anime-related market expansion.

If the character MD business can continue to grow market share, while maintaining profitability, then I believe the segment can grow operating income from 2bn yen to 4 bn yen.

For operating income to be 5-6 bn yen as Dungeon Investing believes is the bull case, we simply need 1 of the following:

Domestic markets share grows to 5.5% instead of 4.65%

Overseas sale market share grows to 2.0% instead of 1.0%

Extend the investment horizon to allow for the first 2 points to occur at the current pace in 1-3 more years. Typically, capturing market share doesn’t happen in a linear fashion. Market share can grow at an accelerated rate in any given year.

Valuation and returns at different levels of earnings:

4 bn yen: Multiple re-rates to 7x EV/EBIT. EV=40 bn yen. Return of ~+58% over 3 years incl. dividends.

5 bn yen: Multiple re-rates to 7x EV/EBIT. EV= 48 bn yen. Return of ~+83% over 3 years incl. dividends.

6 bn yen: Multiple re-rates to 7x EV/EBIT. EV= 55 bn yen. Return of ~+108% over 3 years incl. dividends.

*This is simply the valuation from character merchandise segment growth. Returns can be higher if the photo sticker business grows or if the company does get lucky and finds success in a new third segment.

Scenario 3: New Third Segment

Valuation isn’t reliant on this. The price is low enough that the possibility of a profitable third segment is simply a free lottery ticket for investors.

If Furyu gets lucky and creates an anime IP or gaming IP that generates 1-3 bn yen of operating income a year, Furyu’s stock price would meaningfully increase.

Corporate Governance:

Dividend Policy:

The company has a dividend payout ratio of 40% or DOE of 5%.

The company forecasts a dividend per share in FY2025 to be 39 yen per share, this represents a DPR of 52% or DOE of 4.7%

Buybacks:

The company states the following:

“At the same time, the company will also consider a flexible position with regard to share repurchases and other measures, in response to the state of cash flow and the share price trends.”

As the company’s main goal is to create a profitable third segment, I believe share repurchases are unlikely to occur unless the shares get considerably cheaper.

From Aug to Dec 2022, the company repurchased 1 bn yen of shares. The shares traded between 926 and 1158 yen per share during this period.

The company also actively repurchased 1 bn yen of shares throughout the entirety of FY2020. There were no buybacks prior to FY2020.

So the company has shown a willingness to repurchase shares in recent history.

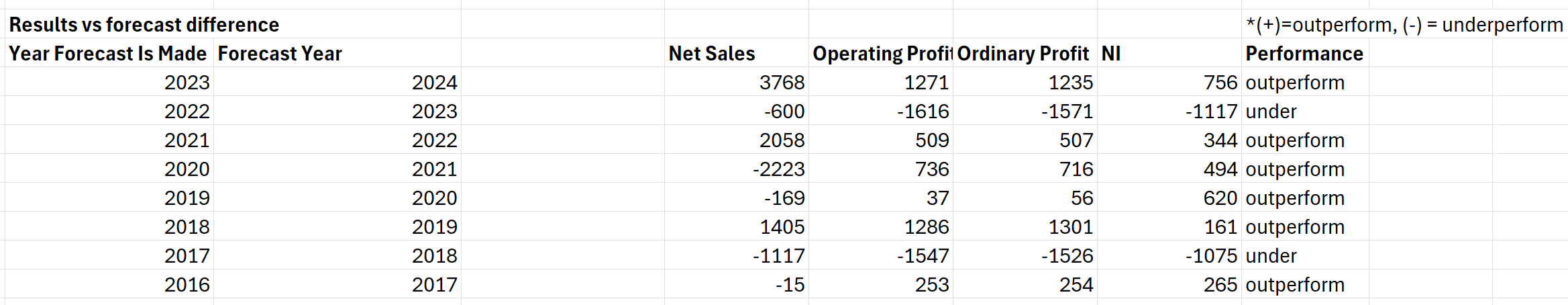

Management loves to underpromise and overdeliver:

Company’s 2025 Forecast:

*Above is English translated version of the below:

I inserted the historical forecasts management makes at the end of every FY and compared them to the actual results achieved.

The results indicate that management has outperformed their own forecasts 75% of the time. I personally believe this “outperformance” is not due to management displaying superior management prowess, but simply because the management has a pattern of consistently underpromising.

Taking my analysis one step further, I wanted to see how the price moved subsequent to the earnings forecasts.

In 7 out of the last 8 FY earnings releases, the stock dropped in price in reaction to the release of the FY end earnings release, which is simply a condensed financial summary.

If one were to simply purchase the shares 1 day after the earnings were released, and hold the shares until 1 day before Q1 earnings are released, you’d have generated a positive return in 7 out of the last 8 years.

If one were to simply implement this strategy over the last 8 years, you’d generate an 187% compounded return, and this is with only an annual 1 quarter holding period.

I’m not really one to trade, but this is an added bonus for the fundamental value investor. Those who are not aware of this pattern will take management’s forecast at face value.

As an investor, management’s pattern of underpromising allows us to enter at a lower price. This pattern provides us with a short-term price catalyst when management ultimately outperforms its own forecast in subsequent earnings releases.

How do I generate my ideas?

I use Koyfin!

My goal with any new idea is to reject it as quickly as possible. Koyfin is a huge time saver when it comes to getting up to speed quickly on a new name.

Use my affiliate link and save 20% off!

-Koyfin has one of the best screeners in the industry, with customizable formulas (create a formula to filter for net-net stocks)

-Koyfin watchlists are super intuitive, organized and easy to use

I mainly use Koyfin to quickly look at a company’s business description, valuation multiples, historical profitability, analyst estimates to gauge future prospects, and form an opinion on whether this idea is worth looking further at.

Not ready yet? Use my link for a free trial to see what you’re missing out on!

Segment Analysis:

In this section, we will discuss the following:

Segment 1: Photo Sticker Booth/Purikura: The MVP income generator and anchor of the company

Segment 2: Character Merchandise: The growth segment in the company

Segment 3: Furyu’s Third Segment: Why this segment likely won’t bear any fruit

Photo Sticker Machine (Purikura) Business: The Company’s Monopoly Business

Furyu is known for its photo sticker business, also known as “Purikura” in Japan. As of 2022, the company had a 94% market share.

How Purikuras work:

The target customers are girls between the ages of 12-25. Purikura were initially very popular in the early 2000s. This was before the advent of smartphones.

Purikura offered an easy way to enhance your facial features. Nowadays, this technology may not seem like much, as most girls know how to Photoshop themselves on their phones, but in the early 2000s, purikuras were revolutionary.

Why does this business still exist?

From a purely technological perspective, photo sticker machines should be obsolete. Everyone’s smart phones are fully capable of taking selfies and performing photo editing.

Why is it that, with superior technology in our own hands, do high school girls in Japan still go to photo sticker booths?

The most relatable example I can think of is Fujifilm’s Instax Mini

*Prices quoted in CAD.

Back in 2014, Instax Minis were making a comeback. High school and college girls purchased Instax Minis.

I thought at the time, Why would anyone pay $1 for an inferior-quality image? Taking photos on your smartphone is free and, in many ways, of higher quality!

Not to get too artsy but there are a couple of variables at play here:

-Sharing a moment with someone important. Taking a photo with someone worthy of wasting $1 of photo film with; hence, it is likely someone you cherish.

-Physical gift with meaning. After you take the photo, you can gift it to your friend. It becomes a cherished memory. Also, it’s really easy to misplace the photo or damage it, so you become careful and treat it like a prized possession.

-Unique retro/vintage look. The photo that comes out of an Instax mini produces a photo that has a unique retro/vintage look and is not the typical style of a normal smartphone selfie. *Although I’m sure there should be a photo filter that can replicate the Instax film look.

-There is beauty in imperfection. There is beauty in knowing you only get one shot at making this photo right. There are no edits; what you get is what you get.

The feeling of receiving a photo sticker is completely different from sending a digital photo via social media. It’s partly why a lot of people don’t even look at the photos they take digitally.

The fragility and scarcity in the physical form of the photo gives it value. (I sound like a snob I know)

How has Purikura adapted to the times?

One must ignore one’s Western upbringing to fully understand why Purikura works in Japan.

Purikura is a popular social activity among teen girls. Exchanging photo stickers is a sign of friendship in Japan.

Purikura are particularly popular when students graduate from high school. Before friends leave for college, Purikura offers a chance for friends to capture an important moment in their childhood before going their separate ways.

Just as guys will revisit their Pokémon, Yugioh, or sports cards for childhood nostalgia, girls in Japan will revisit their photo sticker collection for childhood nostalgia.

I personally believe this business exists uniquely for the Japanese and Asian markets. Unlike crane games, I believe expansion outside of JP into the West to be unlikely.

The photo sticker business is a mid- to high- single-digit operating income margin business.

The cash cow and the backbone of Furyu’s business is a complementary business to its photo sticker business which is PiCTLINK. PiCTLINK is part of the “Content Media” business. The operating income margins for PiCTLINK are spectacular, at 38-39%. Prior to 2021, margins were even higher at 40-55%. COVID negatively affected this segment.

*It should be noted that sales of colour contact lenses are bundled in the “Content and Media” segment. Sales of coloured contact lenses have declined from 1.3bn yen in 2022 to 0.88 bn yen in 2024, hence the decline in margins could be the result of the poor performance of the contact lenses business.

What is PiCTLINK (PL)?

Prior to smart phones, in Japan, high school girls would share photo stickers with their friends and save them in photo albums or scrapbooks. Some will stick these photos on notebooks or other items, but if there is constant exposure to friction, the photos will deteriorate with time. Photo stickers are a fragile and collectible item.

PL offers 3 main services:

The downloading of all the photos in your photo session (4-7 photos per session)

A digital album (digital scrapbook) to store your photos forever

New feature: Cloud storage for all the photos (can’t tell if other file formats are supported) on your phone

Nowadays, your photo stickers come with a QR code:

After you finish your photo session at the Purikura, your photos are uploaded to PiCTLINK.

The QR code provides a link that allows you to download the photos you took within 7 days through the PL app or website. The downloaded photos are saved to the PL app and you can create customized albums.

If you use the photo sticker and the photo deteriorates over time, you will lose the photo forever. PiCTLINK allows the user to keep a digital copy of a cherished memory forever.

With physical photo stickers, you can only share them with a few friends. PiCTLINK allows users to share as many digital copies of photo stickers with as many friends as they would like or upload them to social media.

The 7 day restriction creates a sense of urgency and aids in converting a Purikura customer into a PiCTLINK customer.

Explanation of the superior business economics of PiCTLINK:

As the saying goes, getem when they are young. i.e. Coca Cola and McDonalds are prime examples of marketing to children and creating a happy brand image for kids when they are young.

Tapping into childhood nostalgia or consumption habits is a very smart method to create stickiness.

Furyu offers a middle school program where middle school girls, grades 7 to 9, get premium accounts for free. The premium account allows you to download your pics for free and save them to the PiCTLINK app to access anytime, so you don’t use any of your phone’s storage.

Prior to smart phones, in Japan, high school girls would save these sticker photos in photo albums or scrap books. PiCTLINK offers the digital version of this.

These pictures never expire after they are saved to the app (cloud storage) and are accessible even after their premium account expires after they finish their third year of middle school.

This makes it convenient for app users to go back to the app to see their photos with their friends. If you switch phones, you can simply log into the app to access the photos.

Once they revisit the app, they may have the sudden urge to take some new photo stickers and make arrangements to meet up with their friends to take new photos.

On the app, you can conveniently find the location of the nearest photo booths. You can even see the newly released photo booths that offer photos of a certain aesthetic or theme.

Once they enter the last 2 years of high school or grade 10, the service is no longer free, and you’ll have to pay for a monthly subscription to download your photos.

Breakdown of PiCTLINK Account Types:

There are 3 tiers of accounts:

Free account:

-1 free download per photo session per person (usually 4-7 photos per session)

-If you and a friend were a part of this photo session and there were 7 photos, you each could download 1 photo and share it with each other so 2/7 photos can be saved.

Premium account:

-Unlimited downloads of post-edit photos

-site version: 330 yen per month (incl. tax)

-app version: 450 yen/mo or 4,100 yen/annual (incl. tax)

Premium plus account:

-Unlimited downloads of pre- and post-edit photos

-site version: 550 yen per month (incl. tax)

-app version: 720 yen/mo or 7,200 yen/annual (incl. tax)

*You only need the monthly subscription to download photos. I suspect most customers cancel after 1 month, given the photos are still available after your subscription ends. So you would only ever need the monthly subscription when you take photo sticker photos. So if you go to Purikura twice a year, each more than a month apart, then you would purchase 2 monthly subscriptions.

In May 2023, Furyu updated the PiCTLINK app to provide cloud storage. Apparently, a pain point for high school girls is that they don’t have enough storage on their smartphones.

Furyu added this cloud photo storage feature as a means to reduce customer churn and increase customer LTV. This was initially provided to “Premium Plus” members (Premium in the slide below). This seems to have worked, given that the company saw an increase in premium plus members:

*“Paid members” in the above slide here refers to the basic premium plan (300 yen per month). “Premium members” in the above slide here refers to the highest tier (2nd tier) premium plan (500 yen per month).

In October of last year, the company offered the cloud storage feature to even basic paid members. This expansion in features will likely further reduce churn and increase customer LTV.

Furyu knows that when the girls graduate, they will take photo stickers with their friends, which is when they will charge money when it really counts. Individuals are unlikely to skimp out of paying for a memory with their friends. Their most basic plan is 330 yen for 1 month. A small cost to keep a digital copy of photo stickers with friends you’ve spent all of high school with and are now parting ways with for college.

In the years before high school graduation, offering free access to middle school girls has a few perks:

Offering free access builds a free customer base (email addresses and contact info)

By making the service free, middle school girls are incentivized to learn how the app works. This way, when they graduate, they are familiar with the PL system and are more likely to be funnelled into their monthly digital download service.

Creates a level of stickiness and customer loyalty to Furyu photo booths

If you already paid for a PL monthly subscription, do you want to subscribe to a competitor’s subscription service.

People revisit childhood nostalgia throughout their adulthood. Even if you don’t play Pokémon as an adult, something may trigger your desire to collect some Pokémon cards or open up your old card binder to look at them.

In the same light, if your customer base starts going to photo sticker booths with their friends starting in grade 7, even after they graduate high school, something will trigger them to want to go to a photo sticker booth when they are adults.

Cons of the business:

Japan’s trend of having an aging population and fewer births is a headwind for this business. As the company’s core customers are teenage girls, the population of customers entering the sales funnel dwindles with each passing year.

With technological advances and new social norms, this business may become more and more obsolete.

Furyu designs its photo sticker machines, but the company has concentrated all production of it’s machines with one manufacturer:

Summary:

The business model as it currently stands is offering a low cost and high quality photo sticker at an amusement facility (low margin business). Those who see value in a digital copy of their photos will pay for a monthly subscription (high margin business). The digital copy of the photo comes at no additional cost to Furyu, the marginal gross profit is likely 90%+. The main costs are cloud storage costs, server costs, and hiring a team of software engineers to maintain and improve the app/website. If the photos are not downloaded in 7 days, they are deleted forever and don’t incur additional storage costs on the cloud. Frequent photo sticker customers or those who don’t have enough phone storage space become long-term subscription customers (SAAS model). Given that people change phones roughly every 2-4 years, a new phone with larger storage could result in the customer cancelling their subscription. If we assume it takes someone 1 year to fill up their phone, customer LTV is likely 1-3 years.

3 growth opportunities I want to see the company tackle more are:

Offer limited edition stickers in collaboration with popular character IP. They have done this recently with Sanrio. I’d like to see more collaborations with their own in-house IP (Yuru Camp) and popular anime IP.

Tap into the childhood nostalgia of customers outside their target age range.

The company brought back picture themes from the past. In the above Insta post, there is a “Gal” theme from 2011. I believe the target audience are those outside the normal age range since this theme was created 13 years ago. So if the picture was taken when you were 18, you’d be 31 now.

Add more features to PiCTLINK monthly subscription that its target customer would pay for. Cloud storage was a good idea. I have no clue what other features/services can be introduced. I guess they could do a Costco membership model where subs get a certain discount at Furyu hobby mall.

Segment 2: Character Merchandise

Furyu doesn’t have any A- or S- tier IP in terms of popularity, they do have some IP, but it’s not the most popular. Yuru Camp as an anime could be a B- to A-tier anime in terms of quality, depending on who you ask.

Furyu competes in the same character business as SK Japan. Furyu, like SK Japan, has most of its character merchandise sales generated from amusement facilities:

What differentiates Furyu from SK Japan is that they focus more on making figurines, whereas SK Japan primarily makes plushies, capsule toys, and other character accessories.

A majority of Furyu’s sales are to amusement facilities in the form of prizes (prize figures, plushies, and other character merchandise). The Furyu brand is known for their prize figurines. Prize figurines are mass-produced and of lower quality than scale figures (high-end figurines), but this lower quality is accepted by consumers due to their affordability.

Furyu also sells mid- and high- tier figurines.

Here is a great video I found describing Furyu’s position in the figurine market:

*Fyi, I myself am new to the anime figurine space. I have never purchased an anime figurine.

Based on the above video, Furyu has its hands in a lot of different categories of figures.

Given how low their margins are in character merchandise, I believe Furyu is doing this on purpose to gain market share. They are essentially throwing mud on a wall and seeing what sticks.

Collectors of figurines care about a few things:

quality control (paint application errors, assembly and part fit problems, sculpting flaws, poor material quality, packaging issues, detail inaccuracies, and stability problems)

accurate representation of original character art

base with which the anime figure stands on

value

Based on the videos I’ve watched, it seems Furyu does produce high quality figures, but the initial quality control was off. It does seem that Furyu is improving, but, as the video states, they have to restore the bad faith that has built up over the years. This is likely the result of being in so many product categories at one time.

The general impression I get from Furyu is that they are innovating and putting up a good fight with more well-known and reputable producers.

This can be seen in the company’s mid-priced “Tenitol” line, which rivals Good Smile Company’s “Pop Up Parade” line. The problem with Pop Up Parade is that they put no effort into the base. GSC likely did this as they were the pioneers in mid-tier price bracket space and needed to do something to further differentiate from their more expensive scale figures. Furyu has taken advantage of this weakness and differentiated itself with a base that complements the character.

As we can see, in the same price range, Furyu has creatively incorporated a base that complements the character.

Other innovations I saw from Furyu are in the high-end figure space:

This is a ¥198,000 yen figure. Yes, that is 2000 Canadian dollars!

What is innovative about this figure is that Furyu collaborated with traditional Japanese craftsman of hina dolls. The kimono is designed by the artist. The material for the figure’s outfit is sourced from traditional kimono fabric suppliers.

This is something never before seen in the industry, and it is a bold move that makes me believe they could take market share from their competitors.

I believe as Furyu’s reputation improves over time, they will generate more revenue. Furyu is on the offence to gain more market share, so margins will be suppressed for a period of time.

Furyu’s Hobby Mall Twitter website with 200k followers

Furyu’s prize twitter page, I believe it’s related to amusement prizes

Furyu’s lottery/raffle minno no kuji twitter:

List of all Furyu’s social media accounts on various platforms

Dungeon Investing Character Merchandise Commentary:

First we need to understand that FuRyu is way less profitable than it can be as of now, and it is best to look at it in two sets. First, let's talk about the prize segment. In there, they have tripled their revenue since 2021. Granted, there is some post-covid effect in there, but 2019 revenue is 29% of the current one. They have done that by expanding their offering a lot… and by aggressively capturing market share. If we look at the segment margin history, we see that pre-COVID they were doing 5-6% operating margin. Then in 2021 and 2022 margins explode to more than 13 and 16% as operating leverage kicks in. And then in 2023 we have losses, and in 2024 a 7% margin, similar to pre-COVID times. What is going on there?

First, that margin is blended with the high-price and mid-price range. FuRyu has been investing in getting a whole range of figures in the last few years (since 2019, to be precise), which increases the internal costs. FuRyu externalizes manufacturing, but does sculpting and licensing in-house. That has meant increasing the number of full-time employees to 1051 in 2023, from 45 in 20192.

The play FuRyu is following is two-fold, I think. First, avoid pushing prices for crane sales, and absorbing some costs to gain market share in the last couple of years. Given the rate of growth, I think that has worked out fantastically well, although not sure how sustainable that will be once they try to make a bit more. Second, expand the range as Alan outlined, which is where FuRyu is really investing on growth.

In this, we have three opportunities:

● Continued gain of share in the prize segment

● Expanded line-up in the mid and high price segment:

● North American and [Overseas] market

With these three areas combined, this is the business where I think we can see, if things go well, 5-6B yen in operating profit in a few years, rather than the 2 we saw last year… and this is the growth opportunity I would try to pay for!

Segment 3: Furyu’s “New” Third Segment:

The company’s revenues have been relatively flat in this segment. The company has transitioned from losing substantial money to being relatively breakeven in the segment.

The company recently did a re-segmentation. My view of the re-segmentation is that management chose to consolidate all the loss-makers into the “New Business” group.

Character MD got renamed to “Sekaikan Business.” Sekaikan means worldview, so management is shifting your focus to the overseas expansion of Furyu’s character merchandise.

PiCTLINK can’t operate without the photo sticker business, so I do believe grouping them together makes sense.

In terms of “New Business,” nothing is really “new”. The only revenue streams with any real promise are anime and gaming.

Anime Discussion:

Here is a list of anime produced by Furyu on myanimelist.

In regards to anime, Furyu has been making progress with “Yuru Camp.”

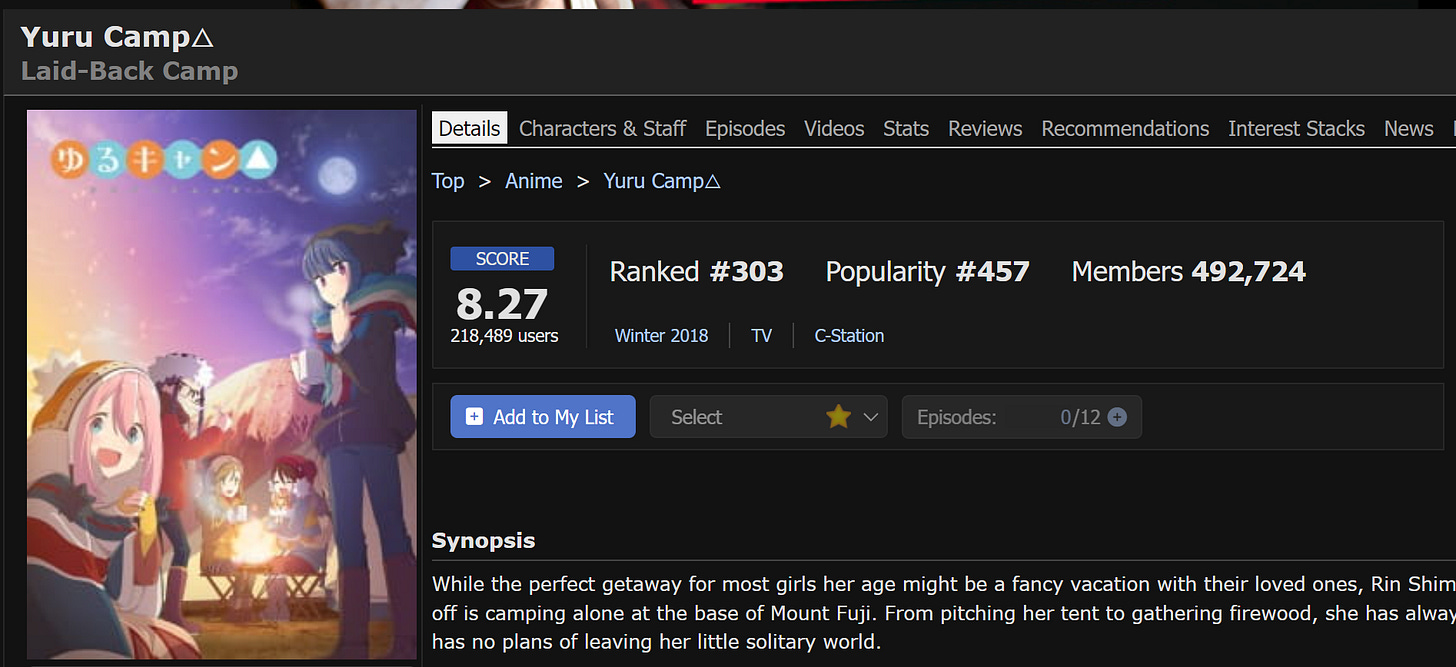

Currently on myanimelist.com Yuru Camp has the following ratings:

Yuru Camp Season 1:

Yuru Camp S2:

Yuru Camp S3:

Yuru Camp Movie:

From my personal experience on MyAnimeList and MyDramaList, I’d consider anything 8 or above to be a solid anime, show, or movie.

The current reality for Furyu is that if you invest too little, it will be hard to compete with competitors with deep pockets like Bandai-Namco, Capcom, Sega, etc.

Sega, Bandai-Namco, and Capcom are examples of the positive outcomes of creating a successful in-house IP.

The biggest value add for Furyu is to develop some in-house IP that is A- or S-tier in the minds of anime fans or gamers. This would allow Furyu to vertically integrate.

Having a successful in-house IP would result in less reliance on purchasing IP from licensors. Having in-house IP results in higher margins on prizes sold to amusement facilities for crane games and for high-end figurines as well.

Prize sales could increase substantially if Furyu gets lucky and lands on a popular IP. Having exclusive rights to the IP would mean that either Furyu could produce all the prizes for “Yuru Camp” (for example) on the market or it could take the risk-free approach of being a licensor, or a hybrid of the two.

In fact, Furyu is already doing this on a small scale. Here is a Minno No Kuji I found for Yuru Camp.

Dungeon Investing commentary on anime:

In anime, most companies don't make much. There is a ton of money in the sector, but it is very spread, and a large part of it ends up with the original IP holders (that is, the manga publishers). As such and for the most part, FuRyu's investments in the sector are the cost of doing business, a way of getting embedded in some production committees and securing relatively good deals for those (and others, by keeping a good relationship with companies that are in more of those). It is akin to what Bandai has done in the space, but with a much smaller balance sheet.

In FuRyu's case in particular, they have been pretty good at picking where to invest in the space. Is It Wrong to Try to Pick Up Girls in a Dungeon? & Laid-back camp has been successful, and other entries in their credits have not done entirely bad either. But that has not managed to make the segment very profitable. Now, we could argue that the investment in anime has been profitable, but the segment hasn't because it also carries the investment in games, but with the exception of the Laid-back camp movie launch in Q2 - FY23, higher profitability in the segment as a whole seems to correlate more with high revenue from game releases, rather than with higher anime revenue. Personally, my impression is that the anime business is probably barely profitable, and I don't have expectations of that changing.

CC: This anime has a 7.5 score, but it has a higher popularity score and members than Yuru Camp.

Alan's theory regarding anime was that the generation of IP might allow vertical integration if the investments were to find a very successful property. But the level of investment Furyu makes is not enough for that. The company has forecasted 0.5 bn yen per year of investment3, spread around between internal costs (employees in FuRyu) and what actually gets invested in the series, and spread around between 6-7 entries per calendar year4.

Most likely, they are only leads in 1-2 (Laid-back camp for example), and in the rest, they invest far less. Now, that is still something in the anime industry, but a far cry from the leaders. IG Port, for example might be spending 16 times that (it is spending more, but I take out part of it as cost overruns, which Furyu doesn't have to deal with), Toei has a similar spend rate looking at their work in progress… and vertical integration depends on huge successes. FuRyu's main business in this regard is prize figures, and that is based in a few evergreen IPs, and whatever is really hot at the moment. Breaking into that and investing less than 10% the amount of each of the big players and spread around into almost as many bets is unlikely.

Gaming Discussion:

If we can learn anything from Sega Sammy (6460) is that earnings from gaming can be volatile. When a game does well, investors tend to get overexcited. When games don’t live up to expectations, the stock price can drop substantially. The success of one title may not guarantee the success of other titles. Investors should view each game release as it’s own IRR project. Previous title successes can lead to future title successes, but there are no guarantees.

Future continuation title releases should be viewed as an extension of the timeline of the IRR project with differing cash flows. There is no guarantee that any title will become a franchise and have the same run as Street Fighter.

Franchise titles like Street Fighter (Capcom) are forever going to attract a core fan base whenever a new numbered release comes out, but if you get a game development team that wants to veer way off course from Street Fighter’s working formula, then you could have a bust. i.e. completely removing the skill gap between a pro and a novice.

I remember reading somewhere that there is a private investor in Japan who loves playing games. By playing games, he can tell if a game is going to be a hit or not. Based on his own experience as a gamer, he has made a killing in the stock market. Besides poker, I would not consider myself an online gamer. If any of my readers have played games in Furyu’s catalogue, please comment on your experience.

Dungeon Investing commentary on gaming:

On videogames, I am slightly more optimistic. And that is because FuRyu already has some reputation as a decent Japanese action RPG maker, so their games get some sales based on reputation alone, and typically cross the 100k units sold now. Crystar and Crymachina have done something to build on that reputation, and Reynatis seems to get some hype.

The Japanese-action-RPG5 subgenre is tried and tested, with both long-running series like Ys that are made on a budget and outsized successes like NieR or Bayonetta. Here FuRyu seems to be investing enough in building up their reputation and IP to be a small profitable developer of the budget version of these games, and I can see them getting there.

The main system for which they develop is Switch (although they port their own IP games to PC and PS), and they are not only developing these kinds of games with their own IP, but also others like Beyblade X: XONE. That and Reynatis are the main upcoming launches.

It is good to note that they already have an international distributor (NIS), and they are trying to cultivate the international market from the start, not falling into the same problems other developers like Nihon Falcom did for a while. But still, while it is interesting, small-size action JRPGs won't move the needle that much on a company the size of FuRyu. Even if they are very successful, we can be talking about 1-2B yen of profit, and the jump to big-time game development is too big to contemplate as of now6.

In all honesty, I think those two sub-segments are side-shows for FuRyu. And what is more, I think FuRyu understands that as well, and is investing accordingly. In 2019, the "games" segment, including video games and anime, had 118 full-time employees. As of 2023, it was 57. This year both were lumped together with the contact lenses business in the same segment, labeled "new business" and basically explained away as looking for growth opportunities. I think what they are doing, though, is lumping together the loss-making businesses and little by little optimizing them to make some money.

Last Remarks:

Different from my previous JP stocks pitches, Furyu does not have a strong near term growth catalyst. Furyu has 4 main paths to increasing profitability:

Continue capturing character merchandise market share

Get lucky and land a popular anime

Get lucky and land a video game IP

Increase play count of its photo sticker booths, and increase customer LTV in its PiCTLINK app.

I am hopeful that Furyu grows its character merchandise segment, but Furyu still operates in a highly competitive industry with no top tier in-house IP to assist in raising margins. A high-tide raises all boats, so the anime and anime adjacent tailwinds are good for Furyu.

Even though the multiples appear cheap, given the population decline in Japan, sales of photo stickers and PiCTLINK are likely to decline over time. The decline will be very gradual yoy given that the student population decline is only roughly 10% per decade. Furyu can combat this by getting more people to play or raising prices to offset the user decline.

At current multiples, with no debt and plenty of cash to fund growth, I believe Furyu is undervalued despite the lack of any strong growth catalyst. In addition, the company consistently underpromises in its annual forecasts, which leads to a high likelihood of outperformance on the part of management. Given the recent price decline that has applied the pre-earnings multiples on the post-earnings NTM forecast, the current market price only factors in management’s under promise and does not reflect the potential for management to outperform.

This pattern of forecasting has resulted in historical profitability by simply holding for 1 quarter prior to Q1 earnings release. Given the company is undervalued based on fundamentals and there lies a trading setup that has been historically profitable, I believe now is the right time to invest in Furyu.

One of the most important principles in gambling, imo, is “a dice has no memory.” This setup is akin to investing in an undervalued stock and the astrology signals and the stars point to your stock going up.

Other Popular Posts:

AGF Management Limited Part 1 (AGF.B)

AGF Management Limited Part 2 (AGF.B) (Paid Sub Exclusive)

Fast Fitness Japan (7092) (Paid Sub Exclusive)

Reader Exclusive Promo:

Koyfin is my go-to tool for quickly rejecting or diving deeper into potential opportunities. With its intuitive platform, I can:

Instantly access business descriptions.

Analyze valuation multiples and historical profitability.

Review analyst estimates to gauge future prospects.

It’s a huge time-saver for forming a clear, initial opinion on any company. Ready to streamline your research process? Sign up to Koyfin here to save an additional 20% and take your due diligence to the next level!

Follow My Other Social Media:

Additional Disclaimer: The post and all its contents herein are the exclusive property of Continuous Compounding. This post is intended solely for informational purposes and is not to be distributed, reproduced, or transmitted, in whole or in part, for commercial purposes or sale without prior written consent from Continuous Compounding. Any unauthorized use, dissemination, or sale of this research is strictly prohibited and may be subject to legal action.

In 2023, probably bigger in 2024, but securities report still has not been published at the time of writing this

The game business, including anime, has reduced since then however, and sits at about half what it was then. That also gives you an idea about where FuRyu is really investing to grow.

In the company’s Q2 FY2024 IP, it states the company will continue investing 0.5 bn yen per year. Furyu did not revise this in the FY2024 IP.

It was 7 in 2023. Only the 4th season of Is It Wrong to Try to Pick Up Girls in a Dungeon? was really relevant

And here one could ramble a lot about the difference between a plain JRPG and an Japanese action RPG… I would say it is mostly how much focus there is in the combat, and it is turn-based or real time… but then again, Tales series is mostly real time and most people would classify it as a JRPG. Regardless, not many doubts about where FuRyu games fall!

Even if it wasn't, that's a dangerous transition. For example, Acquire makes fantastic and successful games, but it was not extremely profitable, so GungHo sold it. It is not clear how much Kadokawa has paid, but looking at the financial statements of both Kadokawa and GungHo, it exceeding 2B yen is unlikely. Vanillaware is also in this subscale big-game-developer category, and they court bankruptcy every couple of years.