Fast Fitness Japan 7092 Deep Dive Part 1 (Free - Former Paid Exclusive)

The owner of master franchise rights to Anytime Fitness in Japan

*Legal Disclaimer: This post and all its contents are for informational or educational purposes only. Continuous Compounding assumes no responsibility or liability for any errors, inaccuracies, or omissions in this post, links, attachments, or any actions taken based on its contents. The information sources used are believed to be reliable, but accuracy cannot be guaranteed. Recipients of this research are advised to conduct their own independent analysis and seek professional financial advice before making any investment decisions. The opinions expressed by the publisher in this post are subject to change without notice. From time to time, I may have positions in the securities discussed in this post.

This post and all its contents herein are the exclusive property of Continuous Compounding. This post is intended solely for informational purposes and is not to be distributed, reproduced, or transmitted, in whole or in part, for commercial purposes or sale without prior written consent from Continuous Compounding. Any unauthorized use, dissemination, or sale of this research is strictly prohibited and may be subject to legal action.

Disclaimer: I am long shares of Fast Fitness Japan (7092) at the time of publishing this post.

I am back today with a brand new stock pitch. One that is not my typical anime-related stock.

I bring to you Fast Fitness (7092). A high-quality and undervalued fitness business in Japan that exhibits superior business economics and product market fit than most of its competitors.

Table of Contents:

Business Overview

Quick Valuation

Key Highlights

Outlook

Comps Analysis

Growth Analysis

Business Economics

Conclusion:

Business Overview:

Fast Fitness Japan (FFJ) owns the master franchise rights to sub-franchise “Anytime Fitness” in Japan. Anytime Fitness is owned by Self Esteem Brands LLC.

What is Anytime Fitness?

Anytime Fitness (AF) was founded in the US as a 24-hour fitness gym focused on providing quality gym equipment at a competitive monthly rate (7000-10000 yen in Japan - 50 to 70 USD). Prices vary by location.

When Anytime Fitness was first introduced in Japan in 2011, it was the first 24-hour gym of its kind.

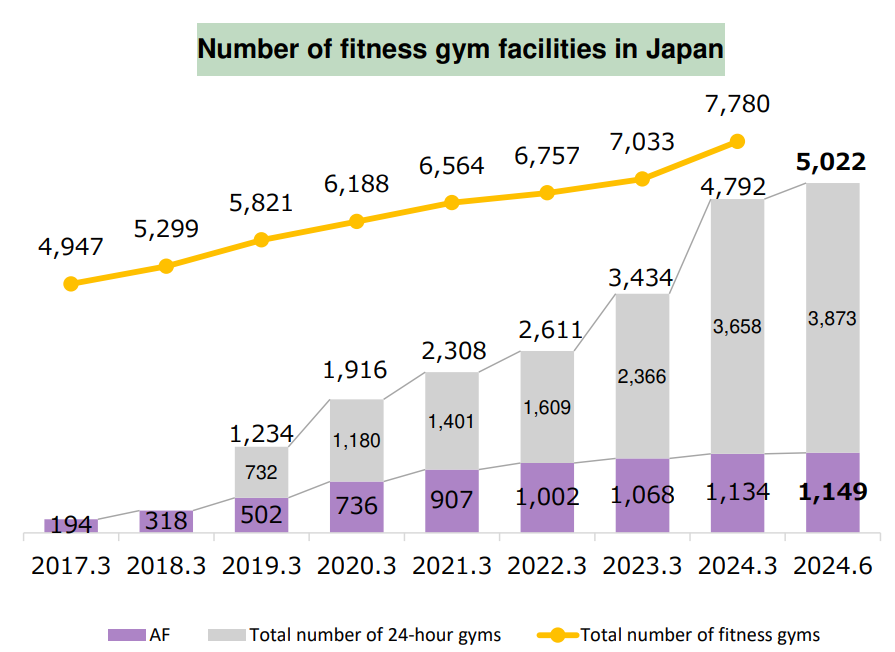

AF’s convenient operating hours, easily accessible locations, quality gym equipment, and competitive pricing have allowed AF to profitably grow to 1,149 stores as of Q1 2025.

*It should be noted that a large portion of the 5022 24-hr gyms are simply existing comprehensive sports clubs that have expanded the operating hours of their gyms to 24-hrs. Their other amenities, like swimming pools and saunas, still follow normal operating hours. There are competitors that have entered the space as well; more on this later.

As of Q1 FY2025, AF has 22.9% market share of the 24-hr fitness club market in Japan in terms of club count.

As of FY2024, AF has 14.6% market share of the entire fitness club market in terms of club count.

Business Structure:

FFJ operates 2 main segments:

Directly owned clubs (DOC) : FFJ operates 182 (16%) directly owned clubs in Japan.

Franchise clubs (FC) : There are 967 (84%) franchise clubs and 171 franchise owners.

As of Q1 FY2025, the company has 1,149 domestic stores, 2 stores in Singapore and 1 in Germany.

FFJ collects franchise fees and a fixed monthly royalty from franchisees. FFJ pays a portion of the franchise fees/royalties per store to Anytime Fitness Franchisor, LLC (Anytime Fitness USA).

Value prop?

Anytime Fitness is a value-oriented gym. This should not be confused with a “discount” gym (3000 yen per month) which typically lacks gym equipment.

Anytime Fitness competes on convenience (24 hrs), accessibility, quality of gym equipment, and being competitively priced in comparison to comprehensive sports clubs.

*One should not compare their gym membership cost in US and Canada to Japan. FFJ’s pricing is competitive to what is offered in the context of Japan.

Comprehensive gyms/clubs offer a swimming pool, jacuzzi, and other creature comforts, which would require a higher monthly fee due to the higher capex, labour costs, and operating expenses.

AF cuts out all the unnecessary creature comforts and only offers gym equipment necessary for a quality workout.

Staff is available for 8 hours a day. Given the gym is 24 hours, the gym is unmanned for most of the operating hours. FFJ works with a security company that sends security guards on the scene if anything were to occur.

This reduction in labour costs, capex from not having to invest in expensive amenities (i.e a swimming pool), and operating expenses, results in savings being passed down to the consumer in the form of a competitive monthly rate.

Target Market:

Anytime Fitness targets users between the ages of 20-40 who have made the commitment to working out and demand quality fitness equipment to meet the demands of their unique workout routine. A gym rat should find the equipment at anytime fitness satisfactory for their workout needs.

Quick Valuation Overview:

Enterprise value:

FFJ’s market cap is 25bn with net cash of 5bn, hence EV is 20bn.

P/B of FFJ is 2.0x. The P/B of FFJ should be high due to the non-capital intensive nature of its franchise club segment. FFJ charges franchisees a flat fee every month regardless of operating results; hence, income from FFJ’s franchise segment is very stable.

The only capital-intensive segment is the directly operated club segment.

Valuation Metrics:

Units in million (mm), yen

*No Growth FCF= FCF + Growth Capex. The growth of the company’s franchise segment requires minimal growth capex, most of growth capex is demanded by the company’s DOC stores.

**EV/E isn’t a real metric, just something I personally use to gauge what happens if management is able to utilize excess cash/investments for increased dividends, special dividends, buybacks, and etc.

Key Highlights:

-Ignoring international growth opportunities, Fast Fitness Japan is undervalued on domestic operations alone:

6 months to 1 year holding upside of 20-60%

3.5 year upside of ___-___% if it can open up to 1400 stores by FY2028 (paid)

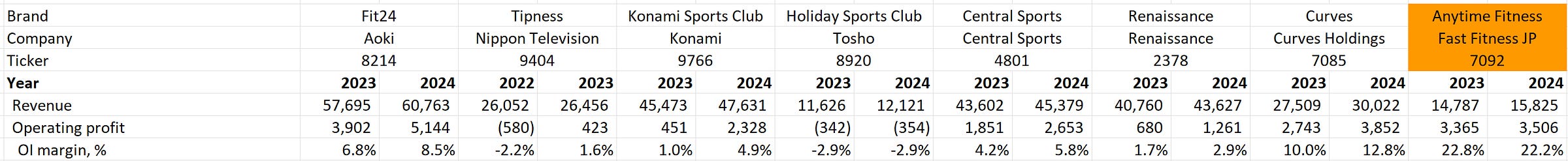

-Fast Fitness Japan has some of the lowest valuation multiples in relation to its comps:

6.2x FY2025E EV/EBIT vs 6.9-32.2x of peers

4.5x FY2025E EV/EBITDA vs 4.4-10.5x of peers

14.3x FY2025E P/E vs 15.8-60.9x of peers

11.7x FY2025E EV/FCF (6.5x if excl. growth capex), vs 9.7-26.1x of peers

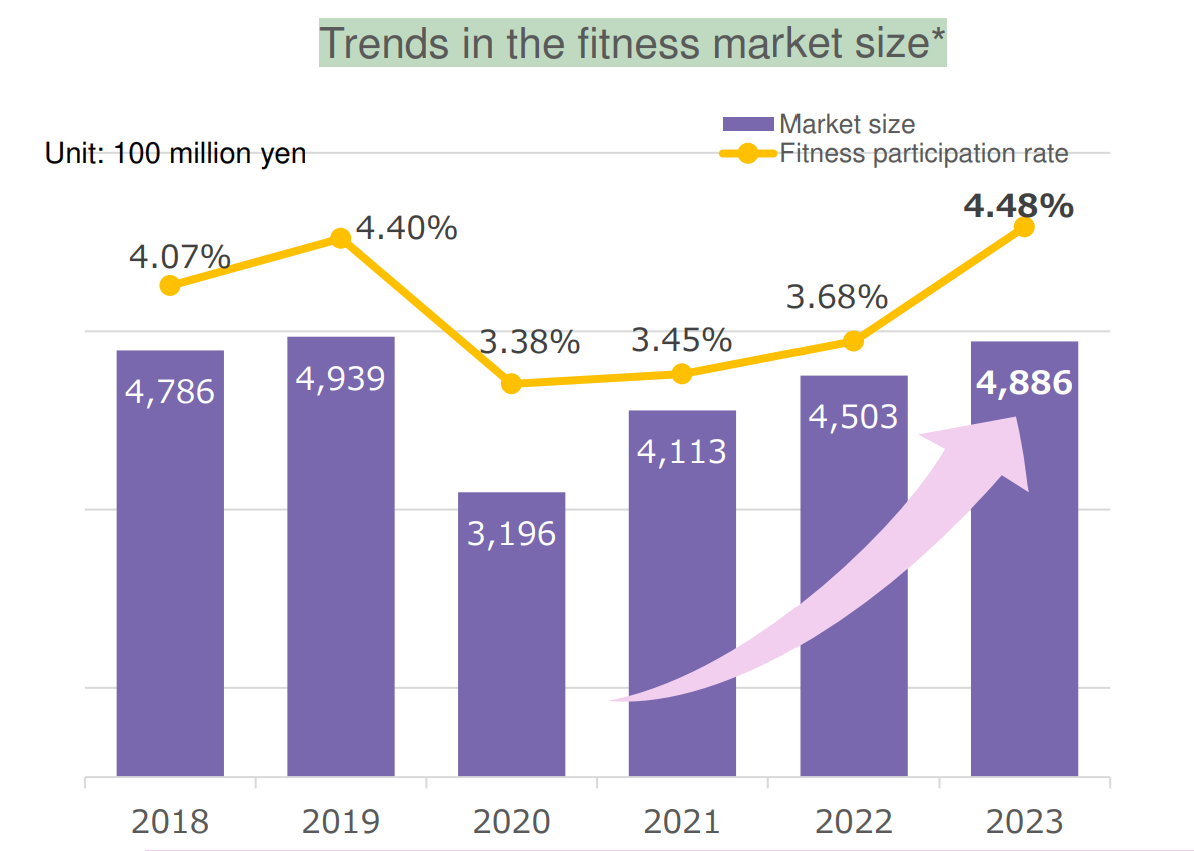

-FFJ has the highest operating income margins out of any of its competitors. This is predominantly due to more than half of operating income coming from FFJ’s franchise operations. Curves Holdings is the only other business in the following list that also has predominantly franchise operations, everyone else directly owns their stores.

*Rizap Group (2928) had negative operating income in FY2024 (-0.4%) and the company projects to have 3.5% OI margins in FY2025. Personally, I don’t think this is going to happen.

-FFJ takes significantly less business risk than its competitors given more than half its operating income comes from collecting fixed monthly royalties from its franchise stores regardless of business performance. FFJ’s current valuation does not appropriately capture the low risk and bond-like qualities of FFJ’s franchise operations.

-Based on FFJ’s current valuation, investors are getting the following growth opportunities for free:

Growth 1 (available with paid access)

Growth 2

Growth 3

Growth 4

Growth 5

Growth 6

Thanks for reading! Consider supporting Continuous Compounding to read the following:

Table of Contents:

Business Overview

Quick Valuation

Key Highlights

Outlook (Paid)

Comps Analysis (Paid)

Growth Analysis (Paid)

Business Economics (Paid)

Conclusion (Paid)

Consider supporting Continuous Compounding:

My most recent stock pitch on AGF was pitched at $8.49 on Sept 22nd, 2024, and has quickly risen up 24% to $10.49. If you were a paid sub, you would have been able to invest in this opportunity.

Track record of stock pitches:

Active Positions:

AGF Management Limited: +24%

Furyu: -0%

SK Japan: +0%

Haier 690D: +75% (inc. dividends)

Closed Position:

Round1: +55% (closed)

Okano Valve Manufacturing: +45% (closed)

GAN: +80% (closed)

CNTY: -50% (closed)

*As of Oct 6th, 2024. Returns are rounded.

Hit rate: 6/8 (75%)

Average return: +29%

Average return for stocks outside of NA (excl. CNTY US, GAN US, AGF.B CN): +35%

Average return for stocks excl. CNTY US: +40%

*My first stock pitch was CNTY US; hence, I’ve been on a winning streak of sorts.

**Past performance is not indicative of future performance. I’d be happy if my hit rate is 60-80% in the long-run.

Paid sub testimonials:

*The above image is simply a joke and should not be interpreted as a threat of any kind.

-Based on FFJ’s current valuation, investors are getting the following growth opportunities for free:

Expansion of Anytime Fitness stores beyond 1400 stores

Growth of other fitness themed clubs in Japan: The Bar Method and SUMHIIT Fitness.

Growth in Germany

Growth in Singapore

Growth in Asia

Growth in Merchandise sales

Outlook:

The company has provided the following guidance in its “medium-term management plan”:

Management has provided financial guidance up to FY2027. I have estimated up to FY2028 because the management guides to 1400 stores by FY2028.

*For details on assumptions used in the above forecast, see the Appendix1

The above valuation metrics assume no further international expansion beyond 3 stores. I did this to highlight the profitability and valuation of FFJs domestic operations.

Based on the above, FFJ is cheap even if it is unable to expand beyond Japan.

Quick Comps Analysis:

Fast Fitness Japan has the lowest valuation multiples among any of its publicly traded competitors.

FFJ has communicated this in their latest IP:

Based on the figures used in the chart above, the following are my best guesses of which company corresponds to which by matching OPM, ROE, PER and Mcap provided:

Company C: Curves Holdings Co. (7085)

Company T: Tosho Co. (8920)

Company R: Renaissance (2378)

Company S: Central Sports (4801)

Here are my calculations of publicly traded comps:

*Firms like Konami (Konomi Sports Club), Nippon Television (Tipness-FASTGYM24), and Aoki Holdings (FiT24) were excluded in the above because their primary business is not fitness clubs; hence, valuation multiples would not be comparable.

Besides the 4.4x EV/EBITDA of Tosho Co. (8920) for FY2025, FFJ has the lowest multiples among its peers.

If we blindly perform a relative valuation, FFJ has a 22% to 600% upside.

Personally, I believe some of the multiples to not be representative of what multiples' can be attained by FFJ. Rizap Group is currently not profitable, operates many different businesses, and trades at high growth multiples. Renaissance trades at high multiples, but I personally don’t see the growth given the limited growth trajectory and demand for comprehensive sports clubs.

Given the difference in growth trajectory and business model, I believe the following normalized adjusted earnings and multiples to be more appropriate:

The above are the FY2025 normalized earnings of FFJ if they were to stop all growth projects and simply milk its current operations. Further profitability can be attained if FFJ were to optimize its workforce and cost structure.

The above normalized earnings will be quite different from what is forecasted by the company due to the increase in SG&A associated with FFJ’s recent international expansion. I have adjusted SG&A to a normalized rate that removes the added cost of international expansion.

Furthermore, the company aggressively recognizes impairment losses of its DOC stores. This was a reasonable practice during COVID. I see this as purely an accounting tactic to reduce taxes paid. I have also adjusted for impairment loss.

Given the company is growing domestic stores and has additional growth avenues, I believe the above multiples applied to be reasonable. Based on the above, a 20-60% 6-month to 1 year return is possible.

But, as the company has projected, they aim to open 1400 stores by FY2028. The following are what I believe normalized earnings will look like in FY2028 and the multiples possible given that at this point FFJ has saturated a large part of its addressable market.

From the above, we can see that the upside for FFJ could be anywhere between 30-90%, but the above normalized earnings have not even factored in the company’s growth opportunities beyond its domestic Anytime Fitness operations.

Before I dive into FFJ’s growth opportunities, I think it’s worth mentioning FFJ has the highest operating margins amongst it’s competitors.

This is thanks in part to the company’s franchise business model. 84% of Anytime Fitness clubs are owned by franchisees.

This combination of having the lowest valuation multiples and the highest profitability does not make sense.

The only variable that could justify such a phenomenon is growth.

So is FFJ a value trap because it is in a state of decline? The short answer is no.

On the contrary, this is where my view is completely different from the markets. At these valuations, the market is assuming FFJ has no chance of growing outside Japan.

*For further discussion of comps, go to “Detailed Comps Analysis” section

Growth Opportunities:

Table of Contents of Growth Opportunities:

Expansion of Anytime Fitness stores beyond 1400 stores

Growth in Germany

Growth in Singapore

Growth in Asia

Growth of other fitness themed clubs in Japan: The Bar Method and SUMHIIT Fitness.

Growth in Merchandise sales

1 - Expansion of Anytime Fitness stores beyond 1400 stores.

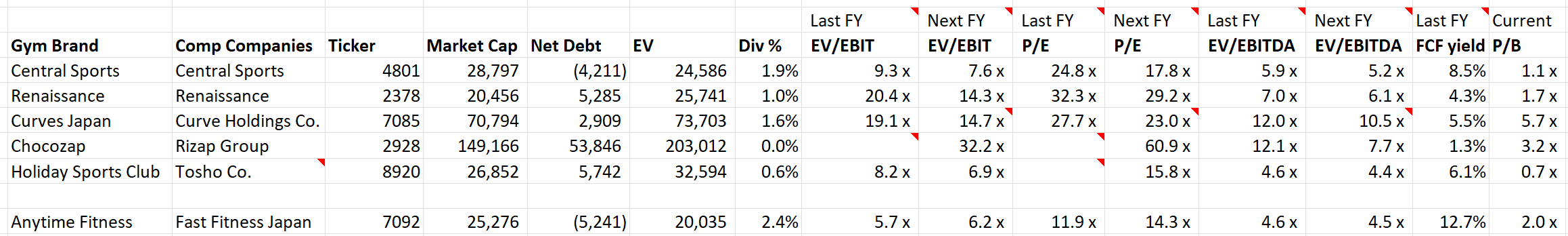

The fitness penetration rate is very low in Japan in comparison to other countries:

If I were to speculate, here are some of my anecdotal observations of Japanese society that may keep penetration rates low:

Japan is a walking and transiting country. The average steps of an individual in Japan is likely higher than someone in America (a car-driving country). Japanese people may get enough exercise from simply walking to and from work and running daily errands. When I travelled to Japan, I easily averaged over 10k steps a day, even up to 20k steps.

The obesity rate in Japan is 4.5%, compared to 42% in the US. In the west, many people sign up to gyms to lose weight and get fit. If you aren’t obese to begin with, you’ll need other reasons, such as trying to improve one’s physique, to hit the gym.

Work-life imbalance leads to lack of energy or motivation to even work out. Most Japanese salarymen work long hours and are completely drained after a long work day. Most salarymen probably want to recover on their days off.

With the above being said, there could be other reasons that could lead to an increase in the penetration rate in the future, such as:

Fitness trends that influence people to take up working out and strength training as their preferred form of physical activity.

Change in ideal physique and what people find attractive. If the ideal physique can be more easily attained through working out, that could help increase penetration rate.

Currently, FFJ’s primary age group is 20-40 year olds. There could be an increase in penetration rate from those below 20 and those above 40.

A shift in work culture that allows for more time outside of work could increase gym participation.

Valuation Impact:

Japan has a population of 120mm; hence, a 1% increase in penetration rate results in 1.2mm additional potential members for the entire market.

Based on the current 4.48% penetration rate, there are roughly 5.5mm fitness participations in Japan. FFJ has 886k members or 16% of the fitness population. If the penetration rate increases by 1%, assuming the same 16% market share, that is roughly 200k potential members. At 800 members per club, there could be roughly 250 new store openings. Roughly speaking, for every 1% increase in penetration rate, FFJ and its franchisees could open up to 250 more stores.

The likely outcome is probably a mix of existing stores filling up to operational capacity and new stores being opened to service the excess demand.

Any gymgoer will tell you they hate it when the gym is packed because it takes them longer to finish their workout. The nice thing about Anytime Fitness is that you can go to any AF location with just one membership. And when you frequent one gym considerably more than your “home” gym, the system automatically switches your monthly fee to the more frequented gym so there won’t be a case of members paying for membership at one gym and frequenting another.

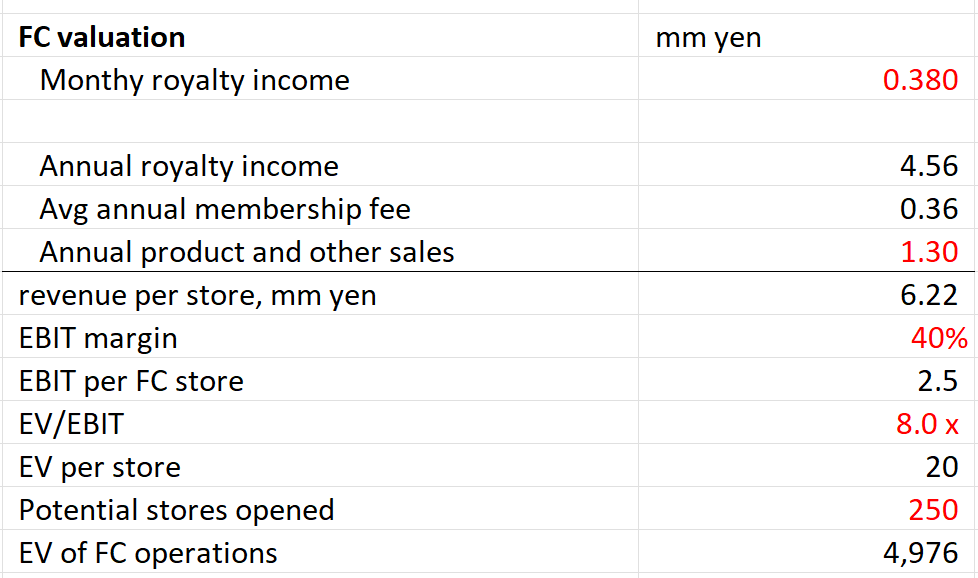

Fast Fitness Japan collects roughly 6 mm yen per franchise store. Assuming a 40% EBIT margin, FFJ generates 2.5 mm yen per FC store. Given that the franchise fees are fixed every month regardless of business performance, the earnings are very stable, and no business risk is taken. Given the bond-like behaviour of cash flows, I believe an 8x EV/EBIT (8-10x is totally reasonable) multiple on collecting franchise fees to be a conservative multiple. This would value the stream of income generated from franchisees at 20 mm EV per store.

If FFJ can open 250 FC stores, the EV boost from those 250 stores would be 5 bn yen. In other words, an 1% increase in penetration rate could increase FFJ’s EV by up to 5 bn yen. If Japan’s penetration rate doubles, we could see up to a doubling of FFJ’s value.

After further consideration, given that new members joining the gym past the breakeven level of 500 members contribute significantly to the bottom line, members filling up existing stores generate more EV than opening new stores.

Given stores are operating below max capacity, we can assume an extra 100 members can be added per store. At 1149 stores, we have an excess capacity of around 85k. At 800 members per store, we could open around 100-110 new franchise stores. New franchise store openings would contribute roughly 2-2.2bn in EV.

The 115k members being absorbed by our entire network, 16% would flow to our directly owned stores which would be 18.4k members at an average of 7000 yen per month or 1.5 bn yen per year of additional revenue. Given this revenue is from members way past the 500 breakeven point, I will assume 70% OI margins or roughly 1.1 bn yen of EBIT. At a 5x multiple, that is 5.5bn yen of EV added.

All in all, a 1% increase in penetration rate could add up to 7.5 bn yen (2+5.5) of EV.

If I were to speculate, I think a doubling in penetration rate is unlikely given the characteristics I described above. By offering 24 hour gyms that were cheaper and more easily accessible than gyms that were originally on the market, I believe AF has assisted in raising the penetration rate. I wouldn’t count out the possibility that there could be other innovations or changes in fitness trends that could increase the penetration rate by 1-2% in the future.

2- Growth in Germany

FFJ has recently acquired 100% of Eighty 8 Health & Fitness B.V., a company with the master franchisee rights in Germany. FFJ aims to open 68 stores in Germany by FY2028.

Germany posts the next great growth opportunity for FFJ. FFJ’s MO is slow, prudent initial store openings followed by rapid store openings once the company believes they have demonstrated the business model works.

I expect we will know how successful FFJ will be in Germany with it’s initial 10-20 stores.

Valuation Impact:

Germany has a roughly 13% fitness penetration rate with a population of approx. 84 mm. This would yield a fitness population of 11 mm, which is double that of Japan.

There are other things I haven’t had a chance to look into, such as gym competition in Germany, population density, pricing of existing fitness companies, and unique traits of the German clientele.

FFJ has 886k members in Japan. If we assume FFJ is able to capture 8% of the fitness population in Germany at the same profitability as Japan, we could see a doubling in market cap from German operations alone.

Lastly, even if Germany doesn’t work out for FFJ, it could acquire master franchise rights in other countries and start from scratch again. I doubt FFJ would fail in Germany and be completely discouraged to try elsewhere.

Self Esteem Brands wants to open 10k AF stores by 2030 and FFJ is a key chess piece to attain that goal.

3- Growth in Singapore

FFJ acquired 100% of Saya Pte. Ltd., which is a franchise club operator of 2 Anytime Fitness stores in Singapore.

What is interesting to me is that Saya Pte. Ltd. does not have the master franchise rights in Singapore and is merely a franchisee.

Why would FFJ expand in a country where the master franchise rights is owned by someone else?

This is a hidden growth catalyst that I believe is going unnoticed by the market:

The potential acquisition of Inspire Brands Asia (formerly known as Anytime Fitness Asia) by Fast Fitness Japan.

Singapore is already a market with Anytime Fitness presence from Inspired Brands Asia (IBA). I don’t see much further contribution to valuation unless FFJ acquires IBA.

The only logical explanation in my head is FFJ is setting up a headquarters in Singapore due to tax reasons, as Japanese tax is quite hefty. The 2 Singapore stores could also function as market research before acquiring IBA.

4- Growth in Asia

On May 27, 2020; “Anytime Fitness Asia [was] purchased by Inspire Brands Asia, a consortium of its top submaster franchisees in Malaysia, Philippines, and Singapore; lead investor Exacta Capital Partners; and co-investor Aura Group.”2

The top submaster franchisees mentioned are Luke Guanlao (contributed stores in Malaysia and the Philippines), Johannes Raadsma (contributed stores in the Philippines), and Andrea Bell (contributed stores in Singapore).3 They were the “top 3 owners, operators, and managed services providers for 30% of the Anytime Fitness gyms in Asia.”4 With the help of 2 PE firms, Exacta Capital Partners and co-investor Aura Group, they formed Inspire Brands Asia (IBA) and acquired master franchisee licenses for 9 countries in Asia.

Exacta Capital Partners is connected to Mizuho Asia Partners, where Kota Igarashi, CEO of Mizuho Asia Partners, is an investment advisor to Exacta Capital Partners. There is some connection to Japan through Mizuho Asia Partners.

Co-investor Aura Group has offices in Singapore and Australia. Based on their website, their AUM is 1.55bn AUD.

Given PE timelines of 7 years, which is quickly approaching in 2027, I believe the following could happen:

The entirety of IBA could be up for sale

Master franchise rights of select countries covered in the IBA portfolio could be sold separately

Exacta Capital Partners sells their stake

Aura Group sells their stake

Luke (CEO) and Johannes (President), former top submaster franchisees, may want to be bought out. *Based on the wording on their website, it seems Andrea Bell may have been bought out and is currently a director on the board.

IBA is a collective company that owns the master franchise rights to 9 countries across Asia: Singapore, Malaysia, the Philippines, Indonesia, Thailand, Vietnam, Taiwan, HK, and Macau.

FFJ has noted that Singapore will be a training hub for international expansion.

When I read this, it got me thinking:

Would FFJ be willing to be subordinate to IBA and simply open franchisee stores? The margins here would be worse than their DOC stores in Japan because you’re paying a cut to IBA and IBA pays a cut to AF USA.

Why would Singapore be a training hub if it plans to be a franchisee? Wouldn’t it be more efficient to perform training in the country you are a franchisee in rather than fly people into Singapore? Or does FFJ plan to make Singapore a training hub after acquiring a few or all the master franchisee rights from IBA? IBA’s headquarters are in Singapore.

I believe the acquisition of Inspire Brands Asia would lead to an immediate rerating of FFJ as it would allow FFJ to immediately mobilize its 5 bn in net cash (8.4bn in cash) on its balance sheet.

I expect FFJ to not simply expand into only Germany and Singapore, but attempt to attain as many master franchise rights in as many countries as possible.

What makes this setup ideal is that there must be a motivated buyer and a motivated seller. FFJ has excess cash on its BS, BS has ample room for leverage, generates positive cashflow, and is eager to grow outside of Japan. IBA is owned by 2 PE funds that likely want to cash out at some point. In addition to the PE funds, a buyout would mean life changing money to the 2 or 3 other owners who seem like self-made millionaires based on their bio.

All things considered, an acquisition of IBA is still highly speculative but doesn’t seem too farfetched.

Value Impact:

Based on Anytime Fitness’ global website, by manually counting, there are roughly 422 Anytime Fitness stores in the 9 countries that IBA oversees.

FFJ currently has 967 franchise stores.

It is difficult to estimate the value of IBA, as it is unknown how many stores are directly owned and how many are franchise stores. If FFJ were to acquire IBA, then FFJ would likely be looking to acquire the intrinsic value of the stream of franchise fee and royalty cash flows and pay a premium to factor in future expectations of franchise store growth in the 9 countries.

There are many deal structures possible. If the former top submaster franchisees still own their stores, then they can retain ownership of their stores, and FFJ simply acquires the franchise fee cash flow, making the entire acquisition price cheaper.

Furthermore, IBA being a mix of first-world, second-world, and third-world countries where the minimum wage can be substantially lower than Japan, a store in a third-world country likely won’t have the same revenue and profits on a constant currency basis when compared to a store in Japan.

I can’t say for certain what the value of IBA is, but an acquisition of IBA would allow FFJ to utilize excess cash on its balance sheet, take on cheap Japanese debt if necessary, and lead the market to reconsider it’s current multiples as FFJ would be able to redirect all operational cash flows towards international store expansion.

5 - Growth of other fitness themed clubs in Japan: The Bar Method and SUMHIIT Fitness.

The company was recently granted the master franchise rights to “The Bar Method” (TBM) in Japan. The company will be opening its very first TBM in the fall.

*The company made a typo in their IP; there are close to 100 TBM stores in NA.

The Bar Method offers instructor-led 1 hr workout sessions that incorporate ballet body weight exercises, light free weights, palates, and stretching. The only equipment a student needs is the barre (ballet bar), their own body weight, light free weights, a ball, and a mat. The largest capex is essentially the interior design of the dance studio with floors, mirrors, and the barre. No expensive gym equipment is required.

The main drawback to TBM vs Anytime Fitness is that an instructor needs to be present for the workout sessions to commence, leading to a more labour intensive business model.

What I like about this business is that it targets a different group than Anytime Fitness. AF is roughly 80% male and 20% female. TBM is targeted towards women.

Based on the following image, TBM competes with the “circuit training for women only” and the “hot yoga pilates” group.

TBM offers an opportunity for FFJ to target a different customer group.

With nearly 100 locations in the US and Canada, the Bar Method operates at a much smaller scale compared to the 2559 (June 2024) Anytime Fitness stores in North America.

TBM started with 1 store in 2001 and expanded to 123 stores when it was acquired in 2019. The company was likely negatively impacted by COVID as the business model involves a group of students being in a room with an instructor. At present, the NA store count has dropped to roughly 100 stores.

It is difficult to say whether the reception to TBM in NA will be similar in Japan.

One would think that one would need a background in ballet to become a barre instructor, but that is not true. The following is a YouTube video made by the company that showcases several franchise owners. Many of the franchise owners are former students turned franchise owners/barre instructors. Another example is a Dallas Cowboy cheerleader with dance experience who made the transition to become a barre instructor.

TBM classes incubate future franchisees, which is an interesting business dynamic.

I have no evidence of this, but I wonder if TBM isn’t as successful as Anytime Fitness in NA because it isn’t as hands off as an AF location. The franchise owner of an AF location doesn’t need to be actively involved. The owners of TBM stores in the above video are instructors themselves; hence, I get the impression TBM requires more active management. As we don’t have any financial figures, I am not sure how profitable a TBM store is if the franchise owner were to simply hire barre instructors and passively own TBM. In small business acquisition, owner-operator businesses where the profit drops to 0 if you have to hire someone to actively manage the business for you would fetch very low multiples and are very hard to sell because you are essentially buying a job. Any investor seeking passive income would not acquire such a business.

If TBM can be passively owned, then there is a large talent pool that could become barre instructors.

From watching Terrace House (ep. 34 of Boys and Girls in the City 2016), iykyk, every year roughly 5 ballet dancers make it to become professional ballet dancers in Japan. There is one competition in March, and if you make the slightest error, you won’t be accepted. In addition, if you don’t make it by age 22, you’re likely not going to make it. Given the high rejection rate, Japan could be an ideal place to open up TBM clubs, as you have a lot of underutilized ballet dancers. Even though these ballet dancers were deemed underqualified to become pro, they are likely overqualified to teach barre.

It’s funny how useless info you store in your brain from watching a Japanese drama can somehow be useful in investing.

In NA, TBM store size ranges between 2000-4000 square feet. Just as gyms are larger in NA, FFJ may optimize the store size for Japan.

Given TBM is a new concept, it can either attract members from other circuit training like business concepts or attract a new customer base and contribute to an increasing penetration rate.

Value Impact:

There are too many unknowns to value TBM at this time. I’ll be closely watching how the first few initial stores perform in Japan. The greatest impact to valuation would be if TBM can be passively owned and be as profitable as an AF location.

Anytime Fitness USA is owned by Self Esteem Brands. Self Esteem Brands is continuously expanding its portfolio of companies. FFJ has the opportunity to acquire additional master franchise rights of other brands in the Self Esteem Brands portfolio in the future, such as SUMHIIT Fitness.

What is interesting is that Inspired Brands Asia (formerly known as Anytime Fitness Asia and has the master franchisee rights for 9 Asian countries) has opted for the master franchise rights of SUMHIIT Fitness.

6 - Growth in Merchandise Sales:

Curves Holdings (7085) is a very good example of merchandising sales done right. Curves is an example of what FFJ could attain if it were able to effectively tap into their member pool.

Curves offers 30 minute circuit training that incorporates strength training and cardio. Curves’ target audience is 50+ year old women. Their argument is that by maintaining and strengthening muscles, seniors can prevent the following:

In addition to providing circuit training, Curves provides diet counselling. A natural upsell after a member has done muscle training is to pitch them on how they need sufficient protein in their diet to allow the benefits of muscle training to come to fruition.

Curves has done a spectacular job upselling its members. Based on the latest 9mo cumulative results, 63% of sales come from merchandise sales.

In addition, a majority of merchandise sales are from protein subscription sales.

Based on their latest IP, the company charges 5000 yen/month for a monthly protein subscription.

Franchisees receive a commission for selling the protein and supplement subscriptions.

Curves has not reported the exact operating margins from merchandise sales and lumps operating income with all its other segments.

What is interesting is that during COVID, there were members who cancelled or paused their gym membership but continued their protein subscription.

The main concern to this working out for FFJ is that their member base is young and experienced in working out; hence, they likely perform their own research on what supplements to use. Protein supplements are abundantly available at the grocery store, drugstore, and Costco.

Potentially, the success of Curves may have something to do with being the first point of contact for their Curves members in pitching protein supplements, offering flavours that better suit the 50+ year old palate, offering protein and other nutrient blends (calcium, vitamins, etc.) that fit the nutritional needs of seniors, and being a point of least resistance. But for 20-40 year olds, it may be hard to pitch a fairly commoditized good unless the value prop or price is competitive.

Alternatively, FFJ could create an EC platform where vendors can sell their products and subscriptions to members, and FFJ simply takes a cut.

Value Impact:

I believe it is too early to tell how profitable FFJ’s product sales and EC segment will be. Most companies that try to tap their membership base for additional sales from non-core products tend to be marginally profitable at best. Curves Japan appears to be an exception.

Business Economics:

Product-Market Fit:

Here are the reasons Anytime Fitness worked so well in Japan:

Japan lacked a reasonably priced gym option. Comprehensive sports clubs are expensive, costing upwards of 10-20k yen per month. Most 20-40 year-olds don’t need to use all the extra amenities but are paying for it.

Japan lacked easily accessible gym options. As an Anytime Fitness member you have access to all 1149 AF locations in Japan and over 5000 locations worldwide. AF locations are smaller format stores that allow them to be situated in densely populated locations and near transit.

Japan lacked a gym that could fit into anyone’s busy schedule. Anytime Fitness is open 24 hours. Consistency is key to seeing results from working out, but sometimes life happens. If you had to stay late for work, you can still maintain your workout routine as AF is always open.

Japan lacked a reasonably priced, convenient, and 24 hr gym that has all the latest gym equipment one may require.

Most gyms missed one or more of the above variables.

Advantages:

A franchise business model is not sustainable if the underlying business doesn’t produce profits.

What is worth mentioning is that FFJ’s directly operated clubs are more profitable than competitors with business models that focus on owning all their stores:

AOKI holdings, Nippon Television, Konami, Tosho, Central Sports, and Renaissance all directly operate their own stores. Curves operates a primarily franchise business model like FFJ (96% are FC stores 1896/1974).

*FY2021 is the period when COVID happened

The superior business economics of an Anytime Fitness gym is due to the following characteristics:

Optimized gym layout: FFJ gyms are roughly 300-400 sqm (approx. 3000-4000 SF). The club space is just right to service 800-1000 members comfortably. Of course, if you go to any gym during peak hours, you’re bound to not be comfortable. The Anytime Fitness app allows members to see how busy a club is at any given time due to their entrance system that requires tapping a key. This helps to prevent overcrowding and for members to spread themselves out across different hours of the day.

Anytime Fitness being open 24 hrs allows members to really spread themselves out if they want to. I know some people who enjoy working out most when the gym is almost empty and choose to work at non-peak times to avoid the crowds. In addition, this 24-hour feature attracts members who sleep late or wake up early and can’t work out during normal operational gym hours. Great for people with unpredictable sleep schedules as well. All in all, the gym layout, the AF app, and the 24 hrs of operation allow each club to service more members/sqm than its competitors. (currently 692 per DOC store and 786 per FC store).

A comprehensive sports club's large sqm requirement also means that fewer sites meet its size requirements, which slows its expansion relative to Anytime Fitness. In addition, the risk of picking a wrong location is quite costly given the high upfront costs of construction.

FFJ’s relatively smaller layout allows it to be situated near train stations and locations where the population is dense. FFJ has more locations to choose from. FFJ’s goal is to be accessible to where you live and integrate seamlessly into your busy schedule.Low relative capex. FFJ’s main capex are for interior construction and design, and gym equipment. No capex for amenities such as a swimming pool, jacuzzi, sauna, etc.

Low labour costs: employees are on-site for only 8 hours a day. No specialized labour force required. Employees primary job functions are to perform administrative tasks (help with member sign-up) and cleaning. Some locations offer personal training, but that is not a focal point of AF.

Low operating expense: Outside of labour costs, operating costs are primarily related to utilities and routine inspections and repairs of gym equipment. Gym equipment has a long useful life and requires very little day-to-day operating costs.

FFJ’s competitors are less profitable due to a combination of higher capex, labour costs, and operating costs. In addition, comprehensive clubs lack the nimbleness in site selection that FFJ’s smaller store layout benefits from. FFJ could situate itself in convenient locations that it’s competitors couldn’t reach.

Franchisor and Franchisee Relationship

FFJ charges fixed monthly royalties, system usage fees, sales promo cooperation fees, and advertising & promotional reserve fund contributions ranging from 350,000-400,000 yen per club per month. Keeping it fixed rather than variable has counterintuitively contributed to FFJ’s rapid growth. Due to royalties not being variable, Franchisees keep all the upside to themselves when times are good. The high profitability of Anytime Fitness clubs resulted in many franchise owners opening multiple stores.

Customers win because they aren’t paying for amenities they don’t need.

The company wins because they receive a fixed franchise royalty and fees no matter the store performance. No business risk is taken. Sacrifice upside from variable royalty rates for stable cash flows. FFJ were minimally affected during COVID (FY2021):

The breakeven point for each store is roughly 500 members; hence, incremental member sign-up beyond this point substantially improves the bottom line.

Franchisees win because stores that meaningfully exceed 500 members, keep all the upside to themselves. Once a franchisee gets a taste of how profitable a store is, they are likely to take the cash flow they generate from their initial store to open more locations. What’s more is that FFJ provides incentives to repeat FC store owners. FFJ charges an opening supervision fee of 3mm JPY for the first club, 1.5mm for the second club, and 300,000 from the third club onwards. The combination of high upside potential and ease of passive ownership resulted in franchise owners aggressively opening multiple stores and helping FFJ capture market share from FY2017-FY2021.

From FY2018 until FY2021, FFJ experienced triple-digit store openings.

Average stores per franchise owner increased from 3.2x to 5.5x in FY2017 to FY2021, respectively.

What I learned from Anytime Fitness is that on the surface a flat franchise royalty rate doesn’t seem profit maximizing, but by not limiting the upside potential of franchisees to make profit and incentivizing organic store openings, they allow the potential for rapid store growth.

To illustrate my point, if FFJ set a variable royalty rate, franchisees make less money. Franchisees take longer to open additional stores as they have less cash flow and take longer to build up capital for a new store. FFJ’s competitors get wind that FFJ’s business model is profitable so they copy FFJ’s business model and compete with FFJ on locations. I could imagine in this scenario, FFJ would have more profitability on a per-store basis, but fewer FC stores in its network and less market share.

FFJ’s flat franchise royalty rate allowed it to win in the long-term.

Competitive Advantage:

Largest 24-hour full-sized fitness club network in Japan. If you have to travel to a different city in Japan, it’s easier to find a gym if you are an AF member.

Having access to many clubs is also beneficial when your home gym is too busy. You can go to a neighbouring AF gym that’s less busy to avoid the crowds. This avoids cancellation if your home gym is always packed, you can opt for another gym in the AF network.

If you frequent a gym more than your home gym, the monthly membership automatically moves to the new gym. This provides a levelling equilibrium effect where overcrowded gyms will have a spillover effect to AF gyms that are underutilized. If all else is equal, an underutilized gym should attract more members due to being less crowded. This helps with preventing the closure of stores as well.

Based on my calculations, no other company can build as large a network as AF in terms of full-sized 24-hr gyms, especially if their business model is one of owning directly owned stores. Only a franchise model can have a chance of competing. Other companies are simply too late to the party. In addition, the new copycat 24 hr gyms have to not only compete with FFJ, but amongst themselves for locations. FFJ is too far ahead of the pack at this point.

Real estate companies voluntarily send FFJ potential store locations. FFJ has a model to figure out if a location will be successful. With over 1100 stores, they have likely gobbled up most of the prime real estate in Japan given the current penetration rate. If a spot comes up, they and their franchisees are likely first in line to lease it as well.Largest 24 hr full-sized fitness club network of over 5000 clubs globally. I wouldn’t say this is really a strong moat, but a nice perk for those who intend to workout when they travel, but likely not a deciding factor.

Value pricing: Anytime Fitness has competitive pricing in the context of Japan.

Pricing vs. comprehensive sports clubs: given their single-digit margins at 10-20k yen/month, they can’t lower prices to compete. What they have done is expand the operating hours of the gym portion of their club to be 24 hrs.

Pricing vs copycat 24hr gyms:In my opinion, the main true copycats are FASTGYM24 (Nippon Television), FiT24 (Aoki Holdings), and JOYFIT24 (Yamauchi Co.). These 3 companies are copying Anytime Fitness’ 24hr gym model to the T, with some minor adjustments.

Central Sports 24 has done a poor job copying FFJ due to a lack of consistency in experience at CS24 locations. Store layouts and sizes vary substantially by location. I get the impression that a lacklustre amount of effort went into creating these stores. It feels to me they copied FFJ for the sake of copying.Side note: If you live in Japan, here is the best deal I found: JOYFIT24 Lite Musashikoganei store at 2980 yen per month with no shower (+1000 yen w/ shower) is the best bang for buck. At this price, there is absolutely no need to even go to Chocozap. There may be a JOYFIT24 Lite near you around this price.

FFJ locations charge a premium to FASTGYM24, FiT24 AND JOYFIT24. This is likely due to the expansive network and brand reputation it has already established. I would be lying if I said there wasn’t any fee pressure from the 3 main competitors above. The pricing competition from the above is likely why the market is pricing FFJ at these multiples.

It is also worth mentioning that the fee pressure only affects FFJ’s DOC operations, FC stores pay the same flat franchise royalty rates regardless. Even if franchisees lower prices to better compete, FFJ is unaffected.Pricing vs Discount Gyms: Chocozap is simply a different 24 hr club model that I believe will ultimately fail (to be discussed in part 2).

Conclusion:

Fast Fitness Japan is undervalued because it trades at the lowest valuation multiples in comparison to competitors within the fitness club industry.

Not only does FFJ have the lowest valuation, it has the highest profit margins.

FFJ is not a value trap because it still has room to grow domestically and internationally, albeit the international part is incredibly hard to quantify.

For the market’s expectations to make sense, FFJ must lose market share and FFJ would have to fail in its international expansion.

Even with the existence of copycat stores that attempt to copy Anytime Fitness’ business model, FFJ is on track to exceed its pre-covid levels of membership per store, while some competitors have been struggling to recover.

With how FFJ is situated in the market and its superior business economics, I believe the likely result is that FFJ will continue to take members away from conventional and old-fashioned comprehensive sport clubs.

There is a new discount competitor called Chocozap which I will analyze in part 2 of this write up. Long story short, Chocozap, although has had rapid store expansion thanks to Rizap group, targets amateurs with a lack of commitment to working out. The product offering of Chocozap may trick an amateur to sign up, but long-run, their insufficient gym offerings will likely lead to high churn. Those that are left unfulfilled by their progress at Chocozap will likely move to a more serious and complete gym like Anytime Fitness.

Anytime Fitness’ goal is to reach 10,000 stores by 2030. Given how rapidly AF stores have expanded internationally, I would not bet against further expansion of Anytime Fitness stores in Asia and Europe.

We can only speculate at this point to how much value can be gained from FFJ’s many growth opportunities. The main lottery tickets that could lead to FFJ’s value doubling are any of the following:

Capturing 8% market share of Germany fitness population

Acquisition of IBA

Although unlikely, fitness penetration rate in Japan doubling

But we don’t need to know what the above opportunities are worth, because we are getting them for free, as FFJ is undervalued based on domestic operations alone. We also receive a 2.4% dividend yield so we receive some reward for our patience.

Other Popular Posts:

AGF Management Limited Part 1 (AGF.B)

AGF Management Limited Part 2 (AGF.B) (Paid Sub Exclusive)

Reader Exclusive Promo:

Koyfin is my go-to tool for quickly rejecting or diving deeper into potential opportunities. With its intuitive platform, I can:

Instantly access business descriptions.

Analyze valuation multiples and historical profitability.

Review analyst estimates to gauge future prospects.

It’s a huge time-saver for forming a clear, initial opinion on any company. Ready to streamline your research process? Sign up to Koyfin here to save an additional 20% and take your due diligence to the next level!

Follow My Other Social Media:

Sources Used:

FFJ Medium Term Management Plan

Assumptions used in model:

Maintenance Capex is related to the 10-year renovation of DOC stores. When franchise clubs renew their franchise contracts at the 10 year mark, they are required to undergo a store refresh. Likely this is to ensure gym equipment is state of the art, the interior design meets modern standards, and that the brand experience is consistent throughout all stores. I have applied the same logic to the company’s DOC stores, forecasting a capex spend on gym equipment and construction

Growth Capex is related to the capex required to open a new DOC store multiplied by the number of stores estimated to be opened in that period. Capex has been estimated in my own financial model, which I will not be sharing at this moment.

Depreciation assumes 10 year straight-line depreciation.

I have my own financial model of 7092 that I will not be sharing at this time, if you would like to discuss this further, feel free to DM me.

https://www.prnewswire.com/news-releases/anytime-fitness-asia-acquired-by-inspire-brands-asia-amidst-covid-19-crisis-301065753.html

https://www.inspirebrandsasia.com/about-us/#our-board

https://www.inspirebrandsasia.com/about-us/#our-board

I just read this for the second time. Nice work! Like AncientSion below I am a bit skeptical of their ability to enter a competitive market like Germany -- and wonder if they'd be better off sticking to optimizing the home market in Japan and Asia. That said, if it doesn't work out they can try somewhere else, as you say. One simple question: am I right to assume the fixed monthly franchise fees would have some kind of index to inflation?

So it took me a while to read through this twice and do some research on my own and think about the value proposition. Im using the gym myself for ten years now, so i have some first hand experience on whats going on as well as the Zeitgiest.

Since you focus on growth opportunties in germany, i can comment on that. Germany has actually quite the buzzing gym scene. As you mentioned, considerable chunk of the population is at least paying, if not training. I wasnt able to find updated numbers, but especially younger ppl are attracted to the gym. Numbers from 2021 indicate that 40 - 45 % aged 15-20 hit the gym. I would assume this number is more or less the same still. This is also the the group of ppl mostly attracted to the 24h opening and the cheap price, so its really the most relevant target group i would say. According to google there are about 10k gyms in germany, and there are a lot of franchises operating already.

I did check the german homepage of fast fitness and they are asking 25 to 30 €, which is basically what a lot of the really big german value franchises are asking as well (FitX, Clever Fit etc). They follow the same concept, mostly, i.e. no swimming, no sauna but you can get in a good workout + shower and they also offers daily excercise courses which i assume FFJ is/will as well.

I would say the german gym market in the "value" segment is definitely highly competetive and right now i dont see how FFJ stands out. Doesnt mean they will fail and the 8 % target does seem plausible since people switch their membership regulary to see what the other gyms are offering etc. But i also dont see any new competitior dominating because they really follow the same concept (long opening hours, clean and modern place, cheap price in exchange for being on your own mostly, i.e. no proper license-d trainers needed nor wanted).

The reasons for the high gym-user penetration is germany is...social media. Some years ago, pre covid, a bunch of teens discovered that they could upload their training videos from the gym to youtube and these guys made out like bandits. They formed companies to sell there own apparell and supplements (whey etc) and these guys become millionares within a few months. And that is what started the fitness craze in germany and why its still on today still. Nowdays they call themselves "Athletes" and they get sponsored by the big fitness diet brants (Weider, ESN, MyProtein ++).

Ideally i would suggest that instead of expanding outside of Japan, FFJ should hire or sponsor some actual influencers / athletes (females) in Japan to promote the "healthy" fitness lifestyle and increase market penetration in japan. which seemingly is a huge laggard.

The whole thing is aimed at young people in the first place, so those 40 to 50 year old white collar worker that is tired every everything (understandibly) isnt the target audience anyway.

I realize japanese culture isnt based so much around how you look and its different from western mentality and thats probably a huge part of the lacking market penetration. Then again. the US exports all their bad habbits to Japan in the past well, right ?

To sum it up im really curious why FFJ believes its easier to take customers off their competitiors in germany / outside of japan instead of tagging people in Japan. All those skinny japanese boys or young men would probably be better off hitting the gym. They need to market it better !