*Legal disclaimer: The post, the attached Excel model, and all its contents herein are the exclusive property of Continuous Compounding. This post is intended solely for informational purposes and is not to be distributed, reproduced, or transmitted, in whole or in part, for commercial purposes or sale without prior written consent from Continuous Compounding. Any unauthorized use, dissemination, or sale of this research is strictly prohibited and may be subject to legal action. Continuous Compounding assumes no responsibility or liability for any errors, inaccuracies, or omissions in this post or for any actions taken based on its contents. Recipients of this research are advised to conduct their own independent analysis and seek professional financial advice before making any investment decisions.

Round 1 (R1) owns a 32% stake in SK Japan (7608). R1 is the largest shareholder of SKJ by a large margin. In this write-up, I explain why SK Japan is undervalued (3.0x FY2024 EV/EBIT) and ripe for being acquired by Round1.

Business Overview:

SK Japan has two segments:

Character Entertainment Business: This segment primarily involves the design and sale of character plush toys, keychains, and other promotional items to amusement facilities domestically and internationally, as well as planning and selling promotional products for businesses. (i.e. Round1)

Character Fancy Business: This segment involves the sale of character plush toys, keychains, and other products to specialty stores and retailers, including department stores and discount stores. (i.e. Don Quijote, Pokémon Specialty Store)

Quick Pitch:

-In Nov. 2021, Round 1 (R1) acquired 2,688,462 shares (32% stake) in SK Japan (SKJ) from its former 2 largest shareholders:

Pre-share acquisition major shareholders:

Yasuko Kubo: (1,880,944 shares/22.97%) (August 31, 2021)

Chiaki Kubo (1,607,518 shares/19.63%) (August 31, 2021)

After the share purchase, Yasuko and Chiaki Kubo were left with 400,000 shares each.

Currently, R1 is the largest shareholder of SKJ by far.

The company states that the reason for the stock acquisition is to ensure a stable supply of attractive prizes. This stock acquisition was just before R1’s “Giga Crane Game” store conversions.

*FY2023 Annual Report (Feb 28, 2023)

To read my quick pitch on Round1 click here:

-Over the last 2 years, Round1 underwent “Giga Crane Game” store conversions in Japan. Increasing the average store crane game machines from 80 to 320 in 73 out of their 100 stores. 73 stores with an average of 240 crane game machines installed is equivalent to roughly 17,520 crane game machines installed. Conversions have slowed to low single digits.

-R1 is still undergoing “Mega Crane Game” store conversions in the US. The company aims to complete 38 conversions by the end of FY2024 (Mar 31, 2024). In the US, the average store has 50-60 crane games. The company aims to have a total of over 150 crane games per mega crane zone store. This is roughly 100 crane games installed per store. Hence, 3800 crane games will be added by FY2024 (Mar 31, 2024). Different from JP, R1 has a long runway of store openings in the US; hence, if the company maintains its 150 crane games per store, total crane game machines will continue to increase.

-R1 is experimenting with small specialized crane game amusement stores. If this is proven to be profitable in JP, US or CN, the company will add more crane game machines.

-SK Japan produces the prizes won at R1’s crane game machines and promotional prizes used to attract customers. I’m not sure about the exact composition of SK Japan prizes as a % of total prizes. The rationale behind R1 owning a stake in SK Japan, in addition to ensuring a stable supply of attractive prizes, could be:

Controlling the cost of prizes. Likely having a major equity stake increases R1’s bargaining power or influence on corporate decisions

Potentially, some oversight on the production quality of prizes

Potentially being able to leverage industry connections to increase SK Japan’s sales. i.e. referring Pokemon, Doraemon, and other anime brands to manufacture prizes at SK Japan

Further capitalize on the crane game uptrend and productively utilize excess cash

Intention to vertically integrate later down the road. Given R1 owns 32%, it is likely for them to want to acquire a majority ownership stake of 50%+

-SK Japan is trading at 9.3x FY2024 P/E, 3.0x FY2024 EV/EBIT(Operating Profit). SK Japan has a market cap of 5.9bn yen and net cash of -3.3 bn yen with no debt, resulting in an EV of 2.5 bn yen.

-Round1 has 32.5bn yen of cash, 25.6 bn yen in debt, hence liquid net cash of 6.9bn on its balance sheet. Round1 accounts for its ownership in SKJ under the equity method (R1’s share of SKJ’s net income is recognized on the IS, and a carrying amount at cost for the investment is recorded on the BS), hence balance sheets are separate. Net cash is more than 10x over the true acquisition price and almost 3x SK Japan's EV.

-Given SK Japan’s financials, R1's financials, and R1's continuous store growth trajectory, Round1 is a natural acquirer of 100% of SK Japan’s equity.

Valuation:

Share Price: 706 yen

Shares Outstanding: 8.3 mm shares (excl. Treasury Shares)

Market Cap: 5.87 billion (bn) yen

Cash and Cash Equivalents: 3.2 bn yen

LT investments: 115 million (mm) yen

Debt: 0, no debt

Net Debt: -3.3 bn yen

EV: 2.5 bn yen

P/B: 1.3x

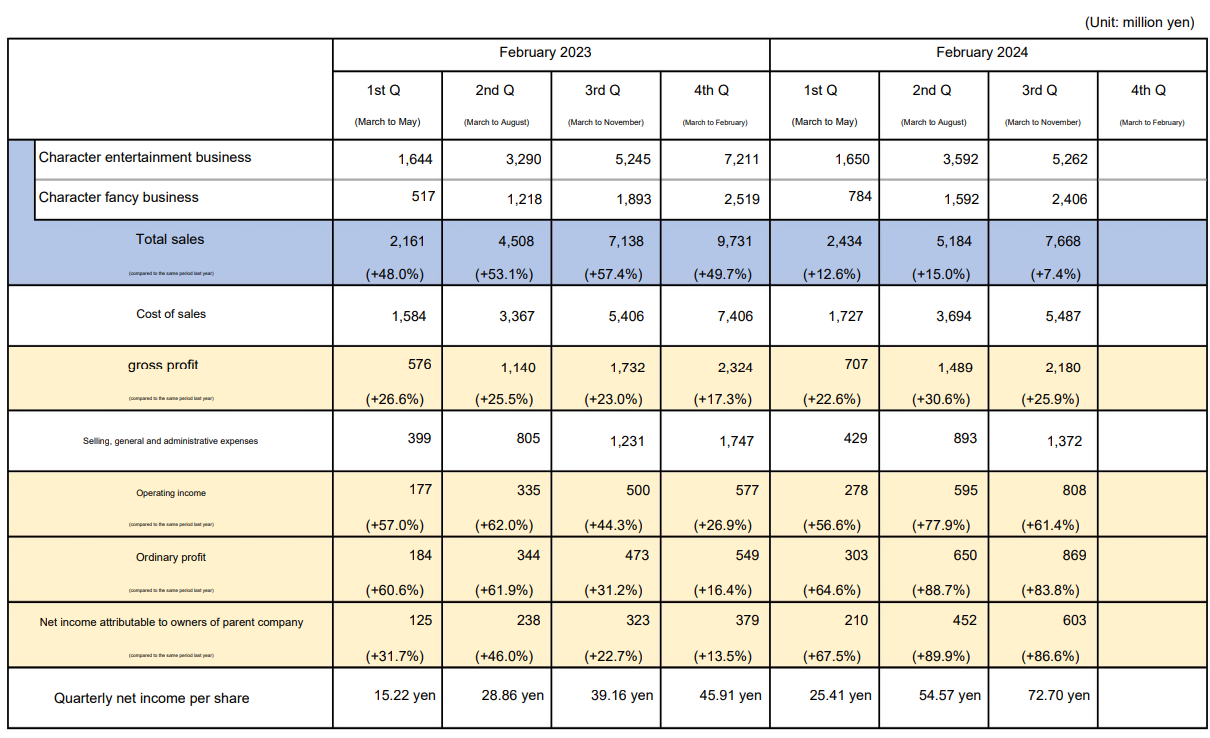

Company Historical Earnings:

Company Forecast:

Valuation Multiples:

P/E: 9.3x

EV/EBIT (Operating Profit): 3.0x

EV/Ordinary Profit: 2.8x

ROE: 14.5%

Analysis:

Round1 started its Giga Crane Game program in FY2022. This coincides perfectly with the increase in sales at SK Japan. As more and more crane game machines are to be added in the future via store openings in the US and China, and continued “Mega Crane Game” conversions in the US, sales will continue to increase.

I do not interpret the sales increase from 6.5 bn yen to 9.7bn yen as a one-time sales spike, but as the new normal given the increased demand for prizes given Round1’s crane game conversions and new store openings.

I believe it is highly likely for SK Japan (7608) to be bought out by Round1 (4680) for the following reasons:

Massive Cash Discount

If you buy a wallet at a garage sale for $5.9 and there is $3.30 in the change pocket, you only paid $2.6 for the wallet. The ticket price to acquire 100% of SK Japan is 2.5 bn yen.

Given Round1 already owns 32% of SK Japan, the true price for R1 to acquire SK Japan is only 650 mm yen:

Shares outstanding: 8.3mm shares

Round1 shares owned: 2,688,462

Shares to be acquired: 5.6mm shares

Market Cap of remainder shares to be acquired: 4.0 bn yen

Debt: 0

Cash and LT investments: 3.3 bn yen

Net-Acquisition Price: 650 mm yen

Once R1 acquires all of SK Japan, the cash goes on R1’s balance sheet. Essentially, it provides R1 with a rebate on the profit SK Japan earned on the prizes sold to R1.

Of course, in most acquisitions, where there are perceived “synergies” acquirers must pay a premium to the market price. Given this is an extremely quick pitch drafted in a few hours, I won’t be doing a comps analysis on recent transactions.

I’d imagine a reasonable EV/EBIT multiple, excl. cash, to be 5-7x EV/EBIT. The justification for this is that although revenues will be in line with Round1’s success and the overall market for collectibles, toys, and plushies, the profit margins are worse than Round1’s. 6x EV/EBIT FY2024 (excl. cash) is roughly a 40% premium to the current market cap.

Ethics aside, given the recent history of ludicrous takeovers that destroy shareholder value in Japan, R1 could get away with murder. If this is the case, the alternative way to play this is to invest in R1 (ticker: 4680) alongside your SK Japan investment, as value destroyed at the expense of 7608 shareholders is gained by 4608 shareholders. On second thought, given that R1 has a market cap of 160 bn yen, the value gained is marginal.

“Synergies”

Hate this word so bear with me.

Currently, the marginal profit on crane games is 60%. Given SK Japan has a gross profit margin of 27% and an operating profit margin of 8.5%, if R1 owns SK Japan, a middle man is cut out so marginal profit margins for crane games increase

-Given R1 has 152 stores globally, if we can learn anything from Costco and Walmart, when a business can reach a lot of customers, its bargaining power increases. In this case, I’d imagine some bargaining power when an anime wants SK Japan to produce its plushies, R1 can guarantee the distribution of its plushies via its 150+ stores and 30,000+ crane game network (adding an additional omnichannel for the client).

-R1 and SKJ could also license the use of certain Japanese IP and come up with Round1 exclusive prizes or promotional products. This would require the company to take on inventory risk.

-The opposite of the above is a revenue share model where, for example, Sanrio comes up with a design, puts up the capital, and pays for the inventory. R1/SKJ is in charge of manufacturing and distribution, and takes no inventory risk.

-I believe once the sales growth from giga and mega crane zone upgrades stabilizes and the company has performed data analytics on its crane games, it will know how many prizes it can sell for a certain IP character. Let’s say Round1 with a 99% probability, can sell out 1000 units of 1 style of Hello Kitty. The company would be comfortable taking inventory risk on inventory levels it has certainty selling.

Scenario Analysis:

No acquisition:

-This is Japan, although it is logical for R1 to acquire SKJ, R1 may never pull the trigger.

-The great thing is that, at 3x FY2024 EV/EBIT, SKJ is very cheap. Even if Round1 owned a significantly smaller equity stake in SKJ, SKJ would still make a great investment given it’s growth potential.

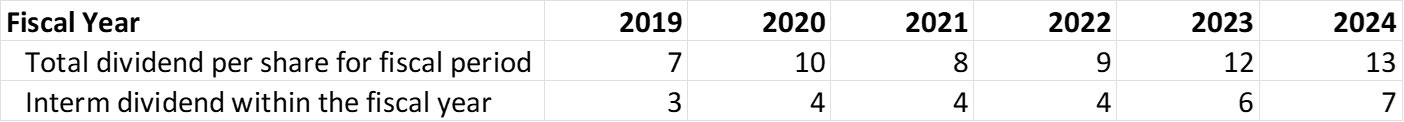

-The most recent half-year dividend has been increased to 7 yen per share. The next interim dividend is 10 yen per share. On an annualized basis, at 20 yen per share, that is roughly a 3% dividend yield (at 700 yen per share).

-With Round1’s growth in stores comes an increase in crane game machines, which in turn increases the demand for prizes. With a 32% equity stake in SKJ, which supplier do you think R1 is incentivized to purchase prizes from?

Acquisition:

-Potentially, R1 can sway the board to start using its cash to repurchase shares. This would increase R1’s equity stake naturally without the need to acquire SKJ.

-If Round1 acquires SKJ, SKJ is likely to be purchased in an all cash deal at a premium to the current market cap. It’s anybody’s guess what the premium could be.

Disclaimer: I am long shares of Round1 (4680) and SK Japan (7608) at the time of publishing this post.

Other Popular Posts:

AGF Management Limited Part 1 (AGF.B)

AGF Management Limited Part 2 (AGF.B) (Paid Sub Exclusive)

Fast Fitness Japan (7092) (Paid Sub Exclusive)

Reader Exclusive Promo:

Koyfin is my go-to tool for quickly rejecting or diving deeper into potential opportunities. With its intuitive platform, I can:

Instantly access business descriptions.

Analyze valuation multiples and historical profitability.

Review analyst estimates to gauge future prospects.

It’s a huge time-saver for forming a clear, initial opinion on any company. Ready to streamline your research process? Sign up to Koyfin here to save an additional 20% and take your due diligence to the next level!

Deep dive out now! Read this stock pitch instead: https://continuouscompounding.substack.com/p/sk-japan-7608-deep-dive-part-1-hidden