Mental Model: GTO and Exploitative Play

A mental model I derived from poker

*My chip stack (~2100 USD) at Horseshoe Casino in Omaha, NE

Last month, I went to Omaha for 7 days to attend the Berkshire Hathaway annual meeting. The trip cost me $1800 USD, but what I didn’t tell you was that in 3 sessions of NLH poker, I made $1300 USD, hence the trip only cost me $500 USD. I would like to thank the Horseshoe Casino and its poker players for sponsoring 2/3 of my trip!

For the cost breakdown of the trip, read the post below. That’s Warren Buffett’s house BTW!:

I love to play poker. It is my most competitive endeavour outside of investing, and I consider it my serious hobby. For those who play poker, you may have heard the terms “GTO” and “exploitative” being thrown around a lot. GTO stands for “Game Theory Optimal.” I learned about GTO through poker, but I also learned about game theory optimal decision-making at UBC (Canada) in PHIL-321, or Philosophy Induction and Decision.

In this post, I will explain what GTO and exploitative decision-making are and how to apply them in your daily life.

What is Exploitative and Game Theory Optimal (GTO) play?

Exploitative play is a decision or strategy aimed at maximally taking advantage of an opponent’s tendencies. Depending on where exploitative decision-making is applied, the goal of exploitative play can be to maximize one’s chances of winning or maximize one’s output.

GTO, in theory, is a decision or strategy that cannot be exploited or taken advantage of. When someone deviates from GTO play, you stand to benefit, or at worst, break even.

That was probably quite confusing, so here is an example. Let’s say we play rock, paper, scissors.

This is what I observe as how most people approach the classic game of rock, paper, scissors. The pattern I see with most people is that most people have an inclination towards rock or start off their analysis with rock as the obvious hand signal to summon. Because most people have an inclination towards rock, most people don’t pick scissors because if the likelihood is that most people pick rock and they pick scissors, they lose. Those that want to exploit the higher population skew towards rock will pick paper as an exploitative strategy.

Shallow analysis (no strategy whatsoever): I prefer rock. I pick rock.

This is what exploitative strategies can look like:

Level 1 analysis: Most people pick rock. I’ll pick paper.

Deeper level 1 analysis: Most people pick rock. I’ll pick paper. Even if my opponent has the same analysis as me, we’ll tie if they pick paper as well, and I’ll win if they pick rock. This results in a higher likelihood of a win/tie scenario.

Level 2 analysis: Most people pick rock; I’ll pick paper. But wait, my opponent is a relatively intelligent individual. I believe he is capable of level 1 analysis. If their skew is towards paper as an optimal strategy, then my exploitative strategy to counter their exploitative strategy should be scissors.

Risk-averse level 2 analysis: But using scissors is risky, as most people pick rock. I’ll just pick paper, as I’ll likely tie and not lose.

Level 3 analysis: My opponent is capable of level 2 analysis. I’ll pick rock.

*For those who watched “Alice in Borderlands” season 2. In the King of Diamonds game, I had the exact same guesses as Chishiya for his first 2 guesses. IYKYK.

Obviously, I can continue infinitely with the levels of analysis, but I’ll stop here.

Exploitative strategy using frequencies

Let’s do an exercise!

Exercise 1: Let’s say our opponent picks 100% rock. And you are betting $1 per round. What is the profit-maximizing exploitative strategy in theory?

Answer: 100% paper

Why is this an exploitative strategy only in theory? It’s extremely likely that by the third time in a row that your opponent puts out a rock and sees you putting out paper, they will likely change to something else.

Exercise 2: Let’s say they become more open-minded and pick rock 50% and scissors 50%. What is the profit-maximizing exploitative strategy in theory?

Answer: Rock 100%

Why is this an exploitative strategy only in theory? It’s extremely likely that by the third time in a row your opponent puts out a rock or scissors and sees you putting out only rock, they will likely change to something else.

Exercise 3: Let’s say your opponent picks rock 50%, scissors 25%, and paper 25%. What is the profit-maximizing exploitative strategy in theory?

Answer:

To be honest, when I first coming up with an answer myself, I was not sure what the mathematically sound profit-maximizing exploitative strategy is here. I initially came up with these strategies being profitable given enough trials:

Exploitative strategy 1: 50% paper, 25% rock, 25% scissors

Exploitative strategy 2: 50% paper, 50% rock

Exploitative strategy 3: 75% paper, 25% rock

Exploitative strategy 4: 100% paper

After playing around with Excel and creating a table to calculate EV, it turns out in this scenario ES4, 100% paper, is the profit maximizing solution.

The reason maximally allocating to paper is profit maximizing in theory is because your opponent has equal distribution of paper and scissors. Rock loses to paper (-1), but beat scissors (+1). Hence any allocation to rock, the EV is 0:

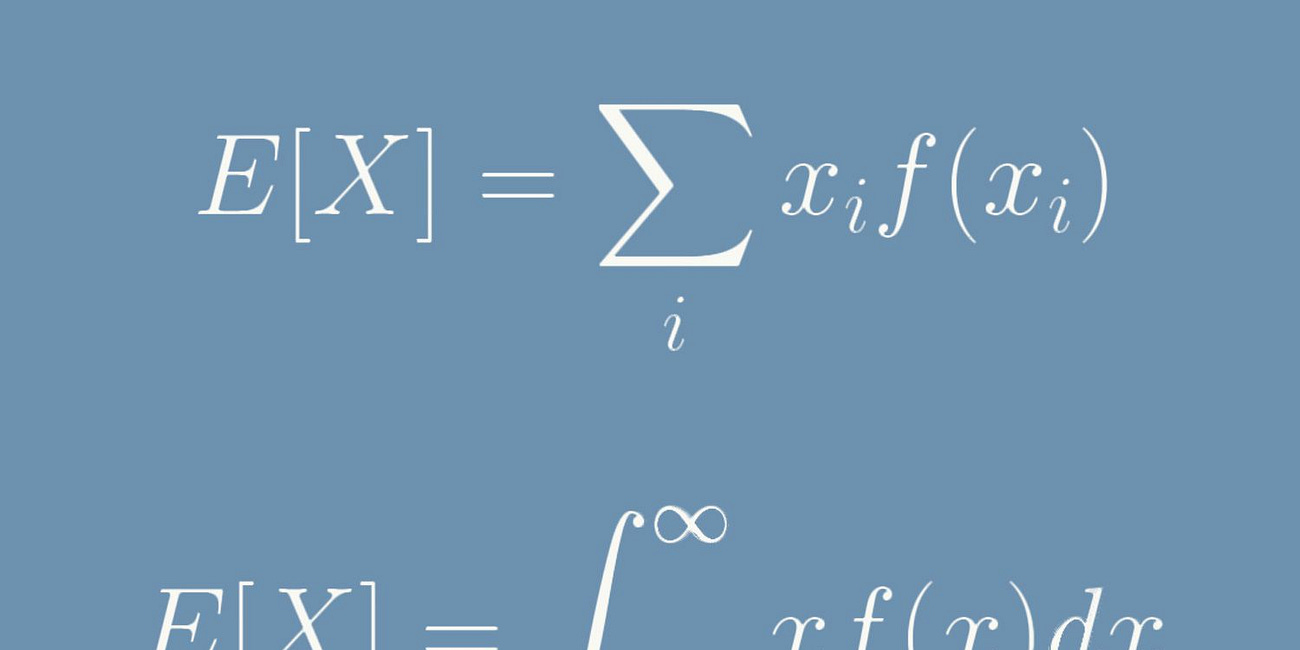

Mental Model: Expected Value and Variance

Don’t know what expected value (EV) is, don’t worry read this post here!

For scissors, since your opponent has 2x the allocation to rock (-1), than paper (+1) or scissors (0), any allocation to scissors is -EV.

So any allocation to Rock is 0 EV, any allocation is scissors is - EV. The profit-maximizing solution is then to fully allocate to paper.

This adjustment your opponent has made is called a mixed strategy. They are no longer making absolute decisions but randomizing their decisions at different frequencies for all options. In practice, exploitative strategies 2 or 3, especially 4, will be hard to implement. Again, in real life, it is likely your opponent will notice you aren’t using any scissors, so to counter you, they will significantly reduce their rock to counter your strategy. If you pick ES4, in real life, after maybe 5 times of using paper, they will change strategies.

If you have a golden goose that lays golden eggs, don’t cut the goose up to take out all the eggs. I believe the best strategy for long-term profit is to pick a mixed strategy, where it is almost impossible for your opponent to notice the deviations in your strategy. Hence, something like 40% paper, 30% rock, and 30% scissors, or some variation where the exploitative tilt will barely be noticeable. If I had a billionaire gambler neighbour who wanted to gamble with me every day for $100 for a single game of rock, paper, scissors, and I knew they had a major skew towards rock, the 40/30/30 strategy would be what I would implement, as that would keep my exploitative strategy under the radar and keep the golden eggs coming. If you think about it, that’s exactly how casinos make billions of dollars. You are bleeding money, but you barely notice it.

Notice how the profit-maximizing solution in theory kills the golden goose, while my slightly profitable solution in theory makes more money in the long run.

If I use 100% paper, I have an EV of $25 per game. By the 10th game, the Billionaire will see what I’m up to and stop playing with me or adjust their strategy to cover up their leaks, cuz they have lost $250. My strategy on the other hand has an EV of $2.50 per game. After one year, the billionaire will barely notice the swings. I make $912.50 per year and as long as we are both each other’s neighbours, we’ll keep playing with each other. After 3 months, I might even request, hey the stakes aren’t high enough, let’s play for $1000 a pop.

What is the GTO solution?

In theory, though, all this is completely meaningless if your opponent understands GTO play. There is a game theory optimal solution to rock, paper, scissors where you cannot lose in the long run. It is simply to pick rock, paper, and scissors one-third of the time, or 33.33…..% of the time. If you pick all the options of rock, paper, scissors equally, there is no way to exploit you. The pro and con of GTO in rock, paper, scissors specifically is that despite the improbability of exploiting you in the long run, you won’t be winning in the long run either.

Picking rock, paper, and scissors 33% of the time against the billionaire, knowing they have a skew towards rock, would be an incredibly dumb decision, as you would both tie in the long run.

What is the purpose of the GTO strategy?

In rock, paper, scissors, GTO is not a profitable strategy. This is because picking rock, paper, or scissors independently has the same expected outcomes for each option; win (+1), lose (-1), or tie (0). It’s your overall frequencies that makes you exploitable. In poker, GTO can be profitable when your opponent deviates, especially suboptimally, from GTO play. In poker, you have multiple streets of decisions making. Each potential option at each node has a different potential payout. A poor decision made initially can compound itself in exponential fashion to the final node. You can deviate suboptimally at each node of a decision tree. So making a suboptimal move can be very costly in poker, as there are varying degrees of profitable and unprofitable decisions.

GTO, I believe, is a very good defensive strategy. If you believe your opponent is outthinking you or has a superior strategy to yours, you can pick the GTO optimal solution to not lose. Even if your opponent knows you are using a GTO sound strategy, there is theoretically nothing they can do against you. In the meantime, while you are using GTO, you get to observe the deviations other opponents are making and collect information. Once you get a feel for how your opponents are exploiting you, you can now switch from GTO to counter-exploit them yourself.

How does this apply to investing? What is the GTO play in stock investing?

Before I start, I must bring your attention to the following:

*Legal disclaimer: This post is not investment advice. Please do your own due diligence. Please seek guidance from a professional financial advisor nearest you. Investing in stocks carries risk. No returns are guaranteed.

In stock investing, the GTO play, in my opinion, is simply to dollar cost average periodically in an ETF like the S&P500. This has the lowest fees, requires the least amount of brain power, requires the least amount of time, and is likely to outperform most mutual funds, hedge funds, or your own personal investing.

An ETF is like a roulette table at the casino that pays out a profit if you choose to bet on all numbers. There is no longer a house edge, but now a player’s edge. This is the best kind of casino. If you pick all the numbers on the roulette wheel, are patient, and have a long-term orientation, you will be profitable. If you decide to pick individual numbers (stocks), you run the risk of underperforming your player’s edge.

What is the exploitative strategy in investing?

Stock-picking is an exploitative strategy in investing. Individuals like Warren Buffett, Benjamin Graham, Mohnish Pabrai, Guy Spier, Michael Burry, and Joel Greenblatt are proven investing practitioners who have a track record of outperforming the market. The reason is because value investing is a strategy that exploits market irrationality. In a sense, your “margin of safety” is the extent to which you are potentially exploiting Mr. Market or Mr. Market allowing you to exploit it. How successful you are at exploiting the market is based on how much alpha you generate. Positive alpha is the excess return your portfolio generates above a certain benchmark you pick. Most investors pick the S&P 500 as their benchmark to compare on an absolute basis.

Should you pursue an exploitative strategy in investing?

My answer is that you must be very self-aware.

My goal is to become the best stock investor I can become. I personally believe that in order to attempt to learn to invest and beat the market, one must get their feet wet. Meaning, you have to have money at stake for you to learn many of the market lessons. You can’t learn to skateboard without falling down (another mental model for another time). You can’t learn to invest without losing money. When you lose money, you feel some level of pain, so you are inclined, or at least should be inclined, to dig deeper into why you made an investment mistake. With no money at stake, losing virtual money usually doesn’t incentivize you to look at your mistakes.

Hence, I don’t recommend starting off with a virtual trading account unless you are not old enough to open your own investment account. You might counter by saying, "Well, people skateboard with knee and elbow pads. Isn’t virtual investing similar to skating with knee and elbow pads?” Sorry, I hate to break it to you, but virtual investing is similar to your overprotective parents giving you a scooter because they believe that with a handlebar, you are more in control of what you’re riding. It’s a completely different thing. To prove my point, look at most professional skateboarders. An overwhelming majority of them learned their skate tricks without protection. Don’t counter with Tony Hawk, because he does vert skateboarding, which is riding skateboards up ramps. If you are launched 10-20 meters into the air and you lose your board, your elbow and knee pads help you slide down the ramp.

Being smart does not correlate with being a good investor; hence, I believe for 90%+ of you out there who are doctors, software engineers, or working in some high-paying occupation outside of finance, don’t worry about beating the market.

Yes, there is no greater feeling than saying I beat the market with my intellect. It’s the feeling the passionate few are chasing. We all aspire to be like Warren Buffett, but I’m saying most of you will fail. Hell, I might fail too. Guy Spier recently even humbly stated that he doesn’t even know if it’s statistically significant if he is capable of beating the market.

Most of you are better off following the GTO investment approach of simply investing in an ETF that tracks the S&P 500.

Pick GTO if any of the following are your justifications for trying to beat the market:

-I want to appear smart

-I like socially acceptable forms of gambling

-I want to be successful in everything I do

-I enjoy the rush of attempting to beat the market

-I want to get rich quick

Pick exploitative if most of the following are your justifications for trying to beat the market:

-I see learning to invest as a life-long skill. The skills or philosophy are transferable to other areas, such as real estate investing, private business acquisitions, and life in general etc.

-I am a long-term thinker

-I am naturally curious about many industries and companies

-I have the time to dedicate myself to studying companies

-I will continue to learn about investing and expand my circle of competence throughout my life

If you are truly passionate about investing, then my advice is to use a mixed portfolio strategy with a majority % allocation to an ETF that tracks the S&P 500 and a minor % allocation to a self-directed personal investment portfolio.

The art and science here is picking a dollar amount to allocate to your personal investment account, where if you lose money, you will feel a burn that is enough for you to want to look at your investment mistakes and learn from them. That delicate equilibrium I leave for you to decipher.

As your investment knowledge increases and you become more confident in your abilities, you can increase the allocation to your self-directed investing account and decrease your % allocation to ETFs. Of course, if you can prove that you can beat the market, you can shift the weight to majority self-directed investing. Joel Greenblatt has had as high as a 10% allocation to an ETF that tracks the S&P500.

*Legal disclaimer: This post is not investment advice. Please do your own due diligence. Please seek guidance from a professional financial advisor nearest you. Investing in stocks carries risk. No returns are guaranteed.

An additional note for those who don’t have a finance background:

“The best investment you can make is an investment in yourself.” -Warren Buffett

My view is that most people should focus on improving their skills and aim to increase their own income potential. This is especially the case for those who are doctors, software engineers, or people with a well-paying job.

There are 3 variables that affect the future value of an investment portfolio: principal, rate of return, and investment timeframe.

Principal: The larger your starting principal the more money you’ll end up with at the end of your investment horizon

Rate of return: The higher the return you are able to achieve over your investment horizon, the higher the future value of your portfolio

Investment timeframe: The earlier you start investing, the better. The return of the S&P 500 is around 10%. The rule of 72 states that roughly every 7 years (72/10=7), you should double your investment funds (generate a 100% return). The difference between investing when you're 23 and 30 is that at retirement, if you started at 23, theoretically, you would have double what you would have if you started at 30. This is assuming you contribute the same amount every year.

Being better at investing means your goal is to increase your rate of return. But what is the benefit of a high rate of return if your principal is low? A NBA player who generates millions a year will have a larger investment account, even if they put their money in a savings account at the bank (1-5% return), compared to someone who generates 50% a year but earns 100k a year.

Let me use a better analogy. For software engineers, getting promoted from SDE2 to SDE3 can take 2-4 years+ depending on how fast you attain skills and necessary experiences. The pay bump is quite massive, in the high 5 figures and potentially 6 figure range. This would have a massive impact on your disposable income and your monthly savings rate. If you study to become the best stock investor you can be, your annual return is likely to be between 10-20%. But if you increase your salary at your job, the amount of principal you can contribute regularly to your investment account can be far greater.

Roughly 2 years ago, the average household income in Vancouver is around 110k after tax. The average household's disposable income is 5K a year. Say you are the sole breadwinner at home and get a pay bump from 150K to 250K. Let’s say your after-tax income increases from 110K to 160K, a 50K increase. Keeping your former lifestyle constant, you now have 55k of disposal income a year, or 11x your disposal income or your ability to contribute to your investment account. If you decide to live more lavishly and allocate 30k as your annual disposable income budget and save 25k for investing, you still 5x your principal contribution per year. Hence, I hope this example demonstrates why the greatest investment one can make is truly in oneself.

Why are you telling me this? Why are you discouraging me from learning how to invest?

Charlie Munger, the chairman of Wesco Financial (insurance company), mentioned in an interview which insurance plans he would never buy. The interviewer asked Charlie, "Isn’t what you said bad for your business? Wesco sells insurance, and you are telling people what not to buy.” Charlie replied, and I am paraphrasing, that it’s important to tell the truth as it is.

Applying GTO and exploitative decision-making in daily life?

The mental model of GTO and exploitative decision-making can be applied to everyday life. It can help you save time, save money, and earn more money.

Here are examples of places where I’ve applied the ideas of GTO, or exploitative strategy, in my everyday life:

Driving: People sometimes don’t like to change lanes in the city where I live. Sometimes, certain lanes are simply crowded because people just want to stay in the same lane. On many occasions, I’ve changed lanes and gotten near the front of the pack, helping me save time on my commute.

I would like to make a distinction here. Sometimes what is GTO and what is exploitative depends on what your goals are. The person refusing to switch lanes could be listening to an audiobook. So staying in one lane allows them to maximize their listening comprehension. For me, when I drive, my goal is to reduce my commute time; hence, the best exploitative strategy is simply to change lanes.

Washing Dishes:

I hate washing dishes with a passion. Growing up in a traditional Chinese household, I was trained in the martial art of hand dishwashing. When I first lived on my own, I didn’t use a dish washer. I would wash my dishes every 1-3 days, wasting 30 mins to 1hr of my life each time. If my math is correct, that is roughly 90 to 180 hours wasted in an entire year. Of course, I would often listen to an audiobook or attempt to watch some self-improvement videos on YouTube to feel more productive.

When I finally fully embraced the miracle that is the dish washer, I created a dishwashing supply chain management system that is super efficient.

First things first, go to IKEA and purchase 7 days worth of cups (I personally use more cups), plates, bowls, and utensils. Very likely, depending on the size of your dishwasher, it will only fit 4-5 days worth of dishes before it is 100% full. I purchase a week’s worth of dishes because, depending on what you are cooking or how many cups of coffee/tea you want to drink in a day, you may run out of certain dishes faster than others. I live with a roommate, so the left sink is mine. Once my side is filled up, usually in 4-5 days, I’ll put my dishes in the dishwasher. *Remember to thoroughly rinse your dishes after each meal. This way, no odours can develop. Also, dishes are easier to clean when there isn’t any gunk dried to the surface. Since I only rinse my dishes and no longer have to wash them, I spend 30 minutes loading up my dishwasher every 4–5 days. I spend only 40-50 hours a year on my dishes. How much is an hour of your time worth? If I ever build my own house, I’ll have 2 dishwashers. One dishwasher is for clean dishes, and the other is for dirty dishes. That way I’ll never have to unload dishes and put them in the drawer, resulting in additional time savings.

Career choice:

When I was 5, I told my parents I wanted to be an artist. My parents told me that paintings are only worth something when the painter dies. The last thing an immigrant couple from China wants to hear is that their only child wants to become an artist, where the perceived likelihood of success is low.

Who would have predicted, with the creation of the internet and social media, that now there are so many revenue streams available for an artist?

Let’s say you aspire to become a fashion designer. You can start a vlog to document your journey from design school to starting your small business. On the way, you can gain followers. You can showcase your production process, review the collections of other fashion designers and offer your own insight, create tutorial videos on some of the techniques you use, and collaborate with other designers to build your following. Follow the “Supreme” business model of doing limited supply runs where the output severely undercuts the demand, which in turn increases demand. Those that are able to obtain your pieces will cherish them, brag about the exclusivity of their purchase, and advertise your brand through word of mouth. I can go further, but I’ll stop here.

You no longer have to be a starving artist. The ability to succeed as an artist is higher than it has ever been because people can build their own following without the need for investors or large sums of capital for advertising.

My parents thought the GTO strategy for my success was to go to a highly ranked university and get a job. In some ways, this entrepreneurial endeavour of mine is still viewed by them as risky, but I have come to terms with the fact that it is difficult for them to see the opportunities that I see. Most people in finance won’t switch lanes because they are offered a salary that is above average, which affords them an above-average lifestyle. Why risk a path that is proven?

I decided to switch lanes because I saw that the other lane was almost empty and way less crowded. While the 6-figure finance pros are competing amongst themselves to see who can work more hours, part-time personal finance and investing gurus are making upper 6-figures and 7-figures. I know there is a market for this when people are getting finance and investment information from real estate agents, a former restaurant server, and an accountant. If people without a solid finance or investing background are making a killing in the finance space, don’t I have a competitive advantage? My decision to become an entrepreneur is part of an exploitative strategy.

I hope you enjoyed this post. If you or anyone you know is looking to attend the annual meeting in the future, please share this post with them.

If you have any further questions, please ask them in the comment section below.

Please leave a like on this post, as it helps me reach new audiences and grow organically. Thank you for being part of this journey!

Follow me on any social media platform you use: https://linktr.ee/continuouscompounding