Jeremy Raper Goes Activist on BRAG

*This idea is from Jeremy Raper (JR) of Raper Capital. I have DMed Jeremy to get his approval to release this post. Jeremy, being an extremely busy investor/father does not have time to verify whether everything I input in this post is factually true or 100% accurate. So I simply received his blessing to release this post.

**Legal disclaimer: The post, attached model, and all its contents herein are the exclusive property of Continuous Compounding. This post is intended solely for informational purposes and is not to be distributed, reproduced, or transmitted, in whole or in part, for commercial purposes or sale without prior written consent from Continuous Compounding. Any unauthorized use, dissemination, or sale of this research is strictly prohibited and may be subject to legal action. Continuous Compounding assumes no responsibility or liability for any errors, inaccuracies, or omissions in this post or for any actions taken based on its contents. Recipients of this research are advised to conduct their own independent analysis and seek professional financial advice before making any investment decisions.

On Nov 22, 2023; Jeremy Raper, one of the best investors on FinTwit imo, went activist on BRAGG Gaming.

*On a side note, if there is one investor that I would highly suggest anyone learn from, it is Jeremy Raper. Jeremy’s stock pitches are extremely well written in language that is concise and to the point. Even on podcasts, Jeremy always gets to the meat of the investment thesis—no prolonged rambling.

Jeremy wrote an engagement letter to the CEO of BRAG, which can be found on his website here.

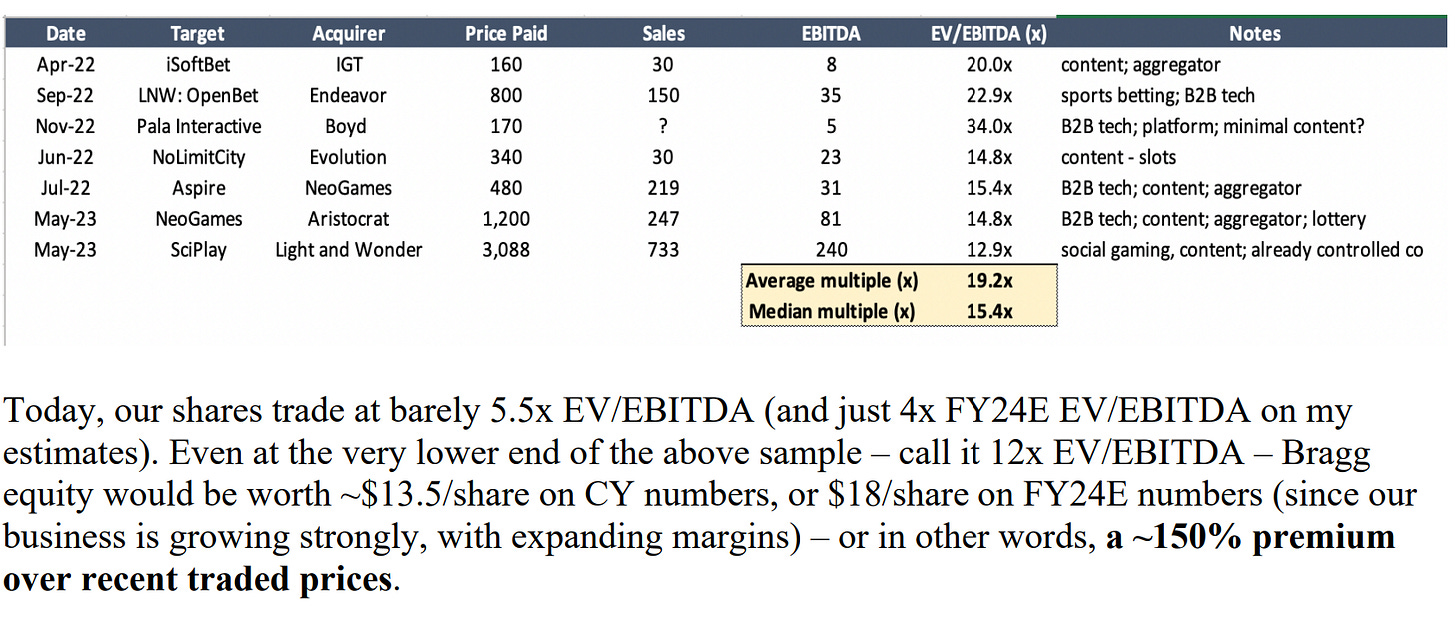

Essentially, Jeremy believes BRAG is undervalued and that the market is not appropriately valuing the company. Based on recent transactions, Jeremy believes if BRAG were to be sold for the lower bound of 12x EV/EBITDA, it would help unlock shareholder value while the M&A door is still open in the market.

After Jeremy released his letter, the stock price went from $6.30 CAD/share (BRAG.TO) to ending the day at $7.79/share.

Hopefully, someday, I will build a track record so strong that this is the kind of market reaction I get.

As I was interested, I went and modelled the info found in Jeremy’s letter into a simple model, which can be found here:

Bragg Gaming BRAG Google Drive

Valuation:

Here is the EV calculation for BRAG before Jeremy’s letter was released to the public:

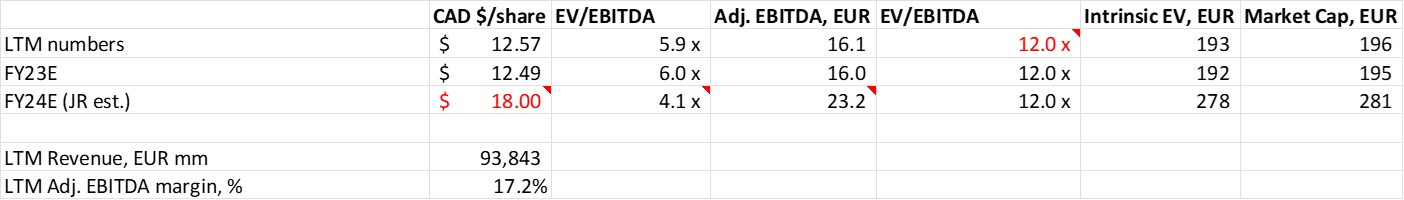

Pre-Jeremy’s activist campaign, BRAG had an EV of €95 mm Euros or $104mm USD.

Recently, GAN and Sega Sammy entered into a definitive merger agreement where Sega Sammy will pay $1.97/share of GAN. GAN is being acquired for roughly 90mm USD EV. If I were to compare BRAG vs GAN, I’d say BRAG is a better company for these main reasons:

BRAG generates magnitudes more positive Adj. EBITDA (LTM €16.1 mm Adj. EBITDA EUR) than GAN. GAN is currently burning cash (LTM $-4.9mm Adj. EBITDA USD)

GAN has “going-concern risk” if it does not get acquired. BRAG has a longer runway if management decides not to sell

Jeremy states, “If an entity like GAN is worth $100mm to a new market entrant, I believe our Company is comfortably worth 2-3x that to a strategic acquirer.”

Jeremy’s statement is consistent with his projections at the lower bound of 12x EV/EBITDA. From the above calculations, we can see the range is approximately €190-$280mm EUR.

*The CAD $/share of $12.50 is different from Jeremy’s $13.50, probably because Jeremy's calculation of Adj. EBITDA is different from management's or slight variations in EV calculation.

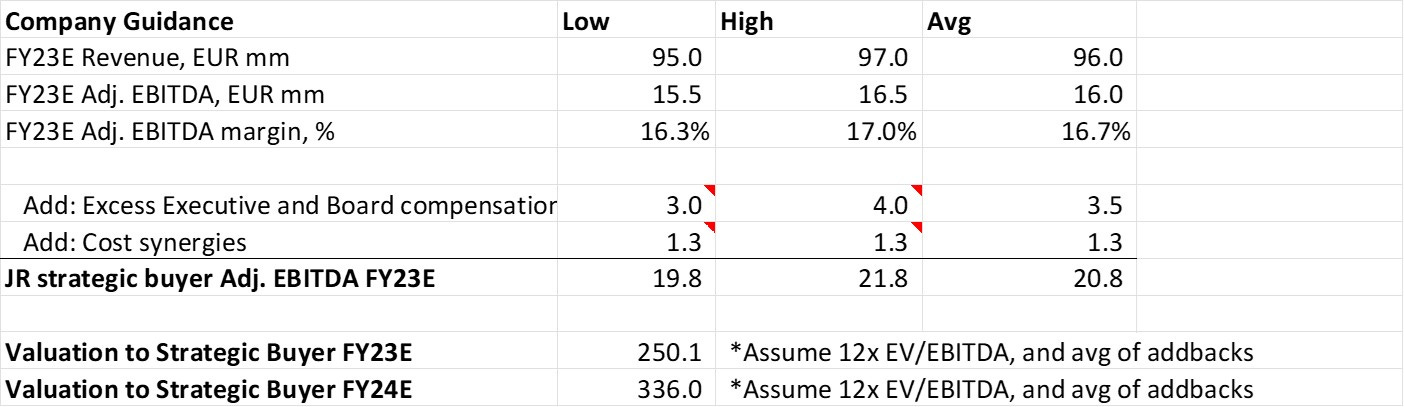

Jeremy pointed out cost synergies ($2 CAD mm or €1.3 mm) and a reduction in excess executive compensation (€3-4mm) to a strategic buyer that would increase FY23E Adj. EBITDA to €19.8-21.8mm.

"3-4mm in additional EBITDA to an acquirer, or a 20-25% uplift versus FY23E forecasts"

*JR did not state in CAD or not, so assume he meant EUR. The calculation of “20-25% uplift” is consistent with it being EUR.

This would lead to a valuation for a strategic buyer in the range of €250-336 mm.

Return:

The following is the return profile if BRAG finds a buyer and the deal goes through successfully.

*Current market cap based on $7.75/share

Decision Tree Analysis:

BRAG.TO ended the trading day on Nov 22nd at $7.79/share. Here is a decision tree analysis to determine what the market is potentially pricing in as the probability of BRAG getting sold.

*In the “BRAG sold” scenario, applying the logic that the lower the price, the higher the likelihood it gets sold

Based on the above assumptions, to arrive at a share price close to $7.79/share, the market is pricing in a 16% chance of BRAG getting sold.

Sensitivity Analysis:

The above is a sensitivity analysis of what the stock price could be at different probabilities of BRAG being sold and at different EV/EBITDA multiples.

Concerns:

-As Jeremy mentioned, “Named Executive Officers” are paid quite well, so they may want to hold onto their jobs and not sell the business

-Multiples in 2022 were higher than in 2023 because the euphoria around iGaming and online sports betting was still in play. We have used a conservative 12x EV/EBITDA multiple, but with the hype dying down, it may be difficult to find a buyer despite management’s willingness to sell

-The timeline from the engagement letter to the company being sold may take a long time. GAN expects to close their deal in Q4 2024. Expect a timeline of 1-1.5 years if you are considering investing.

Disclosure: I am currently long shares of BRAG, Bragg Gaming Group Inc.

Thanks for your support!

To stay up-to-date or receive notification of when I release my latest stock pitch, please follow:

Twitter: https://twitter.com/compoundersEX

Instagram: https://www.instagram.com/compounders.ex/

YouTube: https://www.youtube.com/@continuouscompounding

Want to enjoy paid memberships for free? Help me grow by referring a friend!

1. Share Alan’s Substack: Continuous Compounding.

When you use the referral link below or the “Share” button on any post, you'll get credit for any new subscribers. Simply send the link in a text, email, or share it on social media with friends.

2. Earn benefits. When more friends use your referral link to subscribe (free or paid), you’ll receive special benefits.

Get a 1 month comp for 1 referrals

Get a 3 month comp for 5 referrals

Get a 6 month comp for 10 referrals