*Legal Disclaimer: The post and all its contents herein are the exclusive property of Continuous Compounding. This post is intended solely for informational purposes and is not to be distributed, reproduced, or transmitted, in whole or in part, for commercial purposes or sale without prior written consent from Continuous Compounding. Any unauthorized use, dissemination, or sale of this research is strictly prohibited and may be subject to legal action. Continuous Compounding assumes no responsibility or liability for any errors, inaccuracies, or omissions in this post or for any actions taken based on its contents. Recipients of this research are advised to conduct their own independent analysis and seek professional financial advice before making any investment decisions.

I’m on the hunt for my next write-up. I thought that as I go through companies, it’s worthwhile to share companies I find interesting and to start a discussion with my readers. I’d love to tap into my reader’s circle of competence and to learn from you guys as well.

Hence, the “Idea Gen Series” is born. I will create simple and fast stock pitches.

I must admit that nuclear energy is outside my circle of competence. For those familiar with the nuclear energy theme in Japan, please share your thoughts in the comments. I would love to learn more.

Uranium has had quite the rally. For those wanting to invest in the bull-case for nuclear energy in Japan, this stock could potentially be an alternative way to play it.

TL;DR

Okano Valve Manufacturing (TSE 6492)

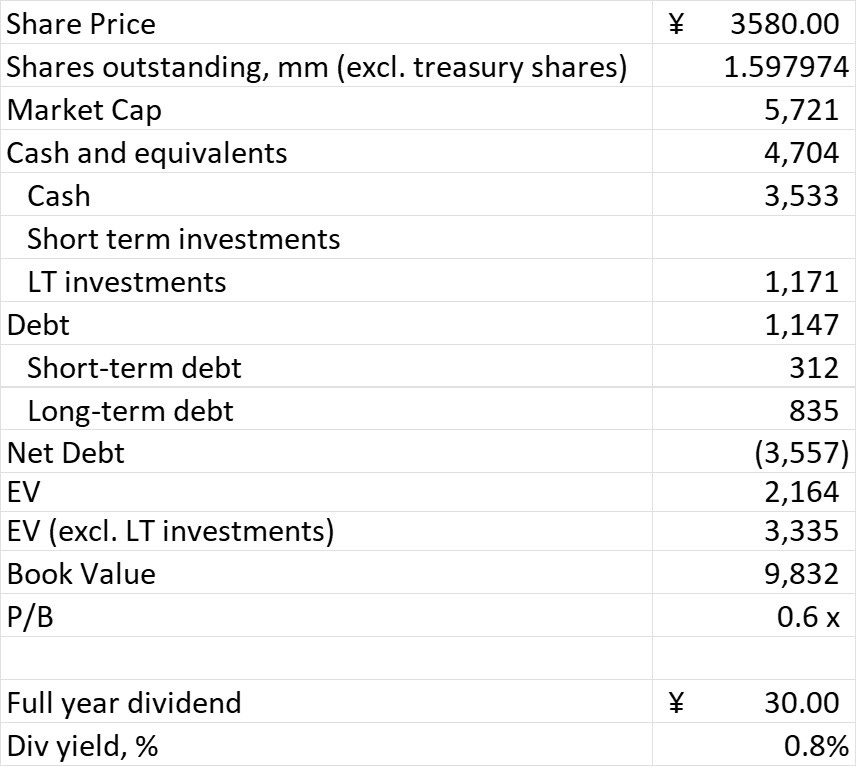

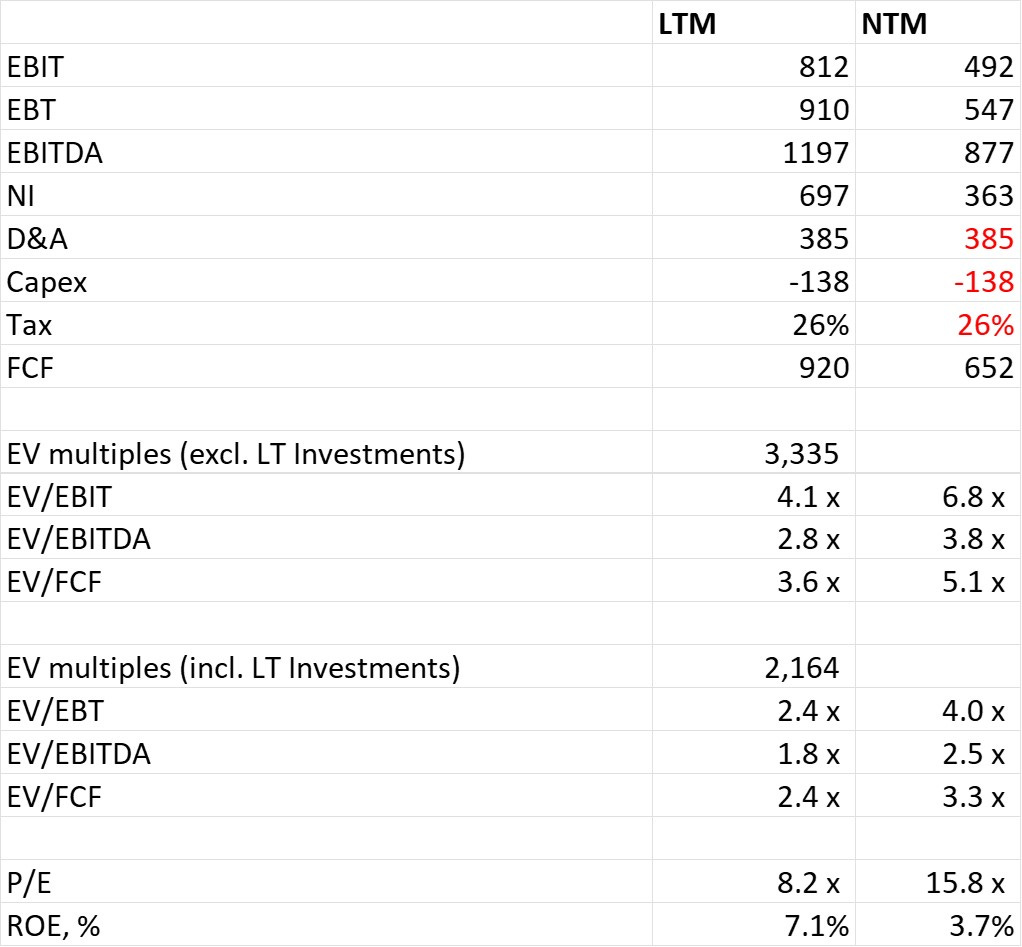

*LT investments include long-term securities and real estate investments. The company earns rental income in the IS.

Management forecast (Q4 Financial Summary):

“For the next fiscal year, the valve manufacturing and sales division is expected to sell valves for domestic nuclear power generation, including Shimane Nuclear Power Plant Unit 3 and Tokai No. 2 Power Plant, but sales of replacement parts will be lower than in the previous fiscal year. As a result, sales are expected to decrease compared to the previous fiscal year.

In the maintenance department, we are engaged in decommissioning work at Fukushima Daiichi Nuclear Power Station Unit 3, equipment inspection work at Higashitori Nuclear Power Station Unit 1, Shimane Nuclear Power Station Unit 2, Kashiwazaki-Kariwa Nuclear Power Station Unit 7, and Fukushima Daiichi Nuclear Power Station Unit 7. We are also planning to remodel the connecting valves at our facilities, and we expect sales to be at the same level as the previous fiscal year.

Regarding other new businesses, we are planning activities aimed at securing orders, and we expect sales to increase compared to the previous fiscal year.

On the other hand, in terms of profits, sales of highly profitable replacement parts are expected to decrease from the previous fiscal year, and the cost ratio of the valve manufacturing and sales division is expected to be higher than the previous fiscal year due to the impact of soaring prices of purchased parts. As a result, overall profits are expected to decrease compared to the previous fiscal year.”

(Translation via. Google Translate)

Overview:

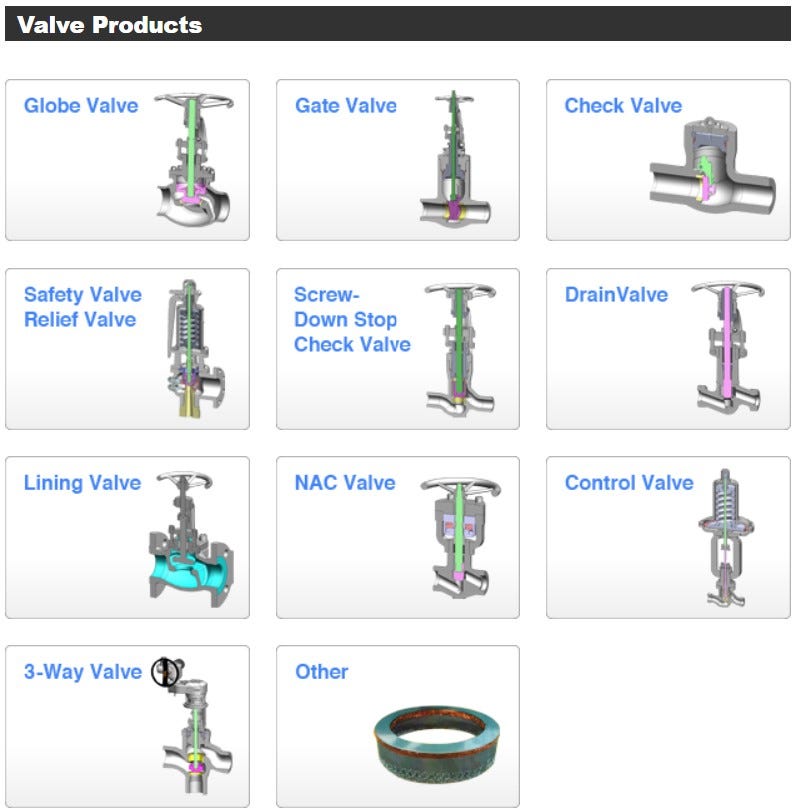

Okano produces and sells industrial valves for high-pressure and high-temperature service in Japan and internationally. It also offers steel castings; and maintenance services. The company provides its products for thermal and nuclear power plants, large tankers, and chemical industries, as well as marine, steel manufacturing, textile, and other industrial service applications. Okano Valve Manufacturing Co. Ltd. was founded in 1926 and is headquartered in Kitakyushu, Japan. (Summary paraphrased from Koyfin description)

Products and Services:

Maintenance:

-Maintenance

-Preventive maintenance

-Chemical decontamination

-Technical training on Okano valves for customers

Brief Nuclear Energy in Japan Overview:

Source:

Nuclear reactor restarts in Japan have reduced LNG imports for electricity generation (Feb 8, 2024)

-Japan has been reducing its LNG imports. Nuclear energy, as % of total power generation, has been steadily increasing.

-”After the 2011 Fukushima Daiichi accident, Japan suspended operations at all of its remaining 48 nuclear power reactors by 2013 and relied almost exclusively on imported natural gas to replace the lost electricity generation.”

“Nuclear restarts have been slow since 2015. Japan has restarted 12 units, bringing currently operating nuclear capacity to 11 GW. Japan has 10 more units under review and 5 more that have passed review but have yet to restart.”

-Of the 5 that have passed review, what are the one-time and maintenance revenues likely to be derived from these plants?

-Of the 10 under review, what is the success rate of plants passing the review process? The more operating power plants, the more potential customers.

-Given that valves are durable components that aren’t swapped every year, but require routine inspection and maintenance, revenues will come in the form of one-time revenues for nuclear power plants that are under construction and in preparation for review. Once a power plant has passed review, the company should derive maintenance revenue from routine upkeep. How can one approach modelling this?

To-Do List:

-Do they have any moats? The only potential moat I see so far is in maintenance. Okano maintenance personnel are situated in Japan giving them a proximity and language advantage over overseas manufacturers. For something as dangerous as nuclear, the safe bet should be Okano’s own labour force, right?

-Maintenance services seem the most interesting. Obviously, the in-house maintenance personnel would be the most efficient in maintaining their company’s own valves. Similar to a car mechanic for a BMW, but all car mechanics are efficient at fixing early 2000s Hondas. Are the valves complex or simply designed? I am not an engineer.

-This maintenance business segment is likely sticky. A Chinese manufacturer may not set up maintenance services in Japan. Potentially generalist maintenance personnel are hired to maintain valves from brands not situated domestically in Japan. Again, my novice opinion is that you can hire a generalist repairman to repair your refrigerator, but how likely are you to hire a generalist over a company’s specialist for something like nuclear? Please tell me I’m wrong if I am.

-Clearly, the tailwind is nuclear energy in Japan. Which part of the cycle are we at?

-Given the decline in margins given an increase in costs, it seems the company does not have the ability to pass on costs to buyers (poor pricing power). This is likely due to the high competition from global or domestic competitors. Who are the comps?

-Is FY2023 a one-off year, or will there be more nuclear plants starting up again?

-P/B is 0.6x. Could it be so capital-intensive that it’s current return profile would deter market entrants? How much would it cost to create Okano from scratch?

-What is the useful life of a valve? Do entire valves get replaced? How is maintenance work conducted? How often is their recurring revenue?

-Could there be a demand and supply imbalance coming later on that can create periodic monopolistic margins. I.e. being one of 2 swimming pools in the city (both privately owned) and its summer and the summer Olympics are being hosted. No one is going to open a new swimming pool, given the capex. So during the Olympics, with all the demand from tourists and local residents far exceeding the occupancy levels at your pool, you can severely upcharge. Too many nuclear power plants are restarting, and too few valve manufacturers.

Concerns:

-Capital intensive business. P/B is 0.6x. Is maintenance capex expected to be very low, or will there be a large capex later down the road?

-Is the company limited to mainly revenue from domestic clients?

-What % of rev is from international?

-Is the company even trying to grow? Create more products/services?

-Capital allocation efficiency. Company has too much cash on BS.

-Revenues have been rather stagnant. Is management just content with not growing?

-Finally increased dividend; will they continue this?

-Buybacks?

Disclaimer: I do not have a position in this company.

Want to enjoy paid memberships for free? Help me grow by referring a friend!

1. Share Alan’s Substack: Continuous Compounding.

When you use the referral link below or the “Share” button on any post, you'll get credit for any new subscribers. Simply send the link in a text, email, or share it on social media with friends.

2. Earn benefits. When more friends use your referral link to subscribe (free or paid), you’ll receive special benefits.

Get a 1 month comp for 1 referrals

Get a 3 month comp for 5 referrals

Get a 6 month comp for 10 referrals

Thanks for your support!

To stay up-to-date or receive notification of when I release my latest stock pitch, please follow:

Substack:

Twitter: https://twitter.com/compoundersEX

YouTube: https://www.youtube.com/@continuouscompounding

Instagram: https://www.instagram.com/compounders.ex/

r/TSEvaluestocks: https://www.reddit.com/r/TSEvaluestocks/

Anyone know what developments in nuclear in Japan caused this stock to spike up so much after I pitched it?

Nuclear or uranium are not my specialties. Would love to learn from others.

For now, I'm going to close this position as an easy win until I learn more from others.

Thats true, but perhaps I misunderstood your initial statement. Either way, just interesting observation.

Thats true an investor with deep pockets might meaningfully move the stock