How to Navigate Japanese filings Without Knowing Japanese (Continuous Update)

Tips, tricks and tools I use to analyze Japanese stocks (v1.1)

*Legal Disclaimer: This post and all its contents are for informational or educational purposes only. Continuous Compounding assumes no responsibility or liability for any errors, inaccuracies, or omissions in this post, links, attachments, or any actions taken based on its contents. The information sources used are believed to be reliable, but accuracy cannot be guaranteed. Recipients of this research are advised to conduct their own independent analysis and seek professional financial advice before making any investment decisions. The opinions expressed by the publisher in this post are subject to change without notice. From time to time, I may have positions in the securities discussed in this post. The post and all its contents herein are the exclusive property of Continuous Compounding. This post is intended solely for informational purposes and is not to be distributed, reproduced, or transmitted, in whole or in part, for commercial purposes or sale without prior written consent from Continuous Compounding. Any unauthorized use, dissemination, or sale of this research is strictly prohibited and may be subject to legal action.

In this post, I will be sharing with you my tips and tricks to navigate JP filings even if you don’t understand Japanese.

This post will be continuously updated as I improve my process and discover new helpful tools. Consider bookmarking or saving it somewhere for later reference.

I think the biggest barrier to entry to investing in Japanese (JP) stocks is the language barrier.

Most JP companies fall into the following camps:

JP and English (ENG) investor relations with JP and ENG filings

JP and partial ENG filings (the bare minimum)

JP filings only

Amongst the companies that are nice enough to release English filings, sometimes they lack information existent in the JP version.

I have seen entire segmented revenue breakdowns, tables, and disclosures that are missing in the ENG versions. Often times, if you start off looking at ENG filings, you have to go to the JP filing to look for more information.

In addition, some of the best value investment opportunities in Japan come from micro/small-cap stocks. Knowing how to navigate these stocks with little to no ENG filings will open up your investment universe. You can turn over more rocks.

My goal is to:

enable you to analyze these companies without Japanese proficiency

save time and have an efficient process

translate more accurately

This article is based on my personal experience and the tools that I have used. There are likely tools on the market that I have not discovered that are better than what I suggest.

If you think you have a better process and/or tools, please share them in the comment section! I want this to be a discussion for readers to share their tips and tricks.

Track record of stock pitches:

Haier 690D: +30%

Round1: +20%

SK Japan: +10%

Okano Valve Manufacturing: +60%

GAN: +80% (closed)

CNTY: -50% (closed)

*At time of publishing this post

Want to enjoy paid memberships for free?

Or…

Share my posts on Twitter:

If you repost 1 post on Twitter, I am offering a 1-month paid sub ($10 value) for free!

If you repost all 3, I’ll comp 2 months paid sub ($20 value), not bad for 10 seconds of work:

How to Navigate Japanese Filings Without Knowing Japanese Twitter Post

DM me on X after you’re done, and I’ll comp you asap.

*Those who have already claimed this offer in this post or previous posts will not be able to claim it again. Minimum threshold for followers on X is 40 to be eligible for this offer. My apologies to those with fewer followers; this is to prevent someone from creating a new account with 0 followers to abuse this promo. Offer expires at the end of May 2024. Offers may change or be removed at any time without notice.

Myth bust #1: Google Translate is the most accurate translator

For most words or short phrases, Google Translate does a great job, but sometimes certain sentences translated from Google Translate don’t make much sense.

I have found that if, on first try, Google Translate doesn’t work, use ChatGPT. The free version 3.5 is sufficient for this.

Tools:

1-Best free tool to read Japanese financial statements translated to English (imo):

KaijiNet/Japan Express:

https://www.kaijinet.com/jpexpress/

Kaijinet.com has been my go-to for looking at Japanese filings that are translated in English. Even for JP companies without ENG filings, they have the 3 statements in a standardized ENG format that is easy to read.

Kaijinet provides the income statement, balance sheet, and comprehensive income statements for every quarter. Cash flow statement depends on whether the company reports it.

Pro-tip: The website automatically picks US$ by default, make sure to click “Yen” as that is the most accurate.

A while back, I found the FX conversion to not be reliable for historical periods; potentially, they simply use the prevailing FX conversion for all periods, which isn’t accurate.

I use Kaijinet when I want to quickly and accurately calculate the enterprise value:

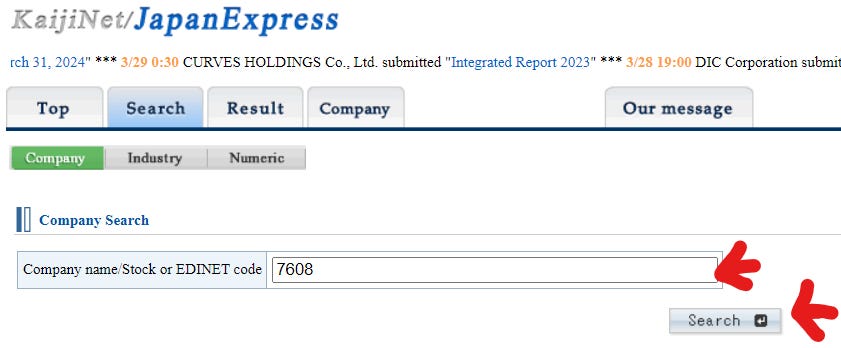

Step 1: Find your company

Click the “Search” tab in KaijiNet:

Enter your ticker (in this case, SK Japan’s code is 7608) and click Search.

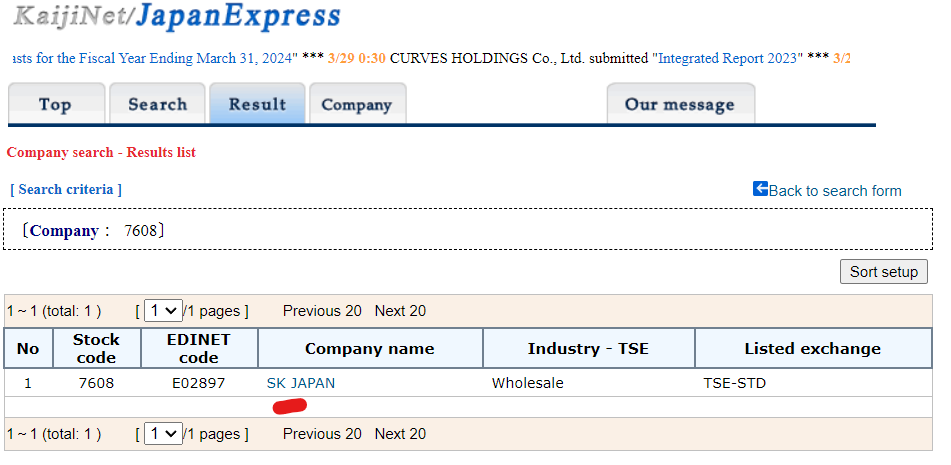

Select your company from the search results; if you entered the code correctly, it should come up.

Step 2: Locate Shares Outstanding

Click “Summary” Tab

Shares Outstanding is located at the bottom of the “Summary” tab

I typically take EOP shares and minus treasury shares.

Take the most recent share price and multiply by shares outstanding to get Market Cap.

Step 3: Calculate Net Debt and Enterprise Value

Go to “Financial Statement” tab

A couple things to note:

-The BS is automatically selected without you having to press anything

-The most recent quarter/period is also selected automatically

-By default, the US% is selected, so all you have to select is yen.

Then calculate Net Debt using inputs you would normally use, and add Market Cap in step 2 to get the Enterprise Value.

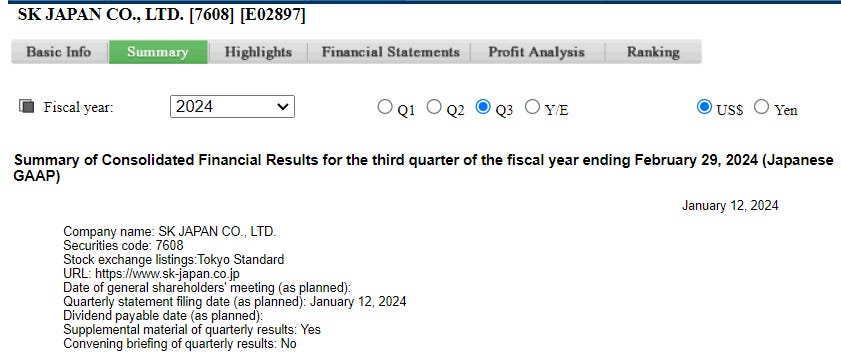

Tool #2: Google Chrome Extension: Definer

Google Chrome Auto-translator

There are a lot of auto-translators on the market. Essentially, how they work is that you hover your mouse over a word or phrase and a pop-up shows and auto-translates your selection.

This makes reading a lot faster, as you don’t have to copy/paste everything you want to translate.

Shoutout to my friend Wendy, who brought such tools to my attention.

I’ve only used a couple of these auto-translators and this is the one that works best for me and my use case. (Fyi, this is probably the 3rd or 4th auto-translator I used before sticking to this one; there definitely might be better ones.)

Definer extension in Google Chrome Web Store

The reason I like this one the most is because of its “PDF mode.”

Here is an example:

Click on the following JP filing: Round1 Annual Report PDF

Go to page 5, and try to copy and paste 売上高 (revenue).

Next, enter CTRL+F search function and copy and paste 売上高. You will notice that nothing was copied or pasted. I don’t know code, but I speculate it isn’t able to identify the characters.

It’s weird, it’s a hit or miss, some JP PDF filings work, some don’t. But this solution is a good backup plan in case the PDF doesn’t work.

No worries, “Definer” to the rescue:

Step 1: Click Definer Chrome Extension:

Step 2: Click in “open in PDF Reader”

Step 3: Go back to page 5 and highlight 売上高.

You will notice straight away when you highlight text, the auto-translator starts working.

*I did notice a bug where, when you sometimes highlight the text, nothing happens. Use the shortcut ALT+D. Or refresh the page and see if the auto function comes back.

Step 4: Highlighting long sentences:

Sometimes when you highlight a long sentence or paragraph, the translation can get confusing or hard to follow.

My advice is to enter the sentence in to ChatGPT. Free version is enough for this task:

The difference is night and day.

Other:

The main reason I use Definer in PDF Mode is to be able to toggle through things I want to find other instances of. i.e. Revenue, operating income, etc. This allows me to search for things in the raw Japanese text, rather than relying on the translated ENG text, which could be wrong.

Tool #3: Online Doc Translator

This one was suggested to me by AltayCap. I highly recommend subscribing to AltayCap if you invest in Japan.

Essentially, “Google Translate” has an entire document translation feature

While the feature saves you a lot of copy and pasting, the output isn’t perfect.

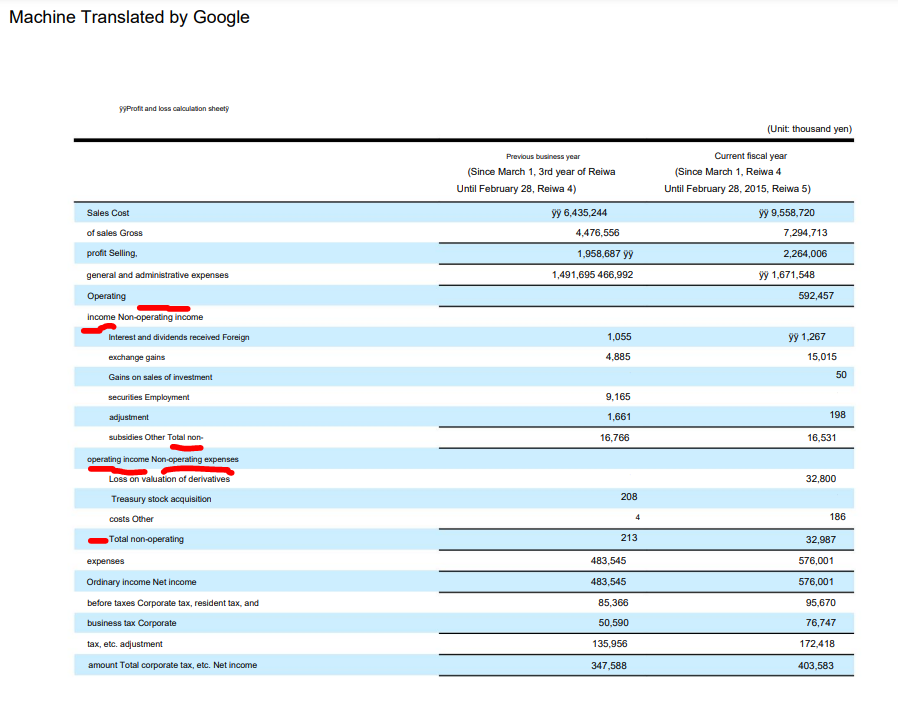

For financial statements, I often find the translator will populate tables incorrectly:

We can see from a few highlights, “income” from ”Operating Income” spills over to the “Non-operating income” line. There are other instances of spillage.

This error is fixed with OnlineDocTranslator:

As you can see, row titles are exactly what they should be.

Of course, you can never be too confident on anything machine translated so I always have the original version opened in “Definer” (Tool #2).

If I come across any information completely crucial to my investment thesis, I always double check with the original JP filing and use Definer to copy/paste small sections of paragraphs into ChatGPT. Also, something as simple as ensuring the numbers match the original.

*If your first instinct is that the sentence doesn’t make sense, it probably is the wrong translation.

Notice how the font size in the rows of the income statement is inconsistent. This is why I use Kaijinet. Kaijinet financial statements are consistently formatted and easy to read.

I mainly use full document translations for paragraphs about business overview or commentary by the management on their results.

Tool #4: OneNote

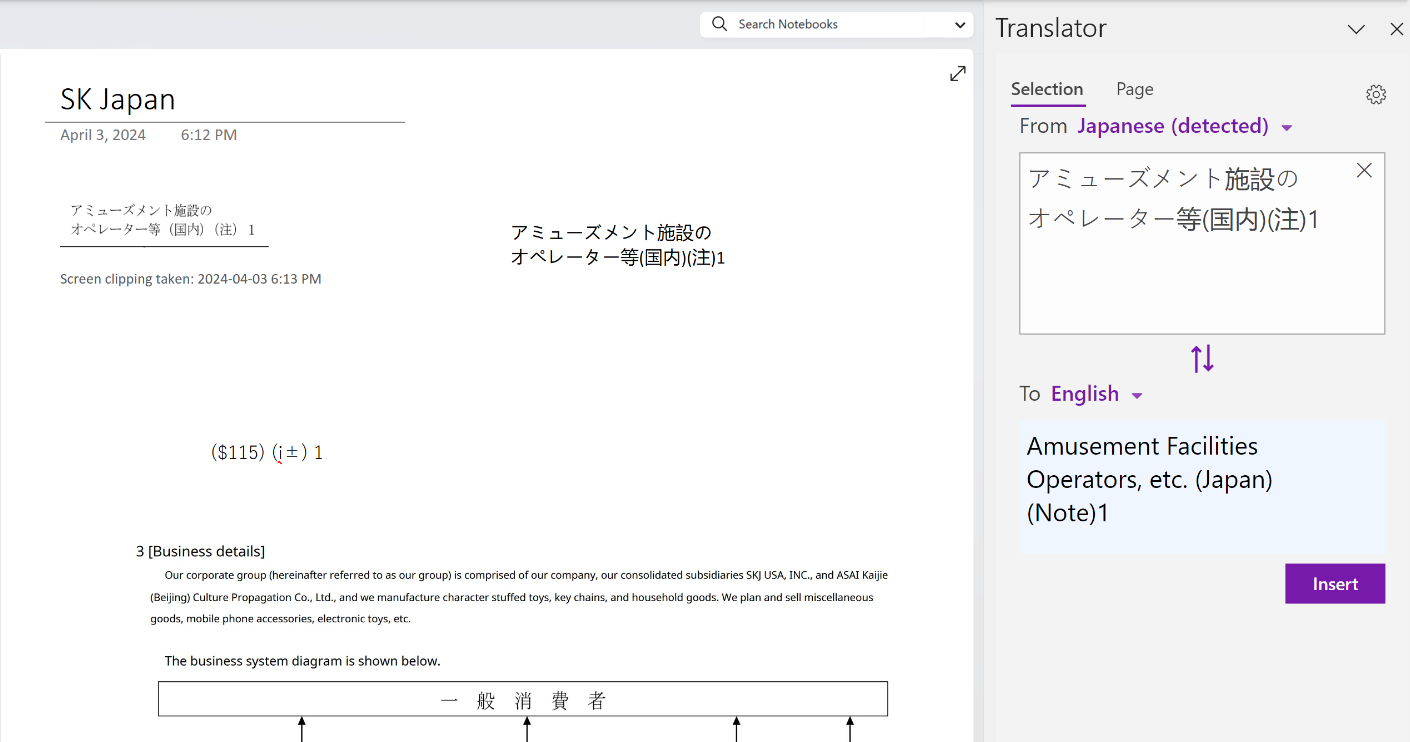

How to translate text in images?

Even when we translate entire documents, what is missed are often images with embedded text.

Notice how the JP words in the business diagram are still in Japanese.

The main function we are using from OneNote is it’s “Copy Text From Picture” function.

For an image as large as this, you can translate everything at once, but the output may be unorganized, depending on the image. Output of translating the entire image:

*When extracting text from large images, given that the output text may be unorganized, you will have to logic through where the text corresponds to its location on the image.

An alternative is simply to clip what you want to translate into small chunks.

You may use the “snipping tool,” which is innate to Windows, or the “screen clipping” function, which is innate to OneNote.

Click “Insert” tab in OneNote

Click “Screen Clipping”

Clip the part of the image you want:

Crucial step: Right-click with your mouse anywhere and set “Make Text in Image Searchable” to “Japanese.” If Japanese is not available, you do not have the Japanese dictionary installed, and you need to install one. Microsoft Office allows you to download the dictionary straight from the app itself; you do not need to go to your browser for external sources.

Then right-click on image, and select “Copy text from picture.” Paste the text anywhere on OneNote and the Japanese text will come out.

To translate, simply highlight the text, right-click and click “translate.” “Translator will pop up on the right side of OneNote:

*You can do this for longer texts and paragraphs, but if the output makes little sense, you can enter it into ChatGPT and prompt it to “Translate to English:”

Tools for Idea Gen and Screening:

Tool #1: Koyfin

My goal with any new idea is to reject it as quickly as possible. Koyfin is a huge time saver when it comes to getting up to speed quickly on a new name.

I mainly use Koyfin to quickly look at a company’s business description, valuation multiples, historical profitability, analyst estimates to gauge future prospects, and form an opinion on whether this idea is worth looking further at.

Affiliate Link: Save 20% on Koyfin!

Screeners:

Koyfin has a very friendly stock screener. You can customize your own formulas. I have used Koyfin to screen for net net investments:

Watchlists:

Koyfin is also very useful for creating watchlists. I categorize my watch list by region and strategy.

If you want a great tool that lots of investors on fintwit use in their idea gen phase, consider adding Koyfin to your list of tools. By using my affiliate link, you get 20% off any paid license and can help support my Substack.

Additional Promo: On top of the 20% off any paid license, I’ll also throw in a 3-month paid subscription to my Substack for free! (DM on Twitter or email me to claim offer)

I use Koyfin for the idea gen process mainly. You should never rely on any data platform for accurate calculations. You should always calculate your own enterprise value and other valuation multiples. From my own experience, Koyfin does a great job in the data accuracy department, but like any platform, there are bound to be errors, or you may disagree with how something is calculated.

Tool #2: Interactive Brokers (Free)

Before Koyfin, I used IBKR. IBKR has a company tab and offers free analyst estimates for stocks that have analyst coverage.

From personal experience, valuation numbers on IKBR can be hit or miss, but historical financials (rounded and sometimes lumped into categories) are accurate enough. So it’s good to get a general sense of the valuation multiples, but you should calculate your own.

The reason I moved over from IBKR to Koyfin was due to trust in the data and calculations, and the massive time savings. Before, my initial stock evaluation took 5-25 mins. Now it takes only 5-15 mins with Koyfin. This was mainly because I did not trust the valuation multiples listed in IBKR, hence having to calculate them myself. Koyfin’s results are quite close to my own calculations most of the time, hence saving me time trying to sanity check.

Other mentions:

TradingView:

TradingView is more of a trader’s program. It is great for charts but lacking for fundamentals.

It does help with watchlists, the ability to create more watchlists is limited for free users. The hack is to trial run paid and create a boatload of watchlists. After the trial is over, your watchlists are still intact. You can edit them and rename them as well. The caveat is that you can no longer add more watchlists.

The thing I hate about TradingView is that their valuation multiples are not reliable.

I’m not a trader, but I do use TradingView to gauge entry and exit prices for when I want to enter or exit a position. Their charts look very nice.

TIKR:

I have not used it extensively enough to have any opinions. I occasionally use it to track the stock picks of certain top investors. What’s great is that international stock picks that are not available on 13Fs are sometimes reported. i.e. When an investor owns more than 5% of a Japanese company.

Tip #1: Reiwa Era (令和)

Japan has their own calendar conventions. Currently, we are in the “Reiwa” era.

Google translate and OnlineDocTranslator screws up interpreting these dates:

As we can see, the dates make no sense.

The Reiwa era started on May 1, 2019. So the way to calculate what year we are in, is simply to count with your fingers. If 2019 is year 1 or your first finger, then year 5 is 2023.

Just remember that 2019 is year 1 and you are set.

Tip #2: Get used to thinking in terms of Yen

I urge ENG investors to get comfortable thinking in terms of Yen when investing in JP companies. A simple exercise I do is to simply divide by 100 or move the decimal point to the left twice.

I personally apply the, what would I do if I was on vacation method. So 10,000 yen demoted once is 1 thousand, and demoted once more is 1 hundred.

So if the company has a 100 billion market cap, I demote once to 10 billion and demote 1 more time to 1 billion (demote twice).

Now you may be wondering, hey current USD/JPY is 1 USD to 150 yen. Deal with it, I’m Canadian, be happy you have this problem…(cries in jealousy).

In all seriousness, then you take the number that you divided by 100 and apply a discount or premium. In this case 1 USD to 150 yen is a 1/3 discount. So you can multiply 100 by 66%. or discount by 33%.

For us Canadians, 1 CAD is 110 yen roughly so our mental math is a lot easier, but I rather have the headache, believe me.

Also, it is important to be aware that USD relative to JPY has been this strong since 2022:

Prior to COVID, if you traveled to Japan for vacation, if you were American and looked at the price of something, you’d simply divide by 100. So for the sake of mental math, I’d just divide by 100. And get a more accurate figure in my Excel if the investment looks compelling enough. Plus if you consistently divide by 100, your valuation multiples don’t change either.

This brings me to another point, you should not divide by 150 to get a sense of USD results in historical periods when USD was not as strong, it will give you an inaccurate impression on their USD generation. So if the company has US operations and in 2018, they generated 100 billion JPY of revenue, that is 1 billion USD of revenue in 2018 roughly, not 660 mm USD in revenue.

This is one of the first hurdles English-speaking investors have to get used to: getting used to figures in Yen.

For Chinese speakers (skip if you don’t speak Chinese):

For an English speaker who only knows English, looking at Japanese is like looking at Arabic for me. But for those who can read Chinese, you have an innate advantage.

In Japanese, Kanji (Chinese characters) are used. If you can read Chinese, then you have a couple of advantages:

-You are more comfortable looking at Japanese text (except the hiragana/katakana parts)

-You can guess what some things mean that are very close in definition to their Chinese character definition

Look at the dates; the characters 年,月, and 日 are exactly as they are in Chinese.

In the third line, the words 利益, means “benefit” and what you stand to gain in Chinese. After google translating it, you know this is gross profit. Hence, in your brain, you can reason whenever there is 利益, this refers to some sort of profit or income generated.

Of course, there is the first line: 売上高. For me personally, I could only read 上高which means literally “up high.” In Chinese we commonly use 买/卖 to say buy or sell. 売 is the Japanese variant of 卖。So after google translating these words, and seeing the definition as revenue or amount of sales, it wasn’t too hard to reason that revenues are “up high” (上高)or the top line of the income statement.

Side Reading/Quest (skip if u want):

As a CBC, Chinese born Canadian, I grew up speaking Cantonese and was sent to weekend Mandarin school since I was 7. Iykyk. I quit when I was around 13 because, at that point, I was fluent enough to understand TV shows and even bargain with vendors in Shanghai at a sketchy knock-off mall. I wanted a souvenir t-shirt, and the vendor started off at 120. I countered at 40 RMB. When they refuse, I just walk off and threaten to go to the next stall. They agree to your price every time. IYKYK. You can probably get away with 30 RMB. If they don’t stop you from leaving, then the offer might actually be too low.

Long-term Hack: Learn Japanese

To reduce the language advantage Japanese investors have over foreign investors, simply learn Japanese.

I am currently learning Japanese. I have finished learning Hiragana. Currently learning Katakana.

I recommend “Remembering The Kana” by James W. Heisig. This book covers Hirigana and Katakana.

Want to enjoy paid memberships for free? Help me grow by referring a friend!

1. Share Alan’s Substack: Continuous Compounding.

When you use the referral link below or the “Share” button on any post, you'll get credit for any new subscribers. Simply send the link via text, email, or share it on social media with friends.

2. Earn benefits. When more friends use your referral link to subscribe (free or paid), you’ll receive special benefits.

Get a 1 month comp for 1 referrals

Get a 3 month comp for 2 referrals

Get a 6 month comp for 3 referrals

Thanks for your support!

To stay up-to-date or receive notification of when I release my latest stock pitch, please follow:

Substack:

Twitter: https://twitter.com/compoundersEX

YouTube: https://www.youtube.com/@continuouscompounding

Instagram: https://www.instagram.com/compounders.ex/

r/TSEvaluestocks: https://www.reddit.com/r/TSEvaluestocks/

Alan, I like the way you are building your circle of competence covering a very niche industry and an explored market. I'm sure this will give you an edge over long term. I also appreciate the fact that you are keeping a track of your own performance by highlighting all the previously covered stocks. For me the outcome is more important than anything else whether you are an analyst, an investor or a fund manager. So keeping a score is important and good job for being right 5 times out of 6. Keep it up buddy!