Glory 6457 Deep Dive

*Legal Disclaimer: This post and all its contents are for informational or educational purposes only. Continuous Compounding assumes no responsibility or liability for any errors, inaccuracies, or omissions in this post, links, attachments, or any actions taken based on its contents. The information sources used are believed to be reliable, but accuracy cannot be guaranteed. Recipients of this research are advised to conduct their own independent analysis and seek professional financial advice before making any investment decisions. The opinions expressed by the publisher in this post are subject to change without notice. From time to time, I may have positions in the securities discussed in this post.

This post and all its contents herein are the exclusive property of Continuous Compounding. This post is intended solely for informational purposes and is not to be distributed, reproduced, or transmitted, in whole or in part, for commercial purposes or sale without prior written consent from Continuous Compounding. Any unauthorized use, dissemination, or sale of this research is strictly prohibited and may be subject to legal action.

Disclaimer: I am long shares of Glory Co., Ltd. (6457) at the time of publishing this post.

Table of Contents:

Company Overview

Valuation Overview/Quick Investment Thesis

Outlook

Growth Analysis

Sources of Revenue

Risks

Conclusion

Company Overview:

Glory is a market leader in its core business of cash-handling machines and systems. This includes bill (banknote) and coin recyclers/counters.

Bill and coin counters are exactly as the title describes; they authenticate and count the exact number of bills and coins.

Bill and coin recyclers are machines that not only count the bills and coins but can also dispense bills and coins as well. In a financial setting, this assists in the process of depositing and withdrawing funds. In a retail setting, this assists in providing change.

Glory’s key technology is image recognition technology that can authenticate whether a banknote or coin is real to the finest of details at very high speeds. Glory can authenticate bills even if they are in poor condition. Glory is able to identify over 3000 banknotes issued globally.

Glory operates under four business segments:

-Financials: Banks

-Retail and Transportation (incl. Food and Beverage): Grocery stores, train stations, QSR (quick service restaurants), restaurants. *F&B might be separated out in the future when revenues become substantial enough.

-Amusement: Pachinko parlours

-Overseas: Primarily servicing financial and retail companies outside Japan

Financial Application:

In the financial application, Glory assists in the efficient counting, sorting, and bundling of cash and checks, aiding in the deposit and withdrawal banking process. The value proposition comes from cost savings due to speed of processing, accuracy in counting (preventing human error), and authentication of fraudulent bills.

The following is a video showcasing Glory’s use case in a cash-oriented country like Paraguay:

TLDR of the above video:

Paraguay is cash-oriented country where a substantial portion of the population is unbanked

The small and medium businesses of Paraguay employ 90% of the workforce

These private small and medium enterprises primarily use cash

Traditional banks close at 3 or 4pm, hence making fulfilling the banking needs of these small/medium businesses difficult as they aren’t open after these businesses close

Ueno Bank is open 24/7 and, with the help of Glory’s machines, is able to process a significant volume of cash for these enterprises on a daily basis.

Other products in the financial segment include: coin recycling modules for ATMs, security storage systems, key management systems, banknote recycling modules for horse racing ticket vending machines

Retail application:

In the retail application, Glory has multiple offerings:

-Retail: primarily seen in grocery stores, department stores, hospitals, transportation companies, but can be applied to a variety of retail settings

-Food & Beverage: quick service restaurants (QSR), any restaurant that wants to save on server/waiter costs

The primary retail businesses Glory caters to are any retail businesses that typically have long lines during peak times and would find efficiency gains from faster cash-transaction/cashless-transaction processing (i.e. grocery stores, QSRs, and convenience stores).

In peak hours, when line ups at cashiers can be long, Glory’s speed of processing cash transactions offers grocery stores the ability to reduce customer checkout times, process more transactions, and clear queues (line ups) faster.

Glory’s appeal in retail lies in its ability to lower labour costs and mitigate the impact of labour shortages.

In niche applications, such as a bakery, Glory has enabled bakeries to process cash transactions without physically touching cash. Not touching cash is hygienic and a major convenience for bakery staff, as they are in constant contact with food and ingredients.

In the video below, the store manager highlights that the efficiency gains from Glory machines have allowed for fewer cashiers and a much less disruptive rehiring of new cashiers, as training times have reduced from 3-4 days to 1 day.

My first job was a retail job in an electronics store. At the end of the day, the manager on duty would manually count up the excess cash in the tills and place it in a safety deposit box in the back room.

With Glory, end-of-day cash reconciliation is automated, leading to faster closing times and lower labour costs (if you save 10 minutes from closing, that is 10 minutes you don’t have to pay your employees). Companies pay for employees to stay after closing hours to perform cash reconciliation. Glory’s back-office machine value proposition is in labour cost savings from shortened closing times, fewer human calculation errors, and theft prevention.

At the beginning of the day, Glory’s back office machines allow for automated till replenishing, making beginning-of-day operations faster as well. The entire process doesn’t require cashiers to be in contact with cash, leading to reduced potential for theft or manual errors.

The following is a video showcasing Glory’s retail cash infinity solution system:

Food and Beverage Retail Application:

In the food and beverage application, Glory offers self-service kiosks and drive-thru systems.

If you live in Canada or the US, you have probably come across these self-service kiosks at McDonald’s. In fact, Glory has been deemed “the globally approved digital cash solution for McDonald’s.”

Customers who order through a self-service kiosk tend to order more as they have more time to customize their order to their liking. The time pressure is mostly gone with self-service kiosks. In addition, with AI and data analytics, companies can alter their customer experience in a way that encourages them to order more.

In 2020, Glory acquired Acrelec, a producer of self-service kiosks. Different from Glory’s core products of recyclers, self-service kiosks are a cashless solution that replaces the need for a cashier, while Glory’s core products are complementary to a cashier’s job.

*Glory has introduced the C27, a self-service kiosk that supports cash and cashless payment options.

Other products in the retail segment include: smart vending machines, ticket vending machines, drive-thru systems, coin-operated lockers, medical payment kiosks, RFID self-checkout systems for cafeterias, and ballot sorters for handwritten ballots.

Amusement Application:

Glory is one of the top prepaid IC card reader companies servicing the pachinko industry in Japan. Glory’s amusement offerings are currently limited to Japan.

TLDR on the pachinko industry: The pachinko industry is in a secular decline. Participation rates are dropping yoy with no signs of slowing or flattening out.

On a normalized basis, pachinko is only around 5-6% of revenues, so even if pachinko ceases to exist, by the time that happens, the impact on Glory’s earnings would be negligible.

Overseas:

In the overseas segment, Glory offers sales and maintenance services primarily to financial institutions, cash-in-transit companies (CIT), retail stores, and food and beverage clients. The products offered to financial and retail clients overlap with what is offered domestically. The designs of the machines may be different, likely due to acquiring Revolution for the US market, but the underlying functionality and technology are the same.

Self-service kiosks (touchscreen) are not as widely adopted domestically in Japan as they are overseas (this should not be confused with ticket vending machines that you see in ramen shops in Japan). In Japan, small restaurants use ticket vending machines to order food, which is outdated tech. Given many restaurants, such as ramen shops, use ticket vending machines, Glory needs to make the value proposition high enough for these restaurants to replace the old tech. I believe adoption of self-service kiosks is a major growth engine for the company in the future.

Quick Valuation:

Glory, despite having a lot of cash on its balance sheet, also has a lot of debt.

Why does Glory need debt? The company has used a combination of cheap debt and cash flows to finance strategic investments to strengthen its core business and expand into new business domains.

Glory plans to invest 20 bn (billion) yen a year into strategic investments.

The following are the strategic acquisitions/investments the company has made since 2020:

The purpose of these strategic investments is to expand Glory’s product and service offerings, reducing their dependency on their cash-handling products.

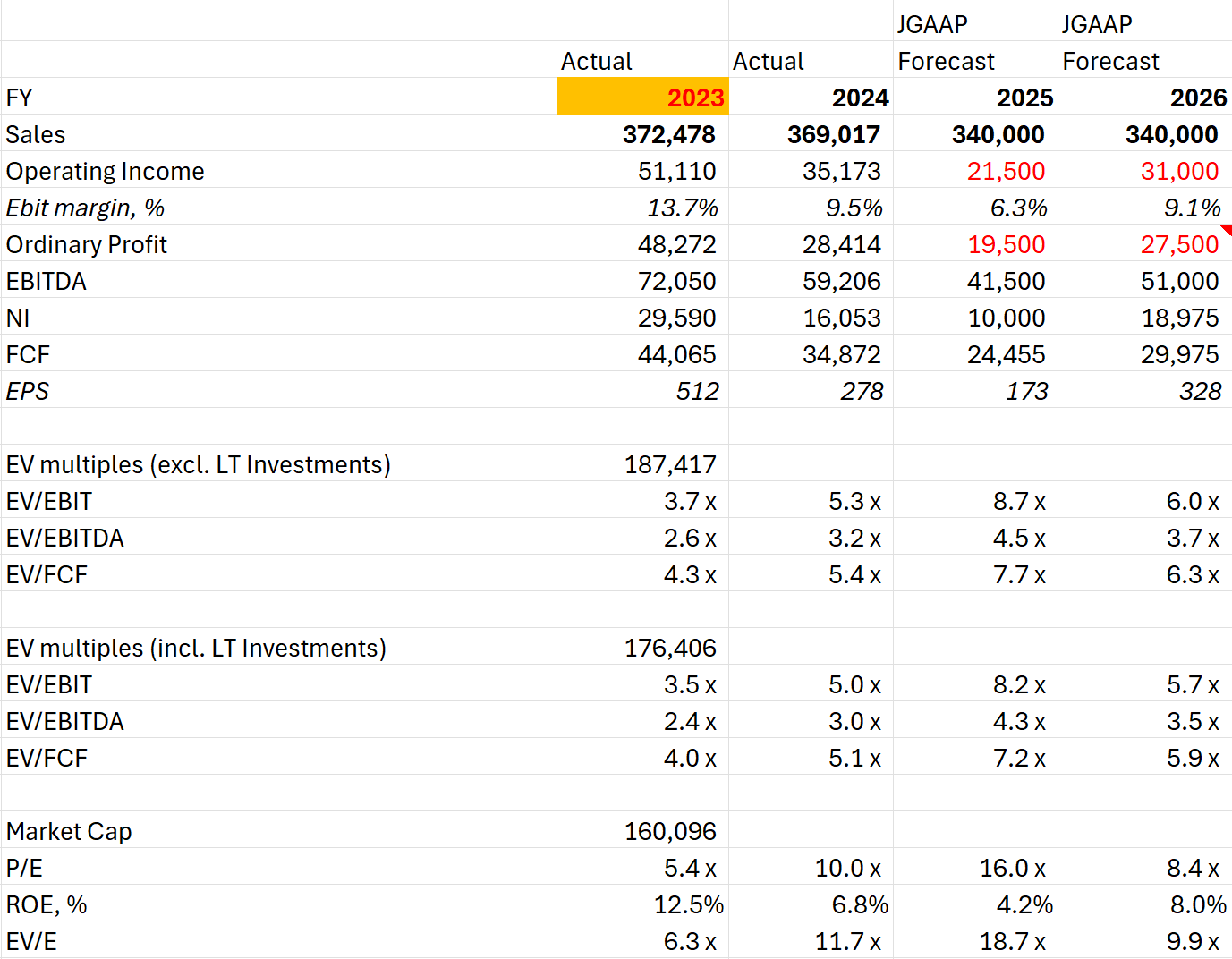

*The lastest period is FY2024 (ending March 31, 2025)

Glory had a record year in FY2023 (ending March 31st, 2024) due to Japan’s issuance of new banknotes. This resulted in high-margin sales due to machine replacements, parts replacements, and software upgrades to account for the new banknotes.

From a valuation standpoint, I would not use FY2023 as a reflection of Glory’s earnings in a normalized state.

New banknote-related sales spilled over to FY2024.

Due to the positive impact of new banknotes, Glory’s domestic clients are expected to take a breather on capex in FY2025; hence, margins are expected to drop due to:

negative effects of operating leverage when domestic sales drop

The increase in sales and operating income in overseas operations is not enough to offset the domestic drop in earnings.

The period to focus on is FY2026, as this period reflects a more normalized period for Glory as the effects of Japan’s new banknote issuance have dissipated.

So why do I think Glory is undervalued?

Glory trades at 6.0x FY2026 EV/EBIT and 8.4x FY2026 P/E (2770 yen/share). Glory is undervalued for the following reasons: ….

To continue reading this post, consider becoming a paid subscriber!

Paid subs were notified of this idea 1 month before free subs. Those who followed my Glory trade in April would have made +30% return.

My paid sub below has made a +39% gain as of the release of this post (3144 yen/share as of 5/28/2025). His average price is 2255 yen/share.