Fast Fitness Japan 7092 Deep Dive Part 1 (Paid Exclusive)

The owner of master franchise rights to Anytime Fitness in Japan

*Legal Disclaimer: This post and all its contents are for informational or educational purposes only. Continuous Compounding assumes no responsibility or liability for any errors, inaccuracies, or omissions in this post, links, attachments, or any actions taken based on its contents. The information sources used are believed to be reliable, but accuracy cannot be guaranteed. Recipients of this research are advised to conduct their own independent analysis and seek professional financial advice before making any investment decisions. The opinions expressed by the publisher in this post are subject to change without notice. From time to time, I may have positions in the securities discussed in this post.

This post and all its contents herein are the exclusive property of Continuous Compounding. This post is intended solely for informational purposes and is not to be distributed, reproduced, or transmitted, in whole or in part, for commercial purposes or sale without prior written consent from Continuous Compounding. Any unauthorized use, dissemination, or sale of this research is strictly prohibited and may be subject to legal action.

Disclaimer: I am long shares of Fast Fitness Japan (7092) at the time of publishing this post.

Here’s an update on my life that no one asked for. Thanks

for DMing me to ask how I was doing:Life Update:

Got COVID a few months back. Felt low on energy for an entire month. I am fully recovered now.

First close family member passing. First time attending a funeral. The family member had a peaceful passing and lived a good life. I am all well; not to worry.

Got my largest live poker tournament score to date for almost $8k CAD

Japan stock market: partially sidestepped the entire crash and was able to go long on multiple opportunities. I actually came out a winner after the crash. How did you guys do?

Put on one of my biggest trades I’ve made my entire life for 3/4 of my net worth and came out a winner. Won’t be sharing this trade, sorry.

Relative to your net worth, what is your biggest trade?Learning how to make videos for YouTube: Working with a video editor. A mix of procrastination, being camera shy, building the willpower to be comfortable in front of a camera, and messing a lot of things up (audio quality), resulting in me not uploading anything as of yet.

I made a short investing comedy sketch, but my editor doesn’t like it, so it might not see the light of day.

I have 1 video coming down the pipeline, just wait for that. I’ll be turning this stock pitch into a video stock pitch as well.

Subscribe to my YouTube! to be first to get the video!Took some “me” time to study investing. Going through the entire Joel Greenblatt class at Columbia. I took a pause on studying Japanese, I should probably resume.

Went to Banff to see Lake Louise and Moraine Lake in Canada for the first time in my life. I personally enjoy nature and scenery.

I am back today with a brand new stock pitch. One that is not my typical anime-related stock.

I bring to you Fast Fitness (7092). A high-quality and undervalued fitness business in Japan that exhibits superior business economics and product market fit than most of its competitors.

Table of Contents:

Business Overview

Quick Valuation

Key Highlights

Outlook

Comps Analysis

Growth Analysis

Business Economics

Conclusion:

Business Overview:

Fast Fitness Japan (FFJ) owns the master franchise rights to sub-franchise “Anytime Fitness” in Japan. Anytime Fitness is owned by Self Esteem Brands LLC.

What is Anytime Fitness?

Anytime Fitness (AF) was founded in the US as a 24-hour fitness gym focused on providing quality gym equipment at a competitive monthly rate (7000-10000 yen in Japan - 50 to 70 USD). Prices vary by location.

When Anytime Fitness was first introduced in Japan in 2011, it was the first 24-hour gym of its kind.

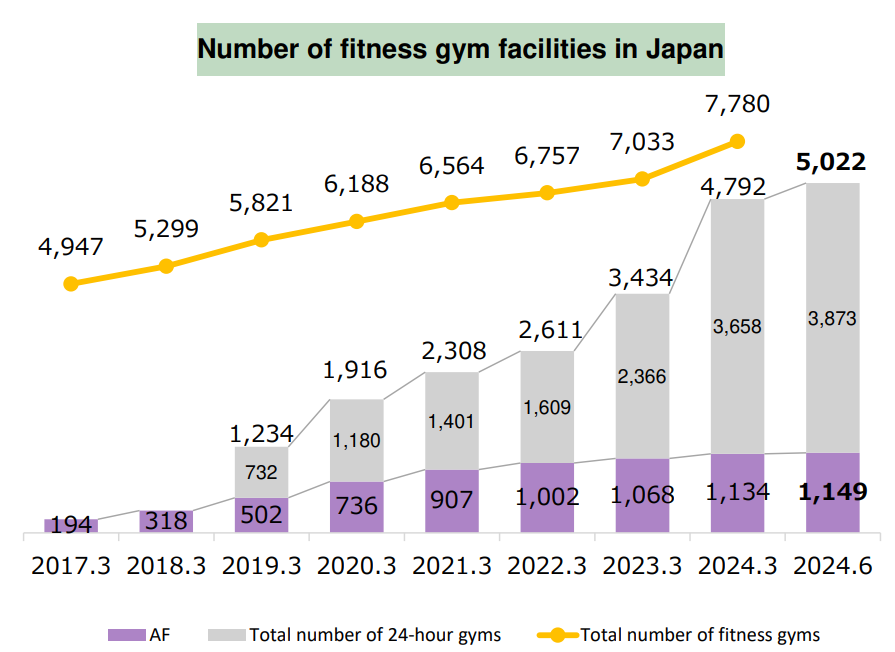

AF’s convenient operating hours, easily accessible locations, quality gym equipment, and competitive pricing have allowed AF to profitably grow to 1,149 stores as of Q1 2025.

*It should be noted that a large portion of the 5022 24-hr gyms are simply existing comprehensive sports clubs that have expanded the operating hours of their gyms to 24-hrs. Their other amenities, like swimming pools and saunas, still follow normal operating hours. There are competitors that have entered the space as well; more on this later.

As of Q1 FY2025, AF has 22.9% market share of the 24-hr fitness club market in Japan in terms of club count.

As of FY2024, AF has 14.6% market share of the entire fitness club market in terms of club count.

Business Structure:

FFJ operates 2 main segments:

Directly owned clubs (DOC) : FFJ operates 182 (16%) directly owned clubs in Japan.

Franchise clubs (FC) : There are 967 (84%) franchise clubs and 171 franchise owners.

As of Q1 FY2025, the company has 1,149 domestic stores, 2 stores in Singapore and 1 in Germany.

FFJ collects franchise fees and a fixed monthly royalty from franchisees. FFJ pays a portion of the franchise fees/royalties per store to Anytime Fitness Franchisor, LLC (Anytime Fitness USA).

Value prop?

Anytime Fitness is a value-oriented gym. This should not be confused with a “discount” gym (3000 yen per month) which typically lacks gym equipment.

Anytime Fitness competes on convenience (24 hrs), accessibility, quality of gym equipment, and being competitively priced in comparison to comprehensive sports clubs.

*One should not compare their gym membership cost in US and Canada to Japan. FFJ’s pricing is competitive to what is offered in the context of Japan.

Comprehensive gyms/clubs offer a swimming pool, jacuzzi, and other creature comforts, which would require a higher monthly fee due to the higher capex, labour costs, and operating expenses.

AF cuts out all the unnecessary creature comforts and only offers gym equipment necessary for a quality workout.

Staff is available for 8 hours a day. Given the gym is 24 hours, the gym is unmanned for most of the operating hours. FFJ works with a security company that sends security guards on the scene if anything were to occur.

This reduction in labour costs, capex from not having to invest in expensive amenities (i.e a swimming pool), and operating expenses, results in savings being passed down to the consumer in the form of a competitive monthly rate.

Target Market:

Anytime Fitness targets users between the ages of 20-40 who have made the commitment to working out and demand quality fitness equipment to meet the demands of their unique workout routine. A gym rat should find the equipment at anytime fitness satisfactory for their workout needs.

Quick Valuation Overview:

Enterprise value:

FFJ’s market cap is 25bn with net cash of 5bn, hence EV is 20bn.

P/B of FFJ is 2.0x. The P/B of FFJ should be high due to the non-capital intensive nature of its franchise club segment. FFJ charges franchisees a flat fee every month regardless of operating results; hence, income from FFJ’s franchise segment is very stable.

The only capital-intensive segment is the directly operated club segment.

Valuation Metrics:

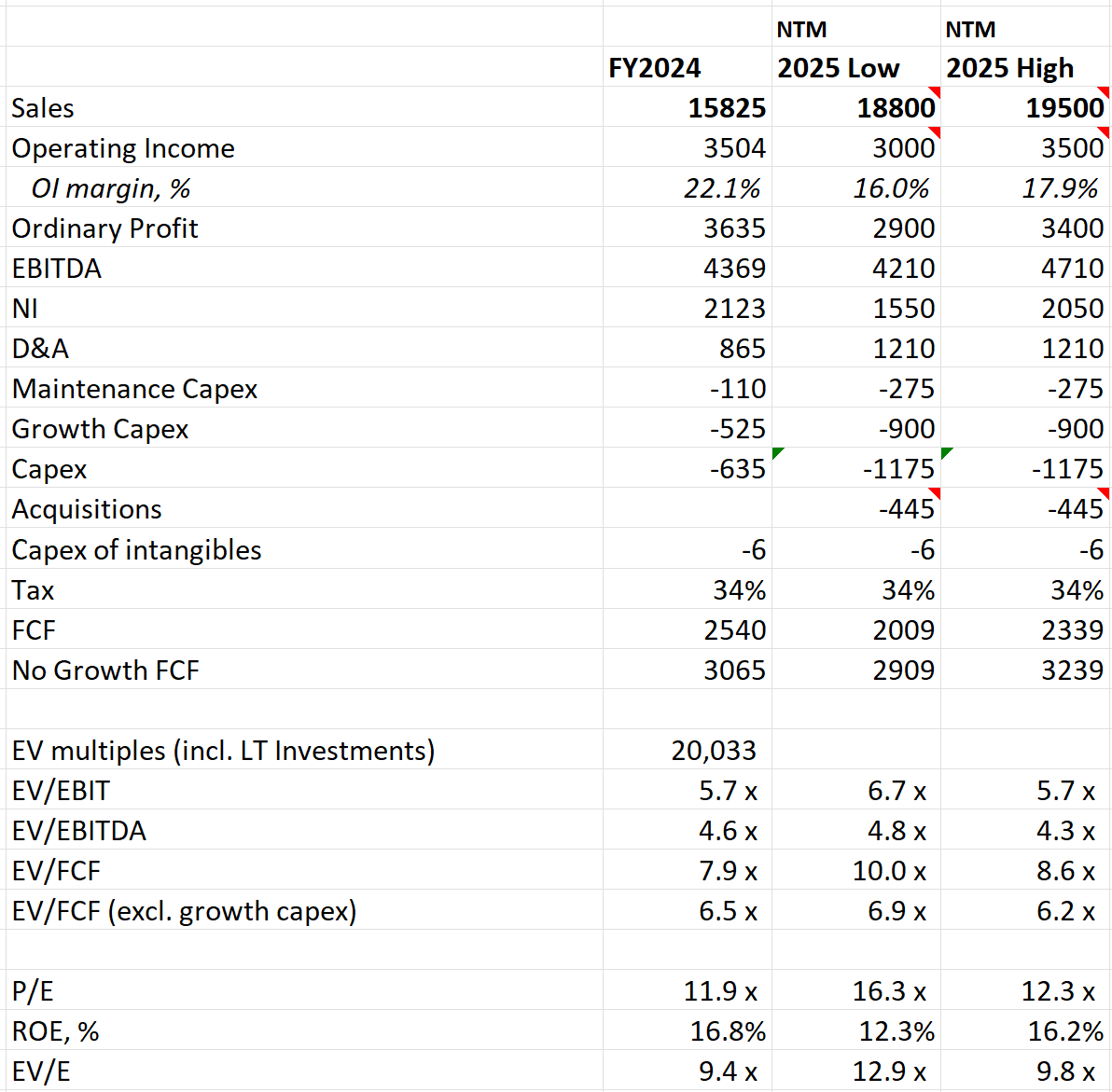

Units in million (mm), yen

*No Growth FCF= FCF + Growth Capex. The growth of the company’s franchise segment requires minimal growth capex, most of growth capex is demanded by the company’s DOC stores.

**EV/E isn’t a real metric, just something I personally use to gauge what happens if management is able to utilize excess cash/investments for increased dividends, special dividends, buybacks, and etc.

Key Highlights:

-Ignoring international growth opportunities, Fast Fitness Japan is undervalued on domestic operations alone:

6 months to 1 year holding upside of 20-60%

3.5 year upside of ___-___% if it can open up to 1400 stores by FY2028 (paid)

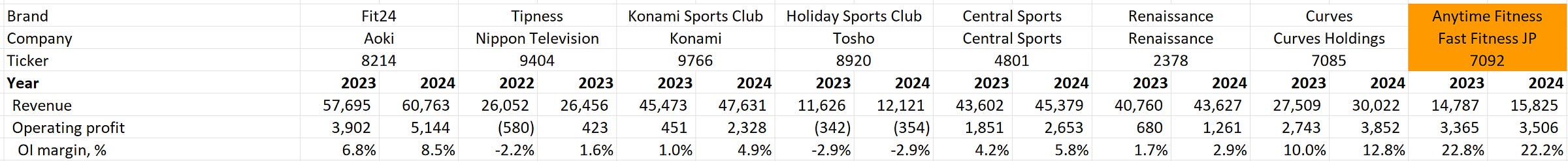

-Fast Fitness Japan has some of the lowest valuation multiples in relation to its comps:

6.2x FY2025E EV/EBIT vs 6.9-32.2x of peers

4.5x FY2025E EV/EBITDA vs 4.4-10.5x of peers

14.3x FY2025E P/E vs 15.8-60.9x of peers

11.7x FY2025E EV/FCF (6.5x if excl. growth capex), vs 9.7-26.1x of peers

-FFJ has the highest operating income margins out of any of its competitors. This is predominantly due to more than half of operating income coming from FFJ’s franchise operations. Curves Holdings is the only other business in the following list that also has predominantly franchise operations, everyone else directly owns their stores.

*Rizap Group (2928) had negative operating income in FY2024 (-0.4%) and the company projects to have 3.5% OI margins in FY2025. Personally, I don’t think this is going to happen.

-FFJ takes significantly less business risk than its competitors given more than half its operating income comes from collecting fixed monthly royalties from its franchise stores regardless of business performance. FFJ’s current valuation does not appropriately capture the low risk and bond-like qualities of FFJ’s franchise operations.

-Based on FFJ’s current valuation, investors are getting the following growth opportunities for free:

Growth 1 (available with paid access)

Growth 2

Growth 3

Growth 4

Growth 5

Growth 6

Thanks for reading! Consider supporting Continuous Compounding to read the following:

Table of Contents:

Business Overview

Quick Valuation

Key Highlights

Outlook (Paid)

Comps Analysis (Paid)

Growth Analysis (Paid)

Business Economics (Paid)

Conclusion (Paid)

Consider supporting Continuous Compounding:

My most recent stock pitch on AGF was pitched at $8.49 on Sept 22nd, 2024, and has quickly risen up 24% to $10.49. If you were a paid sub, you would have been able to invest in this opportunity.

Track record of stock pitches:

Active Positions:

AGF Management Limited: +24%

Furyu: -0%

SK Japan: +0%

Haier 690D: +75% (inc. dividends)

Closed Position:

Round1: +55% (closed)

Okano Valve Manufacturing: +45% (closed)

GAN: +80% (closed)

CNTY: -50% (closed)

*As of Oct 6th, 2024. Returns are rounded.

Hit rate: 6/8 (75%)

Average return: +29%

Average return for stocks outside of NA (excl. CNTY US, GAN US, AGF.B CN): +35%

Average return for stocks excl. CNTY US: +40%

*My first stock pitch was CNTY US; hence, I’ve been on a winning streak of sorts.

**Past performance is not indicative of future performance. I’d be happy if my hit rate is 60-80% in the long-run.

Paid sub testimonials:

*The above image is simply a joke and should not be interpreted as a threat of any kind.